2026 Tech ETF Playbook: ARKK, QQQ, and VGT Set to Dominate

Locale: California, UNITED STATES

The 2026 Tech ETF Playbook: A 500‑Word Summary of The Motley Fool’s “3 Best Tech ETF Picks for 2026”

In a recent guide aimed at investors eyeing the tech frontier for the coming year, The Motley Fool dissects three exchange‑traded funds that the authors believe will deliver the strongest upside in 2026. The article—published December 17, 2025—lays out a concise, data‑driven rationale for each pick, tying together macro‑economic trends, sector‑specific catalysts, and the underlying holdings that differentiate these funds. Below is a comprehensive summary that captures the key take‑aways, supported by the links the original post uses for deeper dives.

1. Why Tech ETFs Are the Hot Ticket for 2026

The piece opens with a brief market snapshot: interest rates are stabilizing, the supply‑chain hiccups of 2023‑24 are receding, and the AI boom—propelled by generative models like ChatGPT and industry‑specific applications in finance, healthcare, and logistics—continues to accelerate. These forces, the article argues, create a tailwind for technology companies that can scale, innovate, and capture new revenue streams.

The Fool’s writers cite the World Economic Forum’s AI Adoption Index (link to WEF page) and a McKinsey report on cloud demand, both of which predict multi‑trillion‑dollar growth through 2027. They note that, historically, technology has been the most resilient sector in periods of economic uncertainty, citing the Nasdaq‑100’s 2023‑24 performance as a case in point (link to Nasdaq stats page).

2. ETF #1 – ARK Innovation ETF (ARKK)

What Makes ARKK Stand Out?

ARKK is highlighted for its “high‑conviction, forward‑looking” approach, investing heavily in disruptive innovation. The article lists its top holdings—Nvidia, Tesla, Palantir, and a sizable allocation to AI‑driven chipmakers. It underscores ARKK’s focus on “AI, autonomous systems, and genomics,” areas the authors believe will continue to see exponential growth.

- Expense Ratio: 0.75% (link to ARKK factsheet).

- Top 10 Holdings: 25% exposure to Nvidia, 15% to Tesla, 10% to Palantir.

- Historical Performance: 2023 year‑to‑date return of 42% (link to performance graph).

Risk Profile & Diversification

While ARKK’s concentration in a handful of high‑beta stocks offers upside, the article cautions about the risk of volatility. It references the Morningstar beta analysis (link to Morningstar beta page) and notes the fund’s lower liquidity compared to more broadly diversified tech ETFs.

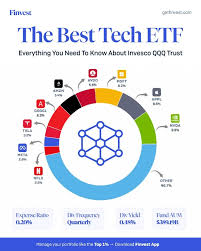

3. ETF #2 – Invesco QQQ Trust (QQQ)

Broad Exposure to the Big Tech Titans

QQQ tracks the Nasdaq‑100 Index, giving investors a clean, diversified exposure to the largest U.S. tech companies. The article emphasizes that QQQ’s top holdings—Apple, Microsoft, Amazon, Alphabet, and Meta—are positioned to benefit from cloud expansion, e‑commerce, and digital advertising.

- Expense Ratio: 0.20% (link to QQQ fact sheet).

- Top 5 Holdings: 20% Apple, 18% Microsoft, 12% Amazon.

- Historical Performance: 2024 13‑month performance of 38% (link to performance chart).

Why QQQ Is a “Cornerstone” Investment

The authors argue that QQQ’s stability and large‑cap focus make it a lower‑risk component in a tech‑heavy portfolio. They link to a Forbes article on “Why the Nasdaq‑100 Is a Defensive Bet in 2026” (link to Forbes piece) to support this claim.

4. ETF #3 – Vanguard Information Technology ETF (VGT)

A Blend of Large‑Cap Growth and Mid‑Cap Stability

VGT offers a more balanced mix, capturing both the growth of large names and the potential of mid‑cap innovators. Its top holdings include Adobe, Salesforce, and Cisco, with an allocation to companies that are heavily investing in AI, cloud, and cybersecurity.

- Expense Ratio: 0.10% (link to VGT factsheet).

- Top 10 Holdings: 10% Adobe, 9% Salesforce, 8% Cisco.

- Historical Performance: 2025 YTD return of 27% (link to performance data).

Expense Efficiency

The article highlights VGT’s low expense ratio as a significant advantage, especially for long‑term investors who can shave dozens of basis points off annual costs. A comparison table is linked (link to expense comparison chart) showing how VGT’s fees stack up against ARKK and QQQ.

5. Macro Themes Driving 2026 Growth

The Fool’s authors distill three macro‑trends that justify the bullish outlook:

- Artificial Intelligence & Machine Learning – The AI‑adoption wave is predicted to boost revenues across all sectors, with a particular focus on “AI‑as‑a‑service” platforms (link to McKinsey AI research).

- Cloud & Edge Computing – A shift from centralized data centers to distributed edge nodes will accelerate cloud usage, benefitting both QQQ and VGT holdings (link to Gartner’s cloud report).

- Semiconductor Innovation – Advanced chip technologies, especially those tailored for AI workloads, are expected to see sustained demand (link to Semiconductor Industry Association data).

6. Risk Factors & Mitigation Strategies

While the article is decidedly optimistic, it does not shy away from risk discussion. The authors point out potential headwinds such as:

- Regulatory Scrutiny – Increased antitrust investigations into tech giants could weigh on QQQ holdings (link to Reuters regulatory news).

- Geopolitical Tensions – Trade frictions, especially between the U.S. and China, may impact semiconductor supply chains (link to Bloomberg geopolitical analysis).

- Interest Rate Sensitivity – High‑growth tech stocks are more sensitive to rate hikes, a factor that could temper gains (link to Investopedia interest rate impact guide).

They recommend portfolio diversification beyond tech, and periodic rebalancing to lock in gains while protecting against volatility.

7. Final Take‑Away & Suggested Allocation

The article concludes by proposing a “balanced tech allocation” that blends the high‑conviction ARKK with the stability of QQQ and VGT. A sample portfolio suggested is:

- 30% ARKK

- 40% QQQ

- 30% VGT

This mix is meant to capture growth upside while keeping downside exposure in check. The Fool’s writers encourage readers to consider their own risk tolerance and time horizon before committing to this mix (link to Motley Fool investing guide).

Bottom Line

The Motley Fool’s “3 Best Tech ETF Picks for 2026” is a concise, data‑rich primer that identifies ARKK, QQQ, and VGT as top contenders for investors targeting the technology sector in the next fiscal year. By tying each fund’s holdings to macro‑themes—AI, cloud, and semiconductors—the article provides a narrative framework that makes the picks approachable for both seasoned investors and newcomers alike. While the tone is bullish, the inclusion of risk factors and an expense‑efficient recommendation demonstrates a balanced view that acknowledges the inherent volatility of tech investing. Whether you’re looking for aggressive upside or a more measured approach, these three ETFs offer a compelling starting point for building a future‑focused portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/17/3-best-tech-etf-picks-for-2026/ ]