AI Investment Opportunities: 3 Tech ETFs to Consider

Riding the AI Wave: Three Tech ETFs to Consider Now (According to The Motley Fool)

The artificial intelligence (AI) revolution is no longer a futuristic fantasy; it's actively reshaping industries and driving significant investment opportunities. For investors looking to capitalize on this transformative technology without picking individual stocks – a strategy that can be risky given the volatility of AI-focused companies – Exchange Traded Funds (ETFs) offer a diversified and accessible route. According to a recent article from The Motley Fool, three tech ETFs stand out as particularly well-positioned to capture the ongoing AI boom: Global X Robotics & Artificial Intelligence ETF (BOTZ), First Trust Nasdaq AI Actives ETF (AIQ), and iShares Semiconductor ETF (SWKSX). This article breaks down each fund's strategy, holdings, pros, cons, and why The Motley Fool recommends them.

The AI Landscape & Why ETFs Make Sense

Before diving into the specific ETFs, it’s important to understand the context. AI isn't a single sector; it permeates numerous industries from healthcare and finance to transportation and manufacturing. This broad impact means that investing in pure-play AI companies can be challenging – many are still in early stages of development or face intense competition. Furthermore, valuations for some AI firms have become stretched, making individual stock selection potentially precarious.

ETFs provide a solution by offering instant diversification across multiple companies involved in the AI ecosystem. This reduces risk and allows investors to benefit from the overall growth trend without needing to pinpoint the "winners" of the future. The Motley Fool emphasizes that while individual AI stocks could offer higher returns, ETFs are generally more suitable for those seeking a less risky approach.

1. Global X Robotics & Artificial Intelligence ETF (BOTZ): The Established Player

- Strategy: BOTZ is arguably the most well-known and established AI-focused ETF. It aims to invest in companies involved in robotics, automation, artificial intelligence, and related technologies. The fund’s methodology focuses on identifying companies that derive a significant portion of their revenue from these areas.

- Holdings: Key holdings include industry giants like NVIDIA (a dominant force in AI chips), ABB Ltd., Fanuc, and Intuitive Surgical (leader in surgical robotics). The portfolio is heavily weighted towards industrial automation and robotics, reflecting the fund's initial focus. You can find a complete list of holdings on the Global X website.

- Pros: BOTZ has a long track record, providing investors with historical performance data. Its broad exposure to robotics and AI offers diversification within that specific niche. It’s also relatively liquid, meaning it’s easy to buy and sell shares.

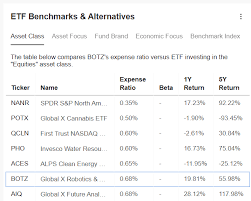

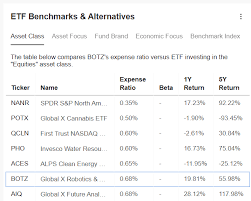

- Cons: BOTZ's focus on industrial automation can limit its exposure to some of the newer, more consumer-facing aspects of AI like generative AI (think ChatGPT). The fund's expense ratio is slightly higher than some competitors at 0.68%. As noted in the Motley Fool article, BOTZ’s performance has been somewhat tempered by concerns about a slowdown in industrial automation spending.

- Why it's Recommended: Despite recent headwinds, BOTZ remains a core holding for investors wanting exposure to the established robotics and AI landscape.

2. First Trust Nasdaq AI Actives ETF (AIQ): The Generative AI Focus

- Strategy: AIQ takes a more targeted approach, focusing on companies actively involved in generative AI – the technology behind tools like ChatGPT, DALL-E 2, and other advanced language models. This fund uses an active management strategy, meaning its portfolio managers can adjust holdings based on their assessment of market conditions and company performance.

- Holdings: AIQ’s top holdings reflect its focus: NVIDIA is again a significant holding (given its crucial role in powering generative AI), alongside companies like Palantir Technologies (data analytics and AI platforms) and C3.ai (enterprise AI applications). The fund's website provides a detailed list of current holdings.

- Pros: AIQ’s active management allows for greater flexibility to capitalize on emerging trends within the rapidly evolving generative AI space. Its focus on this high-growth area offers potentially higher returns than broader AI ETFs.

- Cons: Active management comes with higher fees (expense ratio of 0.94%). The fund's performance is heavily reliant on the skill of its portfolio managers, and active strategies don’t always outperform passive ones. The concentrated focus also means it carries more risk if generative AI adoption doesn't meet expectations or faces regulatory hurdles.

- Why it's Recommended: For investors bullish on the future of generative AI and willing to pay a premium for active management, AIQ offers targeted exposure to this exciting area.

3. iShares Semiconductor ETF (SWKSX): The Infrastructure Play

- Strategy: SWKSX doesn’t directly invest in AI companies but focuses on semiconductor manufacturers – the companies that produce the chips essential for powering AI applications. AI requires massive computing power, and semiconductors are at the heart of this infrastructure.

- Holdings: Key holdings include NVIDIA (again!), Taiwan Semiconductor Manufacturing Company (TSMC), ASML Holding, and Advanced Micro Devices (AMD). These companies are vital in designing and manufacturing the chips that drive AI algorithms. You can view a complete list on iShares' website.

- Pros: SWKSX provides exposure to a critical component of the AI ecosystem without directly betting on specific AI applications or companies. Semiconductor demand is expected to remain strong for years to come, driven by AI and other technological advancements. The expense ratio is relatively low at 0.47%.

- Cons: While semiconductors are essential, the industry is cyclical and subject to geopolitical risks (particularly concerning Taiwan). SWKSX’s performance isn't solely tied to AI; it's influenced by broader semiconductor market trends.

- Why it's Recommended: SWKSX offers a more indirect but potentially stable way to benefit from the AI boom, capitalizing on the underlying infrastructure that makes it possible.

Conclusion: Choosing the Right ETF for You

The Motley Fool’s analysis highlights three distinct approaches to investing in the AI revolution through ETFs. BOTZ provides broad exposure to robotics and automation; AIQ targets the high-growth generative AI space with active management; and SWKSX focuses on the semiconductor infrastructure that underpins all AI applications. Ultimately, the best ETF for an individual investor depends on their risk tolerance, investment goals, and belief in specific areas of the AI landscape. As always, investors should conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/03/the-best-3-tech-etfs-to-buy-now-to-capture-the-ai/ ]