AGNC: A Compelling Income Opportunity in 2026

Locales: UNITED STATES, CANADA

January 28, 2026 - Income investors are increasingly turning their attention to mortgage REITs as economic headwinds necessitate a shift in investment strategy. Among the leaders in this space, AGNC Investment Corp. (AGNC) stands out as a potentially compelling opportunity, particularly as the Federal Reserve continues its easing of monetary policy throughout 2026.

AGNC, a prominent player in the residential mortgage-backed securities (RMBS) market, has long been favored by those seeking a consistent stream of dividends. However, the changing macroeconomic climate - characterized by decelerating growth and responsive monetary easing - presents both opportunities and challenges for the REIT. This article delves into AGNC's position, analyzing its potential for returns in the current environment.

The Rate Cut Tailwind The driving force behind AGNC's potential is the ongoing decline in interest rates. Throughout 2025 and into 2026, the Federal Reserve has been actively lowering rates to stimulate economic activity. This deliberate policy shift directly benefits mortgage REITs like AGNC in several ways. Firstly, reduced borrowing costs enhance profitability, allowing AGNC to fund its investments more efficiently. Secondly, and perhaps more significantly, falling rates increase the value of the company's extensive portfolio of RMBS. As rates drop, the present value of fixed-income securities rises, bolstering AGNC's book value.

The market anticipates further rate reductions throughout the remainder of 2026, providing a solid foundation for continued positive performance. However, investors should remain vigilant, as an unexpected reversal in the Fed's stance could quickly erode gains. Monitoring economic indicators and Fed announcements will be crucial.

A Generous Dividend, But With Caveats Currently, AGNC offers a dividend yield of approximately 12%. This figure dwarfs the returns offered by traditional fixed-income investments like bonds and many dividend-paying stocks, making AGNC an attractive proposition for income-focused portfolios. However, it's crucial to remember that dividend yields are not static. They are directly tied to AGNC's earnings and payout ratio, and can fluctuate based on the company's performance and broader market conditions. A sustainable dividend is paramount, and investors should scrutinize AGNC's ability to maintain its payout.

Proactive Portfolio Management: A Key Differentiator AGNC isn't simply riding the wave of falling rates; its management team actively navigates the market. Their strategic approach to portfolio management involves continuous evaluation of investments and adjustments to capitalize on emerging opportunities. This agility allows AGNC to adapt to evolving market dynamics and potentially outperform its peers. The team's expertise in analyzing mortgage-backed securities and identifying undervalued assets is a significant competitive advantage.

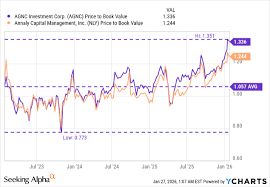

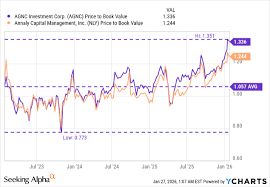

Valuation: A Reasonably Priced Opportunity? Despite the positive impact of the declining rate environment, AGNC's stock price remains reasonably valued. The current price-to-book ratio is slightly below its historical average, hinting at potential undervaluation. This suggests that investors may be able to acquire shares at an attractive price, offering a margin of safety.

Navigating the Risks Investing in AGNC isn't without risk. The most prominent threat is a potential resurgence in interest rates. An unexpected increase could trigger a decline in portfolio value and compress profitability. Furthermore, changes in government regulations pertaining to the housing market or unforeseen disruptions in the mortgage industry could also negatively impact AGNC's performance. Careful consideration of these risks is essential before investing. Diversification is key, and allocating a portion of a portfolio to AGNC should be part of a broader investment strategy.

Looking Ahead: A Promising Outlook AGNC Investment Corp. presents a compelling investment opportunity in 2026. The confluence of falling interest rates, a high dividend yield, and a proactive management team positions the company for potential gains. While inherent risks remain, the current environment favors mortgage REITs like AGNC. Investors seeking a reliable income stream and a potentially undervalued investment should carefully consider adding AGNC to their portfolios.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4863471-agnc-strong-investment-setup-in-2026 ]