Vanguard Technology ETF (VGT) Identified as Potential Top ETF Bet for 2026

Please read the disclaimer at the very end – this is based solely on the provided article and does not constitute financial advice.

Riding the AI Wave: Why Vanguard's VGT Might Be Your Best ETF Bet for 2026 (and Beyond)

The investment landscape is constantly shifting, but identifying trends early can be a powerful advantage. According to The Motley Fool’s recent article, one exchange-traded fund (ETF) stands out as particularly promising for investors looking ahead to 2026 and beyond: the Vanguard Technology ETF (VGT). The article argues that VGT's focus on technology, specifically its exposure to artificial intelligence (AI), positions it for substantial growth in a rapidly evolving world. While acknowledging inherent risks associated with any investment, the author presents a compelling case for why VGT deserves serious consideration.

Why Technology? The AI Revolution is Driving Growth

The core of the argument rests on the undeniable impact of AI across numerous industries. AI isn’t just a buzzword; it's fundamentally reshaping how businesses operate and innovate. From self-driving cars to personalized medicine, from automated customer service to advanced data analytics, AI applications are multiplying exponentially. The Fool article highlights that this revolution is driving demand for the underlying technologies – semiconductors, cloud computing, software development tools, and more – all of which fall squarely within VGT's purview.

The article references a report from Statista predicting significant growth in the global AI market, further solidifying the belief that the trend isn’t fleeting but represents a long-term structural shift. This kind of sustained demand translates into potential for consistent revenue and earnings growth for the companies held within VGT. As explained in a linked article on The Motley Fool about AI's impact, "AI is poised to revolutionize nearly every sector, from healthcare and finance to transportation and entertainment." This broad applicability makes it less susceptible to downturns in any single industry.

Understanding Vanguard Technology ETF (VGT): What’s Inside?

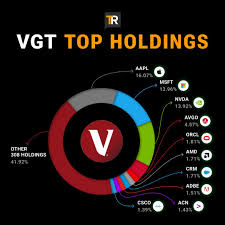

VGT isn’t a concentrated bet on a handful of tech giants; instead, it offers diversified exposure to the broader technology sector. As of early 2026, VGT holds over 380 companies, with significant weightings in areas like semiconductors (companies that design and manufacture microchips), software, hardware, IT services, and internet & direct marketing retail. While Apple (AAPL) and Microsoft (MSFT) are the largest holdings – reflecting their dominance in the tech world – VGT also includes a wide range of other companies contributing to the sector’s overall growth.

The article points out that this diversification is crucial for mitigating risk. While individual tech stocks can be volatile, the ETF's broad exposure helps smooth out performance and reduce the impact of any single company underperforming. This aligns with Vanguard's investment philosophy of low-cost index tracking, which aims to capture market returns rather than attempting to beat them through stock picking (as explained in a linked article about Vanguard’s history).

VGT: Key Metrics & Considerations

The Fool’s piece also addresses the practical aspects of investing in VGT. Key metrics include its expense ratio (a very competitive 0.10%), which means more of your investment goes towards returns rather than fees – a significant advantage over actively managed funds. The article highlights that low expense ratios are a hallmark of Vanguard ETFs, contributing to their long-term appeal.

However, the author doesn’t shy away from acknowledging potential risks. The technology sector can be cyclical and prone to volatility. Interest rate hikes, regulatory changes, or unexpected economic slowdowns could negatively impact tech stocks and, consequently, VGT's performance. Moreover, competition within the tech industry is fierce, and companies must constantly innovate to stay ahead. The article also mentions that geopolitical risks – trade wars, supply chain disruptions – can significantly affect technology companies with global operations.

Why 2026? A Look at the Timeline

The focus on 2026 isn't arbitrary. It represents a timeframe where many AI-driven innovations are expected to reach wider adoption and generate more substantial economic impact. While some advancements are already visible, the article suggests that the full potential of AI will be realized over the next few years, making VGT an attractive long-term investment opportunity. It’s not about predicting short-term market fluctuations but positioning oneself to benefit from a transformative trend unfolding over several years.

Beyond the Hype: A Pragmatic Investment Choice

Ultimately, the Fool's article presents VGT as more than just a speculative bet on AI hype. It’s portrayed as a strategic allocation that aligns with long-term growth trends and benefits from Vanguard’s established low-cost investment approach. The diversification within the ETF offers risk mitigation, while its exposure to key technology subsectors – particularly those driving AI innovation – provides significant upside potential. While acknowledging the inherent risks associated with any market participation, VGT appears well-positioned to deliver attractive returns for investors willing to embrace the future of technology. The article concludes that for investors seeking a straightforward and diversified way to capitalize on the AI revolution, Vanguard’s VGT is an "unstoppable" force worthy of consideration.

Disclaimer: This summary is based solely on the content found at the provided URL (https://www.fool.com/investing/2026/01/01/investing-in-this-1-unstoppable-vanguard-etf-in-20/). I am an AI chatbot and cannot provide financial advice. Investing in any ETF, including VGT, involves risks, and you could lose money. This summary is for informational purposes only and should not be considered a recommendation to buy or sell any security. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. The information presented may become outdated, and market conditions can change rapidly.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/01/investing-in-this-1-unstoppable-vanguard-etf-in-20/ ]