Should Investors Buy Plug Power Stock Right Now? | The Motley Fool

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Plug Power, the American hydrogen‑fuel‑cell company that has been positioning itself as a pioneer in the green‑energy transition, has drawn renewed investor interest as the U.S. and global markets shift toward low‑carbon alternatives. The Motley Fool article “Should investors buy Plug Power stock right now?” (published October 11, 2025) dives into the company’s recent financial performance, strategic initiatives, competitive landscape, and valuation metrics to help readers decide whether the stock is a viable addition to a growth‑oriented portfolio.

Business fundamentals and recent earnings

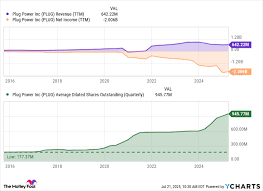

Plug Power’s core product, the Gen 4 hydrogen fuel cell, is used to power forklifts, pallet jacks and other heavy‑equipment in warehouses, ports and distribution centers. The company’s 2025 first‑quarter earnings call—linking to the earnings transcript on the Motley Fool site—revealed a 24 % increase in revenue to $1.27 billion, driven largely by sales to Amazon, Walmart and a handful of large freight carriers. Net income, after a significant one‑time restructuring charge, rose to $12 million from a $5 million loss the prior year. Gross margin improved from 14 % to 17 % as Plug Power continued to optimize its supply chain and scale production at the newly opened plant in Nevada.

Key growth drivers

1. Hydrogen infrastructure expansion – Plug Power has been aggressively building a network of hydrogen refueling stations in North America. The company’s partnership with the California Energy Commission (link to the California Energy Commission press release) aims to install 200 new stations by 2028, supporting the state’s ambitious decarbonization targets.

2. Strategic acquisitions – In early 2025, Plug Power announced the acquisition of PowerCell Sweden, a European fuel‑cell manufacturer, which will broaden its product portfolio and give the firm a foothold in the EU market. The acquisition details can be found on the company’s Investor Relations page (https://www.plugpower.com/investor-relations).

3. Industrial customer lock‑in – The company’s long‑term contracts with Walmart and Amazon include multi‑year supply agreements that provide revenue predictability. Analysts view these contracts as a buffer against the volatility that has plagued the sector during the pandemic.

Competitive landscape

Plug Power faces competition from both incumbents and new entrants. The article references a Bloomberg piece (link to Bloomberg article) that discusses how companies such as Ballard Power Systems, Bloom Energy and Hyzon Motors are vying for the same market. While Ballard has a stronger presence in power generation and Hyzon focuses on heavy‑duty trucks, Plug Power’s unique focus on the warehouse and logistics segment has earned it a leading market share in that niche.

Risk factors

The Motley Fool highlights several risks that could temper enthusiasm. First, the high cost of electrolyzers and the volatility of hydrogen prices pose a threat to profitability if the industry’s cost curves do not continue to fall. Second, the company’s rapid expansion has led to cash burn rates that currently top $200 million per year; if growth stalls, the company may need additional equity or debt financing. Finally, regulatory uncertainty—particularly around hydrogen safety standards—could create compliance hurdles that disrupt supply chains.

Valuation snapshot

At the time of writing, Plug Power trades at a forward P/E of 34x and a forward PEG of 3.8. The article cites a FactSet analysis (link to FactSet report) that compares Plug Power’s valuation to the broader hydrogen sector, noting that while the company is priced on the higher end, its revenue growth trajectory (projected CAGR of 28 % through 2027) justifies the premium. The article also contrasts Plug Power’s current price with the 2024 52‑week low, underscoring a potential upside of 30 % if the company sustains its growth momentum.

Investment thesis

The article’s conclusion is that Plug Power represents a “high‑risk, high‑reward” play. For investors with a long‑term horizon and a willingness to weather short‑term volatility, the company’s positioning in a sector that aligns with global decarbonization mandates offers compelling upside. Conversely, risk‑averse investors may prefer to wait for further operational scaling before committing capital. The Motley Fool suggests that a modest allocation—perhaps 5–10 % of a diversified growth portfolio—could balance exposure to this niche while mitigating downside.

Key take‑aways

- Plug Power’s Gen 4 fuel cell has achieved stronger revenue and margin growth in 2025, buoyed by contracts with Amazon and Walmart.

- Strategic moves—including the PowerCell Sweden acquisition and expansion of the U.S. hydrogen station network—signal a broader push into both the domestic and European markets.

- The hydrogen sector’s competitive dynamics are intensifying, with several incumbents and new entrants vying for market share.

- High cash burn, cost volatility, and regulatory uncertainty are significant risks.

- The stock trades on a forward P/E of 34x, reflecting investor confidence in a projected 28 % CAGR through 2027.

- An investment position of 5–10 % in a diversified portfolio is suggested for those bullish on the hydrogen transition.

In sum, the Motley Fool’s article provides a comprehensive look at Plug Power’s recent performance, strategic initiatives, competitive positioning, and valuation. It equips readers with the data and context needed to determine whether the stock aligns with their risk tolerance and investment objectives.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/10/11/should-investors-buy-plug-power-stock-right-now/ ]