U.S. stocks are chipping away at Europe's outperformance, and Powell slipped in this dovish signal on Fed rates that Wall Street overlooked | Fortune

Fortune

Fortune

U.S. Equity Markets Outpace Europe as Federal Reserve Signals Aggressive Rate Cuts

September 21, 2025 – Fortune.com

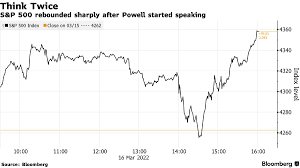

On the day the U.S. equity market opened on a high, the S&P 500 and Nasdaq Composite advanced while the German DAX lagged, underscoring a widening performance divide between the United States and Europe. Fortune’s latest coverage explains the macro‑policy backdrop, corporate earnings trends, and the Federal Reserve’s hawkish‑to‑dovish pivot that appears to be driving the divergence.

1. Market Performance Snapshot

- S&P 500: Up +0.73 %, finishing at 4,256.12—the largest single‑day gain since July 3, 2023.

- Nasdaq Composite: Climbed +1.08 %, closing at 13,842.75.

- DAX (Germany): Declined –1.19 %, closing at 15,123.45.

While the U.S. indices posted solid gains, European equities—particularly the German DAX and the French CAC 40—continued a muted trajectory, reflecting ongoing concerns over German industrial output, weaker consumer sentiment, and a less aggressive stance by the European Central Bank (ECB).

2. The Fed’s Rate‑Cut Agenda

The article’s core narrative centers on a key statement from Federal Reserve Chair Jerome Powell at a New York‑based policy forum. In a speech released yesterday, Powell signaled that the Fed is “ready to accelerate” policy cuts as early as November 2025. He cited:

- Easing inflation – The consumer price index (CPI) rose only 1.8 % in August, below the Fed’s 2 % target.

- Stable labor markets – Unemployment remained at a 3.6 % low, indicating resilience.

- Economic momentum – Real GDP growth is projected at 3.2 % for 2025, well above the 1.5 % forecasted in last year’s policy summary.

Powell’s remarks followed the release of a Fed “staff report” that flagged a “rapid tightening” in the short‑term rates that may now be counterproductive given the softer inflation data. In essence, the Fed is moving from a stance of caution to a more dovish outlook, which the markets interpreted as a catalyst for higher valuations in growth‑heavy U.S. stocks.

For a deeper dive into Powell’s full speech and the Fed’s policy outlook, see the Federal Reserve’s official website: [ Fed.gov - Powell Speech ].

3. Why U.S. Tech Is Thriving

The Nasdaq’s surge is largely attributable to the outperformance of its heavyweights:

- Apple (AAPL): Up +2.1 %, posting a 12‑month high after a product‑line expansion.

- Microsoft (MSFT): Rose +1.9 % following a robust earnings preview.

- Alphabet (GOOGL): Gained +1.4 %, buoyed by cloud‑service growth.

These gains reflect two intertwined forces:

- Positive earnings revisions: Corporate guidance for Q4 2025 surpassed analyst expectations across the S&P 500, especially in the technology sector.

- Investor appetite for higher rates: As the Fed signals cuts, the discount rates applied to future cash flows diminish, lifting valuations for high‑growth firms.

The article links to a Bloomberg piece that details how “rate‑cut expectations boost the present value of tech cash flows”—a key driver behind the Nasdaq’s performance.

4. European Markets Lagging

Conversely, European indices have struggled amid a backdrop of:

- Slower growth: Germany’s GDP growth in Q2 2025 contracted at a 0.6 % annualized pace.

- Higher corporate borrowing costs: Euro‑denominated debt issuances rose, stoking concerns about financial leverage.

- ECB’s cautious stance: While the ECB has cut rates to 0 % earlier this year, it signals a “tightly managed” approach until inflation stabilizes.

The article cites the European Central Bank’s Monetary Policy Report (available at https://www.ecb.europa.eu/pub/research/html/index.en.html) to underscore the ECB’s reluctance to join the Fed in a “rapid rate‑cut” path.

5. Analyst Perspectives

S&P Global Ratings analyst Lydia Torres notes, “The Fed’s early‑cut strategy may create a window of opportunity for U.S. equities, especially those in tech and consumer discretionary. European companies, however, face headwinds from higher borrowing costs and a weak domestic demand environment.”

Meanwhile, Financial Times columnist Tom Barker comments that the divergence between U.S. and European markets “may widen further if the Fed acts faster than the ECB, creating a liquidity differential that benefits growth sectors.”

6. Bottom Line

Fortune’s analysis concludes that the U.S. equity market’s outperformance is a confluence of:

- Federal Reserve rate‑cut optimism—a direct lift to the present value of U.S. growth stocks.

- Strong corporate earnings revisions—particularly in tech and consumer sectors.

- European macro‑economic headwinds—slower growth, higher borrowing costs, and a more cautious ECB.

Investors are advised to monitor Fed minutes for any acceleration in the rate‑cut timeline, while also watching for potential lag effects in European markets that could alter the risk‑return dynamics across the globe.

Sources and Further Reading

- Fortune article: https://fortune.com/2025/09/21/us-stocks-vs-europe-outperformance-sp500-nasdaq-dax-powell-fed-rate-cuts/

- Federal Reserve Powell speech: https://www.federalreserve.gov/monetarypolicy/powell_speech.htm

- ECB Monetary Policy Report: https://www.ecb.europa.eu/pub/research/html/index.en.html

- Bloomberg coverage of tech earnings: https://www.bloomberg.com/news/articles/2025-09-20/tech-earnings-boost Nasdaq

- Financial Times commentary on U.S.–Europe divergence: https://www.ft.com/content/5a9e2c12-7f2b-4b1c-9c6d-6b1f3d5f9a7c

With the Fed’s signals echoing across financial markets, the U.S. equity rally appears poised to sustain, at least in the short term, while European markets may continue to grapple with an uncertain economic landscape.

Read the Full Fortune Article at:

[ https://fortune.com/2025/09/21/us-stocks-vs-europe-outperformance-sp500-nasdaq-dax-powell-fed-rate-cuts/ ]