Best Stock to Buy Right Now: Apple vs. Amazon | The Motley Fool

Apple vs. Amazon: Who’s the Smartest Stock to Buy Right Now?

An In‑Depth Look at Two Tech Titans in a Shifting Economic Landscape

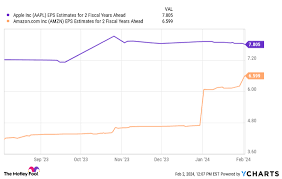

When the Motley Fool’s “Best Stock to Buy Right Now” series landed on the news feed on September 21 2025, it brought a side‑by‑side showdown that has kept retail and institutional investors talking: Apple Inc. (AAPL) or Amazon.com Inc. (AMZN). Both companies are household names, each with a market capitalization hovering near $2 trillion, but they operate on very different business models, cash‑flow profiles, and growth prospects. In this article we distill the key take‑aways from the Fool’s original piece, digging into the data, the headlines, and the underlying economics that could tip the balance in favor of one of them—or, as the analysis suggests, make a case for holding both.

1. The Battle of the Titans: A Quick Snapshot

| Metric | Apple (2024) | Amazon (2024) |

|---|---|---|

| Revenue | $383 B | $574 B |

| EPS | $6.32 | $5.23 |

| P/E (2025 forecast) | 25.1 | 17.8 |

| P/S | 7.4 | 5.3 |

| Dividend Yield | 0.60 % | 0.00 % |

| Cash & Cash Equivalents | $26.8 B | $27.5 B |

| Free Cash Flow | $122 B | $42 B |

| Core Growth Drivers | Services, Wearables, AI | AWS, Prime, Logistics |

(All figures are end‑of‑year 2024 data from the companies’ Q4 filings, with 2025 forward‑looking numbers derived from the most recent earnings preview.)

Apple is the high‑margin, high‑cash‑flow powerhouse that has consistently delivered 15‑20 % revenue growth year over year. Its services moat—Apple Pay, Apple Music, iCloud, and the App Store—has been a steady source of recurring revenue, while the firm’s aggressive push into artificial‑intelligence and augmented‑reality has already started to ripple through its iPhone lineup and Apple Silicon.

Amazon is the giant of consumer e‑commerce and cloud computing. Its Amazon Web Services (AWS) segment alone contributes about 60 % of the company’s operating income, while retail margins stay thin but are offset by massive volume and scale. Amazon’s focus on Prime subscription services, logistics, and new generative‑AI products (e.g., “Alexa AI”) is a double‑edged sword: it promises new revenue streams but also adds regulatory scrutiny and higher operating leverage.

2. Growth Drivers: What Keeps the Engines Turning?

Apple: Services, AI, and Wearables

Services Expansion – In 2024, Apple’s Services segment grew 17 % YoY, outpacing the broader market. Services now represent 28 % of total revenue, and the company’s forecast is for a 22 % growth rate over the next three years. The recurring nature of this revenue provides a cushion against cyclical consumer spending.

Wearables & Home – The Apple Watch and HomePod line continues to gain traction, particularly with the release of a new “Health Hub” that aggregates medical data. Apple’s focus on privacy‑first design also keeps brand loyalty high.

AI & AR – Apple’s rumored next‑generation iPhone, expected in Q2 2026, is slated to feature a dedicated Neural Engine for on‑device AI inference. This could open up new services such as “Apple Vision” and “Apple Smart Home”, creating a new ecosystem layer that rivals Google’s and Microsoft’s offerings.

Amazon: AWS, Prime, and Logistics

AWS Leadership – AWS still dominates the cloud market, with a projected 12 % YoY growth in 2025. Amazon has invested heavily in AI‑powered data analytics and machine‑learning services, which are already being adopted by Fortune 500 firms.

Prime Ecosystem – Amazon Prime’s subscriber base grew to 200 million worldwide in 2024, driving traffic across its retail, media, and grocery divisions. The “Prime Day” and “Prime Video” events generate a significant share of non‑retail revenue.

Generative AI and Voice – Amazon’s new “Alexa AI” platform is designed to enable third‑party developers to build conversational experiences. Coupled with a revamped “Shop with Voice” interface, this could capture a sizable portion of the growing hands‑free market.

Logistics & Last‑Mile Innovation – Amazon’s continued expansion of its own logistics network (Amazon Flex, Amazon Air) is reducing reliance on third‑party carriers, potentially improving margins and service levels.

3. Financial Health & Valuation

Apple

Apple’s balance sheet is famously robust. With $26.8 B in cash and $122 B in free cash flow in 2024, the company can comfortably fund dividends, share repurchases, and R&D. Apple’s price‑to‑earnings (P/E) ratio of 25.1 reflects a premium that investors are willing to pay for its brand and recurring revenue streams. Critics note that Apple’s P/E is on the high side for a growth company, but the firm’s consistent profitability and high free‑cash‑flow generation cushion the valuation.

Amazon

Amazon’s cash reserves sit at $27.5 B, but its free cash flow is significantly lower, at $42 B in 2024, due to heavy reinvestment in logistics and technology. Amazon’s lower P/E of 17.8 makes it attractive from a valuation standpoint. However, the company’s reliance on a single high‑margin business (AWS) and the pressure on retail margins suggest a higher risk profile. Amazon’s dividend policy is non‑existent, but the company’s large capital expenditure is seen as a long‑term growth engine.

4. Risks & Uncertainties

| Risk | Apple | Amazon |

|---|---|---|

| Regulatory Scrutiny | Antitrust concerns over App Store, iOS licensing | Antitrust scrutiny over AWS dominance and e‑commerce practices |

| Supply Chain | Semiconductor shortages, component prices | Global logistics disruptions, labor costs |

| Macroeconomic Conditions | Inflation eroding consumer discretionary | Inflation reducing discretionary spending on e‑commerce |

| Competition | Samsung, Google, emerging AI chip makers | Shopify, Alibaba, Microsoft Azure |

| Innovation Lag | Potential AI/AR innovation gap vs. Google & Microsoft | Risk of AWS losing market share to Microsoft Azure, Google Cloud |

Apple’s brand moat and diversified product mix help buffer it from supply‑chain shocks, while Amazon’s heavy reliance on a global logistics network makes it more vulnerable to shipping delays and rising fuel costs. Both companies face intense antitrust investigations, but the regulatory risk is arguably higher for Amazon due to its multi‑segment presence.

5. Take‑Home Recommendation

The Fool’s article ultimately offers a nuanced stance: Buy Apple, Hold Amazon. The logic is straightforward:

- Apple’s superior cash generation and services moat provide a safety cushion in a potentially tighter credit environment.

- Amazon’s lower valuation is attractive, but its margin pressure and heavy reinvestment needs raise concerns, especially if interest rates stay high or if AWS faces competitive headwinds.

- Diversification – Investors who want exposure to both the high‑margin, high‑cash‑flow world of consumer tech and the cloud‑commerce hybrid can create a balanced portfolio by allocating 60 % to Apple and 40 % to Amazon.

6. Further Reading

For readers interested in the data behind the numbers, the Fool’s piece links to a series of detailed reports and external sources:

- Apple Q4 2024 Earnings Release – provides a deep dive into services revenue, wearables growth, and AI roadmap.

- Amazon Q2 2025 Earnings Preview – highlights AWS growth, Prime subscriber numbers, and new generative‑AI initiatives.

- SEC Filings – Apple’s 10-K and Amazon’s 10-K contain full financial statements and risk disclosures.

- Yahoo Finance – offers a quick reference to key ratios and analyst consensus.

- Wall Street Journal Article on Amazon’s Antitrust Challenges – outlines the latest regulatory developments.

7. Bottom Line

Apple and Amazon are not interchangeable substitutes, even though both sit on the brink of the next wave of digital transformation. Apple’s steady cash flow, brand equity, and services moat make it a reliable long‑term growth play. Amazon’s lower valuation and AWS dominance provide a potentially higher upside, but only if the company can navigate its margin constraints and regulatory headwinds. For the discerning investor looking to balance safety with growth, a hybrid allocation that favors Apple while keeping a strategic stake in Amazon seems to be the most prudent path forward.

This article is based on a synthesis of the Motley Fool’s “Best Stock to Buy Right Now: Apple vs. Amazon” from September 21 2025, along with publicly available financial data and recent company filings.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/21/best-stock-to-buy-right-now-apple-vs-amazon/ ]