Adobe Reverses Animate Discontinuation

TechCrunch

TechCrunchLocales: UNITED STATES, UNITED KINGDOM

San Francisco, CA - February 15th, 2026 - In a dramatic reversal, Adobe has announced it will not discontinue its flagship 2D animation software, Adobe Animate, as originally planned. Instead, the company will place the application into "maintenance mode," providing continued security updates and bug fixes, but foregoing any further feature development. This decision follows a wave of intense criticism and organized resistance from the animation, art, and game development communities.

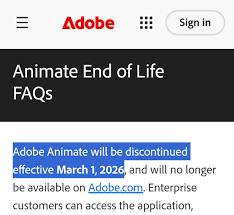

Last month, Adobe sent shockwaves through the creative world when it announced the impending sunset of Animate on March 3rd, 2026, suggesting users transition to Adobe Fresco. This proposition ignited immediate and widespread outrage. Professionals and hobbyists alike took to social media, online forums, and petition platforms to voice their disapproval. Many argued that Fresco, while a powerful illustration and painting tool, lacks the critical feature set necessary for professional 2D animation workflows that Animate provides. The original plan seemed to disregard the unique demands of animators, particularly those working on traditional frame-by-frame animation, vector-based projects, interactive content, and especially within the game development sector.

Multiple petitions garnered tens of thousands of signatures, and the hashtag #SaveAnimate trended for days. Animators detailed the significant disruption the shutdown would cause to ongoing projects, the cost of retraining on new software, and the limitations Fresco imposed on their artistic vision. Concerns were particularly strong among independent animators and smaller studios who rely heavily on Animate's established ecosystem and affordability.

"We've heard you loud and clear," Adobe stated in a blog post released earlier today. "We understand that Animate is an essential tool for many of you, and we apologize for the distress this decision has caused. We will be putting Animate into maintenance mode, which means we will continue to provide security updates and bug fixes, but will not be adding any new features." This carefully worded announcement acknowledges the strong community response while setting realistic expectations for Animate's future.

What Does 'Maintenance Mode' Mean?

While the immediate threat of discontinuation has been averted, the transition to maintenance mode leaves Animate's long-term viability uncertain. The lack of new feature development means the software will not evolve to meet emerging industry standards or integrate with newer technologies. This could eventually lead to compatibility issues with future operating systems, hardware, or other creative tools. However, the continuation of security patches is crucial, preventing the software from becoming vulnerable to exploits and ensuring existing projects remain accessible.

Industry analysts suggest Adobe's initial decision stemmed from a desire to consolidate its product offerings and focus resources on Fresco and other newer applications. The company may have underestimated the depth of reliance on Animate, particularly within niche areas like interactive advertising and educational institutions. The user base's passionate response demonstrated the software's enduring value despite the emergence of alternative animation tools.

A Lesson in Community Power

The Animate saga highlights the increasing power of creative communities to influence corporate decisions. The swift and organized response showcased the collective voice of animators and artists, forcing Adobe to reconsider a plan that initially appeared finalized. This incident mirrors similar situations involving other creative software, demonstrating that companies must listen to their user base to maintain trust and loyalty.

Looking Ahead

Adobe has not specified a timeframe for how long it will continue to support Animate in maintenance mode. This ambiguity leaves users in a somewhat precarious position, requiring them to plan for a potential eventual obsolescence. Many animators are now exploring alternative software options, such as Toon Boom Harmony, TVPaint Animation, or open-source solutions like OpenToonz, as a hedge against Animate's eventual retirement. The focus will likely shift to ensuring continued compatibility and data migration strategies for existing projects. The industry will be closely watching Adobe's future actions to see if this represents a genuine commitment to supporting its creative user base, or simply a temporary reprieve.

Ultimately, the story of Adobe Animate serves as a crucial reminder that software isn't just code; it's a tool that powers creativity, and its fate often rests on the voices of those who wield it.

Read the Full TechCrunch Article at:

[ https://techcrunch.com/2026/02/04/after-backlash-adobe-cancels-adobe-animate-shutdown-and-puts-app-on-maintenance-mode/ ]