Gundlach Warns of Stock Market Bubble

Locales: California, UNITED STATES

Friday, February 20th, 2026 - Jeff Gundlach, the renowned CEO of DoubleLine Capital, is once again raising concerns about the stability of the stock market, warning investors of a potential bubble and outlining strategies to safeguard their investments. His recent pronouncements are resonating with financial analysts and individual investors alike, prompting a renewed focus on defensive portfolio positioning.

Gundlach, known for his accurate market calls over the years, believes the current level of market optimism is "unsustainable" and that a significant correction is increasingly likely. He frames the situation as a classic bubble scenario, stating, "It's the kind of thing you think, 'Well, things can't possibly go on like this forever.'" This isn't a new sentiment for Gundlach, who has consistently cautioned against complacency in recent market rallies, but his latest comments suggest a growing conviction that a downturn is imminent.

Underlying Concerns: Valuations and Risk Perception

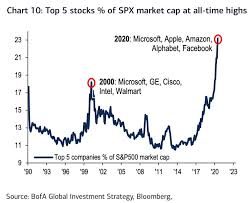

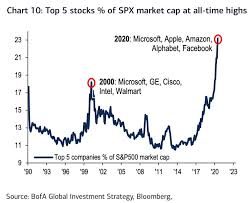

The core of Gundlach's argument centers on stretched valuations. Despite growing economic headwinds - including persistent inflation (though moderating from peak levels), geopolitical instability, and increasing interest rates - stock prices have remained stubbornly high. Gundlach argues that investors are either ignoring these risks or underestimating their potential impact. He believes this disconnect between market fundamentals and price action is a hallmark of a bubble.

"People are acting like we're in a world where everything's perfect," Gundlach noted in a recent interview. "It's not a perfect world." He points to the continued reliance on narratives of 'soft landings' and the expectation of future earnings growth as particularly concerning, given the current economic climate. The belief that central banks will consistently step in to prevent significant market declines, a phenomenon often referred to as the 'Fed Put', is also seen as contributing to excessive risk-taking.

Hedging Strategies: Gold and Bonds as Safe Havens

To mitigate potential losses, Gundlach advocates for a strategic shift towards defensive assets. He specifically highlights gold and bonds as key components of a resilient portfolio.

Gold: The appeal of gold as a safe-haven asset is well-established. During times of economic uncertainty and market volatility, investors often flock to gold as a store of value. It traditionally maintains its purchasing power and can act as a hedge against inflation and currency devaluation. While gold doesn't generate income, its relative stability can help to reduce overall portfolio risk. The increasing demand for gold from central banks globally is further supporting its price, adding to its attractiveness as a portfolio diversifier.

Bonds: Gundlach believes that bond yields, while having risen considerably in the past year, are now attractive. He suggests that bonds can offer a better risk-adjusted return than stocks, particularly in a slowing economic environment. As economic growth slows, central banks are likely to pause or even reverse interest rate hikes, which would drive bond prices higher. Investing in a diversified portfolio of bonds, including government and corporate bonds, can provide a steady stream of income and help to cushion a portfolio against a stock market downturn. However, investors should be mindful of credit risk and interest rate sensitivity when selecting bonds.

Beyond Gold and Bonds: Diversification and Discipline

While gold and bonds are central to Gundlach's recommended strategy, he stresses the broader importance of diversification. Investors should avoid overconcentration in any single asset class or sector. Diversification reduces the impact of any single investment performing poorly and helps to smooth out overall portfolio returns.

Perhaps equally crucial is the need for discipline. Gundlach cautions against the temptation to chase high returns, particularly in a potentially overvalued market. He urges investors to be prepared to "do something different" and resist the urge to follow the crowd. This means being willing to sell overvalued assets and reallocate capital to more defensive positions, even if it means missing out on short-term gains. He emphasizes that preserving capital during a downturn is often more important than maximizing returns.

Looking Ahead

The market's reaction to Gundlach's warnings will be closely watched. While not every prediction comes to fruition, his track record warrants attention. The current economic landscape is complex and fraught with uncertainty. Investors who heed Gundlach's advice and proactively adjust their portfolios may be better positioned to weather the storm, whatever it may bring. The key takeaway is a return to fundamental principles: diversification, risk management, and a healthy dose of skepticism in the face of seemingly endless optimism.

Read the Full Business Insider Article at:

[ https://www.businessinsider.com/how-to-invest-stock-market-bubble-jeff-gundlach-gold-bonds-2025-11 ]