FSK Shifts Focus to Bonds for Income

Locales: New York, Texas, UNITED STATES

The Allure of the Bond Market

So, why bonds? The answer lies in the evolving interest rate environment. Bond yields have become considerably more attractive in recent months, offering a compelling opportunity to lock in consistent income with a generally lower risk profile than private equity. This is particularly significant given the uncertainties surrounding global economic growth and potential recessionary pressures.

Furthermore, the bond market itself has experienced some turbulence, widening the bid-ask spread. This creates a potential buying opportunity for sophisticated investors like FSK, allowing them to acquire fixed income instruments at more favorable prices. Essentially, the company is capitalizing on market inefficiencies to generate yield.

Management's Perspective

During the recent earnings call, FSK's management team repeatedly highlighted their intention to reallocate capital from private equity towards credit strategies. This isn't a complete abandonment of private equity, but rather a strategic adjustment to prioritize current income and reduce overall portfolio risk. The emphasis is on generating reliable returns through fixed income, rather than relying on the potential for outsized gains from private equity investments.

This strategic redirection doesn't necessarily signify a negative outlook for FSK. However, it fundamentally alters the risk-reward dynamic. Investors who previously viewed FSK as a high-growth, albeit risky, private equity play need to recalibrate their expectations. The company is transitioning towards a more conservative, income-focused profile.

Navigating the Risks and Opportunities

The primary risk associated with this shift remains the potential underperformance of existing private equity investments. While FSK's diversified portfolio does offer some mitigation, illiquidity and unforeseen challenges within private companies can still impact returns. The value of these holdings could decline, especially if the broader economic environment deteriorates.

On the opportunity side, a well-managed fixed income portfolio offers greater stability and predictability, particularly in volatile markets. While the potential for explosive growth may be limited, the consistent income stream can provide a solid foundation for long-term returns. The key will be FSK's ability to identify and capitalize on attractive opportunities within the credit markets.

Investor Takeaway

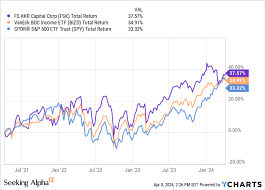

FS KKR is undergoing a significant transformation, adapting to a changing investment landscape. The decision to prioritize fixed income reflects a cautious and pragmatic approach, acknowledging the challenges of finding compelling private equity opportunities in the current environment. Investors considering FSK should carefully assess this strategic shift and understand the implications for the company's risk-reward profile. While the allure of chasing the bottom might be tempting, FSK's management appears to believe that a more stable, income-focused strategy is the more prudent path forward.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4863190-fs-kkr-stock-investing-bonds-looks-better-than-trading-bottom-now ]