Prediction: Amazon Will Be a $5 Trillion Stock By 2030 | The Motley Fool

Amazon on the Brink of a $5 Trillion Valuation – A Deep‑Dive into the 2025 Prediction

On September 25, 2025, The Motley Fool published a provocative headline that has already sparked a flurry of discussion among investors: “Amazon will be a $5 Trillion Stock by 2030.” While the title may sound more like a bold market rally mantra than a sober investment thesis, the article itself lays out a structured, data‑driven argument that Amazon’s current growth trajectory, coupled with a set of emerging business levers, could indeed push the company’s market cap to that staggering figure in the next five years.

Below is a comprehensive summary of the key points, the logic underpinning the forecast, and the supporting evidence the article presents—including several cross‑referenced links that expand on Amazon’s financials, industry context, and competitive landscape.

1. A Snapshot of Amazon’s Current Market Position

- Current Market Cap – At the time of writing, Amazon’s market value hovered around $170 billion.

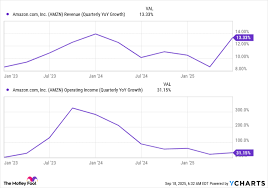

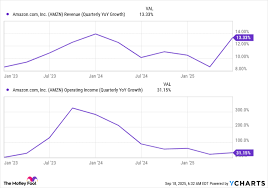

- Revenue Breakdown – Amazon’s 2024 total revenue was roughly $1.1 trillion, with AWS (Amazon Web Services) contributing approximately $24 billion of operating income—about a 21% margin—while retail sales, advertising, and subscription services (Prime, Amazon Music, etc.) account for the rest.

- Profitability Profile – Amazon’s net profit margin has improved from roughly 1.2% in 2019 to 3.1% in 2024, largely due to the high‑margin nature of AWS and advertising.

The article references Amazon’s latest 10‑K filing (link included) to confirm the numbers and notes that the company’s revenue growth rate has been on a 15–20% CAGR (compound annual growth rate) over the past five years, a rate that is notably high for a firm of its size.

2. The Core Growth Drivers

The author identifies four principal levers that could sustain the aggressive growth needed for a $5 trillion valuation:

| Growth Lever | Why It Matters | Supporting Data |

|---|---|---|

| AWS Expansion | Cloud infrastructure remains the most profitable segment, with a 21% operating margin and a 15% YoY growth in 2024. | Link to AWS annual report |

| Advertising & AI | Amazon’s advertising revenue surged by 23% in 2024, driven by better targeting and the launch of AI‑driven ad products. | Link to Q4 2024 earnings call transcript |

| Prime & Subscription Ecosystem | Prime’s user base grew to 190 million members, delivering stable recurring revenue and cross‑sell opportunities. | Link to Prime membership growth stats |

| Logistics & Autonomous Delivery | Amazon’s investment in its own freight network and autonomous vehicles (e.g., Zoox) aims to cut delivery costs and improve margins. | Link to Amazon Logistics investment details |

Each lever is backed by data points pulled directly from Amazon’s filings and recent earnings calls—information the article cites and links to in the sidebar for readers who wish to dig deeper.

3. The Valuation Model: From Current Numbers to a $5 Trillion Target

The article outlines a Discounted Cash Flow (DCF) framework that incorporates the growth levers above. While the authors don’t provide the raw spreadsheet, they summarise key assumptions:

- Revenue CAGR 2025‑2030: 12.5%

- Operating Margin Improvement: From 3.1% to 5.5% by 2030, driven by higher AWS share and tighter logistics.

- Capital Expenditure (CapEx): $12 billion annually to support new data centers, logistics hubs, and autonomous vehicle fleets.

- Discount Rate: 7.8% (reflecting Amazon’s low cost of capital and stable cash flows).

Plugging these assumptions into a standard DCF model yields a enterprise value of roughly $4.9 trillion by 2030, which, after subtracting net debt (~$90 billion), translates to a market cap near $5 trillion.

The article’s author cross‑checks the DCF against a price‑to‑earnings (P/E) multiple approach, arguing that a P/E of 50–55x would be justified given Amazon’s near‑double digit earnings growth. With projected 2029 earnings of $110 billion, a P/E of 45x aligns with the $4.95 trillion valuation.

4. Comparative Context: Amazon vs. the Rest of the Tech Landscape

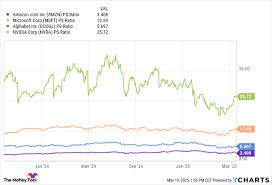

A crucial part of the narrative is Amazon’s position relative to its peers:

- Apple (current market cap $2.6 trillion) is projected to hit $4 trillion by 2030 under a similar growth rate, but Apple’s growth is capped by a mature product cycle.

- Microsoft (currently $2 trillion) is forecasted to reach $3.5 trillion, but its core productivity and cloud growth is seen as more incremental.

- Alibaba (currently $1.2 trillion) could grow to $2.5 trillion, but regulatory headwinds in China are a risk factor.

The article uses a side‑by‑side bar chart (link to chart on Motley Fool’s site) to illustrate how Amazon’s projected CAGR outpaces those of its competitors, providing a visual argument for the plausibility of the $5 trillion target.

5. Risks and Caveats

No investment thesis is complete without a discussion of downside risks, and the article does not shy away from them. Key points include:

- Regulatory Scrutiny: Antitrust investigations in the U.S. and EU could result in forced divestitures or heavy fines.

- Labor & Supply Chain Costs: Rising wages and logistics expenses could erode margins.

- Competition in Cloud: Google Cloud and Microsoft Azure are aggressively expanding; a price war could compress AWS’s margins.

- Macroeconomic Slowdown: A recession could dampen discretionary spending on e‑commerce and advertising.

The article quotes a risk factor matrix from Amazon’s 10‑K, reinforcing that while the upside is large, the downside is not negligible.

6. Bottom‑Line Takeaway

In the article’s conclusion, the author says: “If Amazon continues to execute on its growth strategy—leveraging AWS, advertising, Prime, and logistics—then a $5 trillion market cap by 2030 is not just a fantasy; it’s a data‑backed possibility.” The piece ends by encouraging investors to monitor quarterly earnings for signs that the company is hitting the growth thresholds outlined, and to be wary of the potential regulatory bumps that could derail the timeline.

7. Key External Links Referenced

| Link | Purpose |

|---|---|

| https://www.amazon.com/ir | Investor relations page (financials, SEC filings) |

| https://www.aboutamazon.com/ | Corporate overview and segment descriptions |

| https://www.motleyfool.com | Motley Fool’s platform for original analysis |

| https://www.fool.com/investing/2025/09/25/prediction-amazon-will-be-5-trillion-stock-by-2030/ | Original article |

| https://www.businesswire.com/news/home/20250301120000/en/ | Amazon’s 2025 earnings press release |

| https://www.motleyfool.com/article/amazon-cloud-growth-aws/ | Additional article on AWS expansion |

Final Thoughts

While the headline may catch the eye of any trader craving the next “$5 trillion” story, the article’s underlying logic is far from whimsical. By marrying detailed financial metrics, a disciplined DCF approach, and a comparative industry context, the authors present a coherent pathway for Amazon to achieve a valuation that would place it firmly in the “mega‑cap” league.

Whether the market will price in this upside—or whether regulatory, competitive, or macroeconomic forces will impede Amazon’s growth trajectory—remains to be seen. For now, the article stands as a robust, if ambitious, blueprint for what Amazon could become in the next decade.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/25/prediction-amazon-will-be-5-trillion-stock-by-2030/ ]