VOO, VEA, and VTI: A Core Portfolio Strategy

Locales: Delaware, New York, UNITED STATES

The Core Three: VOO, VEA, and VTI

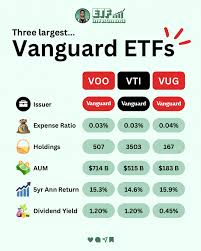

1. VOO: Vanguard S&P 500 ETF - The Foundation of U.S. Equity Exposure

The Vanguard S&P 500 ETF (VOO) remains a stalwart for good reason. Tracking the S&P 500 index, VOO provides exposure to the 500 largest publicly traded companies in the United States, representing approximately 80% of the total U.S. equity market capitalization. This broad representation across sectors - including technology giants, healthcare innovators, financial institutions, and consumer staples - offers a diversified slice of the American economy. Its extremely low expense ratio of 0.03% ensures that a minimal portion of your returns is eaten away by fees.

2. VEA: Vanguard FTSE Developed Markets ETF - Diversifying Beyond U.S. Borders

Limiting investments solely to the U.S. market exposes portfolios to significant concentration risk. The Vanguard FTSE Developed Markets ETF (VEA) mitigates this risk by offering access to companies in developed economies outside of North America. This includes major economies like Japan, the United Kingdom, Germany, France, and Canada. VEA's diversification helps to smooth out portfolio volatility and potentially capture growth opportunities in regions with different economic cycles than the U.S. With an expense ratio of 0.05%, it provides cost-effective international exposure.

3. VTI: Vanguard Total Stock Market ETF - Completing the U.S. Picture

While VOO focuses on large-cap companies, the Vanguard Total Stock Market ETF (VTI) casts a wider net. VTI invests in companies of all sizes - from the mega-cap leaders to small and mid-sized businesses. This comprehensive approach allows investors to capture growth potential from the entire U.S. stock market, including companies that may not yet be included in the S&P 500. Small and mid-cap companies often have higher growth potential, but also higher volatility. VTI's low expense ratio of 0.03% makes it an efficient way to tap into this segment of the market.

Constructing a Resilient Portfolio for 2026 and Beyond

There's no universal "perfect" portfolio. The optimal allocation depends on individual risk tolerance, investment timeframe, and financial goals. However, a starting point for a well-diversified portfolio could be:

- VOO: 40% - 50% - This forms the core of the portfolio, providing solid U.S. large-cap exposure.

- VEA: 30% - 40% - A significant allocation to international markets for diversification.

- VTI: 10% - 20% - Completing the U.S. market coverage with exposure to companies of all sizes.

Adjusting to Your Needs

- Conservative Investors: Might lean towards a higher allocation to VOO (50%) and VEA (40%), with a smaller allocation to VTI (10%) to reduce overall risk.

- Growth-Oriented Investors: Could consider a slightly lower allocation to VOO (40%), a moderate allocation to VEA (30%), and a larger allocation to VTI (20-30%) to prioritize potential growth.

- Long-Term Investors: Benefitting from the power of compounding may consider allocating more to equities overall and less to fixed income.

Looking Ahead

The ETFs highlighted - VOO, VEA, and VTI - offer a simple yet effective way to build a diversified portfolio that can withstand market fluctuations and position investors for long-term success. Remember to regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals and risk tolerance. The current environment requires a pragmatic approach, and these ETFs provide a solid foundation for navigating the uncertainties of 2026 and beyond.

Disclaimer: I am an AI chatbot and do not provide financial advice. This is for informational purposes only. Consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/29/new-investing-build-portfolio-rock-solid-etf-voo/ ]