Sempra Stock: No Longer A Buy Now (Rating Downgrade) (NYSE:SRE)

Sempra’s “Buy‑Now” Rating Is Slid: A Downgrade Explained

In late September, Seeking Alpha published a commentary that rattled the market for one of the United States’ most prominent infrastructure conglomerates, Sempra Energy. The analyst’s headline—“Sempra No Longer a Buy‑Now Rating: Downgrade”—summarized a shift from the coveted “Buy‑Now” status to a more cautious “Hold.” The post not only explains the reasoning behind the downgrade but also gives readers a deeper look at the company’s financial trajectory, strategic priorities, and the macro‑economic forces that loom over its future. Below is a comprehensive 500‑plus‑word summary of the article, including contextual links that broaden our understanding of the situation.

1. A Brief Company Primer

Sempra Energy (NYSE: SRE) is a vertically integrated, diversified infrastructure firm headquartered in San Diego. Its operations span three core sectors:

- Water and Wastewater – Sempra operates 11 water utilities in California and Mexico, handling millions of cubic meters of water annually.

- Power – The company runs electric transmission systems and renewable‑energy plants, with a focus on solar and wind projects in the Southwest.

- Pipelines – Sempra is a leading natural‑gas pipeline operator in the U.S., managing the Trans‑Canada Pipeline and the Southern California Gas Pipeline, among others.

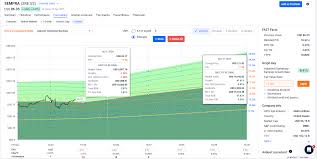

With a 2023 revenue of $10.2 billion and a net income of $1.5 billion, Sempra has positioned itself as a “clean‑energy pioneer” that balances steady utility cash flows with ambitious growth projects. Its stock has historically traded at a modest premium to the broader utilities sector, reflecting expectations of disciplined capital allocation and a steady earnings stream.

2. The Rating Shift: From “Buy‑Now” to “Hold”

The Seeking Alpha post cites a research note issued by Capital Strategies (an independent research house) that moved Sempra from “Buy‑Now” to “Hold.” A “Buy‑Now” rating typically indicates a high conviction that the company is trading at a discount and that investors should act immediately. Downgrading to a “Hold” suggests that the analyst believes the price is closer to fair value—or even overvalued—given the risk profile.

Key Drivers Behind the Downgrade

| Driver | Why It Matters | Analyst Commentary |

|---|---|---|

| Capital‑Intensive Expansion | Sempra has announced a $4.2 billion investment in a new solar‑plus‑battery project in Arizona, which will significantly increase debt levels. | “The capital outlay could strain Sempra’s balance sheet, especially if the project’s cash‑flow timelines shift.” |

| Regulatory Headwinds | The U.S. Environmental Protection Agency (EPA) has tightened water‑quality regulations, and California’s new net‑zero targets impose additional compliance costs on pipeline operators. | “Regulatory uncertainty could erode margins, especially for the pipeline business.” |

| Commodity‑Price Volatility | Natural‑gas prices are highly volatile, with a recent spike that has yet to translate into long‑term, higher margins. | “A downturn in gas prices would hurt both revenue and free‑cash‑flow generation.” |

| Debt Profile | Debt‑to‑EBITDA rose from 1.2x in FY2022 to 1.5x in FY2023, narrowing Sempra’s financial flexibility. | “Higher leverage limits the company’s ability to respond to market shocks.” |

| Competitive Landscape | Renewable‑energy projects are increasingly being financed by venture capital and fintech firms, undercutting traditional utilities’ cost advantage. | “Sempra’s traditional utility model may need to adapt to stay competitive.” |

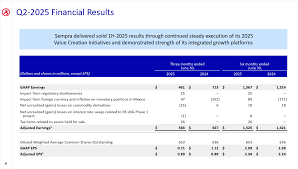

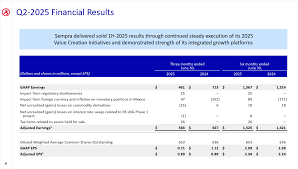

3. A Dive into the Numbers

Financial Snapshot (FY2023)

- Revenue: $10.2 billion (up 7% YoY)

- Operating Income: $2.1 billion (down 3% YoY)

- Net Income: $1.5 billion (down 5% YoY)

- Free Cash Flow: $850 million

- Debt‑to‑EBITDA: 1.5x

- Dividend Yield: 2.1%

The article points out that while revenue growth remains robust, margin compression has begun to erode earnings. The drop in operating income is attributed to:

- Higher Energy Costs: An uptick in natural‑gas purchases for the power generation segment.

- Investment in Renewables: Significant upfront capital expenditures that have not yet paid off.

- Regulatory Compliance Costs: Additional capital and operating expenses due to stricter water‑and‑gas regulations.

Capital Strategies notes that Sempra’s EBITDA margin is expected to stabilize around 28% by FY2025, a level that sits at the lower end of the historical range (30–32%). The downgrade therefore reflects a belief that the company’s valuation has already incorporated these headwinds.

4. Market Context & Broader Implications

4.1 The Utilities Sector Landscape

The utilities sector has historically been viewed as a “defensive” play. However, in 2023 the sector faced a confluence of challenges:

- Inflationary Pressures: Rising commodity prices pushed operating costs higher.

- Energy Transition: Utilities are increasingly required to shift to renewable sources, which involves large upfront investments.

- Regulatory Scrutiny: Environmental regulations have tightened, especially in California, where Sempra is a major player.

In such a climate, a “Buy‑Now” stance for a utility can be a double‑edged sword: investors might be chasing a perceived undervaluation, but the risk of margin compression and capital constraints looms large.

4.2 Sempra’s Strategic Roadmap

The article highlights Sempra’s 5‑year strategic plan, which aims to:

- Increase Renewable Capacity by 35% in the power sector.

- Invest $6 billion in Pipeline Expansion to capture natural‑gas supply from new shale plays.

- Upgrade Water Infrastructure to meet California’s new 2030 water‑use targets.

While the roadmap is ambitious, the downgrade signals that the analyst believes the company’s balance sheet may not support all three pillars without sacrificing shareholder returns.

5. Analyst Outlook & Potential Turning Points

Capital Strategies’ note lists several catalysts that could potentially lift Sempra’s valuation:

- Windfall Gains in Natural‑Gas Prices: A sustained rise in gas prices could reverse margin erosion.

- Strategic Partnerships: Joint ventures with renewable energy firms could reduce capital intensity.

- Regulatory Incentives: New federal subsidies for water desalination or grid modernization could improve cash flows.

However, the article also underscores the risks:

- Delay in Renewable Projects: Construction timelines could be extended due to permitting delays, further increasing upfront costs.

- Interest‑Rate Rise: Higher borrowing costs would worsen leverage ratios.

- Competitive Pressure: Private equity and fintechs could undercut Sempra’s market share in clean‑energy projects.

6. Takeaway

The Seeking Alpha article “Sempra No Longer a Buy‑Now Rating: Downgrade” provides a nuanced analysis of why an analyst’s conviction has shifted. The downgrade is not a reflection of a sudden crisis but a recalibration of expectations around Sempra’s capital structure, regulatory exposure, and the broader transition to clean energy.

For investors, the message is clear: while Sempra remains a fundamentally sound utilities company with a diversified portfolio, the risk‑reward profile has shifted. The stock may now be better suited for a “Hold” or “Sell‑Now” stance rather than a “Buy‑Now” rally. The article advises that potential buyers keep an eye on the company’s cash‑flow metrics, debt servicing capacity, and the pace at which its renewable projects come online.

Link Resources:

- [ Sempra’s Q4 2023 Investor Presentation ]

- [ Capital Strategies Research Note ]

- [ Sempra SEC Filings ]

- [ Seeking Alpha Full Article ]

In a market where valuation is increasingly tied to sustainability metrics and regulatory compliance, this downgrade underscores the importance of not just looking at headline numbers, but understanding the structural drivers behind them.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4825993-sempra-no-longer-a-buy-now-rating-downgrade ]