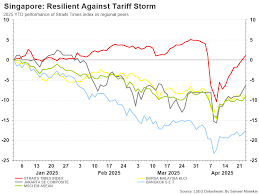

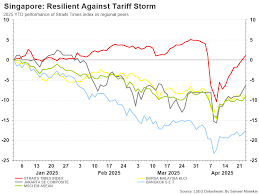

Singapore Stock Market Rises Despite US Tariffs

The Straits Times

The Straits TimesLocale:

SINGAPORE - February 23rd, 2026 - Despite a fresh wave of US tariffs on Chinese goods that sent ripples of concern through global markets, the Singapore stock market demonstrated remarkable resilience today, with the Straits Times Index (STI) closing up 0.5 per cent. The STI finished at 3,159.21, a gain of 15.28 points.

This positive performance arrives after the US administration, under President Trump, announced on Friday plans to impose tariffs on an additional US$300 billion (S$427 billion) worth of goods originating from China. The announcement immediately triggered anxieties across international exchanges, leading to widespread sell-offs. However, Singapore appears to have largely weathered the storm, showcasing a degree of economic stability and investor confidence that contrasts with the more dramatic downturns seen elsewhere.

The gains were primarily driven by robust performances in the financial and property sectors. Banking giants OCBC Bank and DBS Group both experienced positive movement, adding 0.7 per cent and 0.6 per cent respectively, closing at S$12.79 and S$25.53. Property developer CapitaLand also contributed to the positive trend, finishing up 0.7 per cent at S$3.36. These key sectors, traditionally considered barometers of economic health, indicate continued internal strength within the Singaporean economy.

Trading volume surged today, reaching 1.59 billion shares - a significant increase from the 1.24 billion shares traded on Friday. The total value of shares traded also rose substantially, climbing to S$1.74 billion, compared to S$1.26 billion previously. This heightened activity suggests a dynamic market with considerable investor participation, even in the face of global uncertainty.

"The market's resilience reflects confidence in Singapore's economy," stated Nicholas Tan, head of research at Credo Realties. "Singapore's strategic position as a regional hub, coupled with its diversified economy and strong financial regulations, provides a buffer against external shocks." However, Mr. Tan also cautioned that sustained positive performance will depend on how the US-China trade dispute unfolds in the coming months.

Beyond the Numbers: A Deeper Look at Singapore's Resilience

The ability of the STI to move upward despite the trade war escalation raises important questions about the factors underpinning Singapore's economic fortitude. Several key elements appear to be at play. First, Singapore's economic structure is notably diversified, extending beyond reliance on US-China trade. While certainly impacted by global trade flows, the country benefits from strong internal demand, a thriving financial services sector, and a growing focus on high-value industries like biomedical sciences and fintech.

Secondly, Singapore's commitment to free trade agreements (FTAs) with numerous countries provides alternative market access for its businesses, mitigating the impact of tariffs imposed by any single nation. These FTAs, combined with a pro-business regulatory environment, continue to attract foreign investment. [ Further information on Singapore's FTAs can be found at the Enterprise Singapore website ].

Furthermore, Singapore has actively positioned itself as a regional headquarters for multinational corporations, many of which are strategically adjusting their supply chains in response to the trade war. This has led to increased investment and economic activity within the country. This trend reflects a broader global pattern of companies diversifying their manufacturing and supply chain operations to reduce reliance on any single country.

Cautious Optimism: The Road Ahead

Despite the positive market performance, analysts remain cautiously optimistic. The US-China trade war remains a significant headwind for the global economy, and the potential for further escalation cannot be discounted.

"The US-China trade war is far from over, and there is always the risk of further escalation," warned Yeak Chee Seng, chief investment officer at Fortress Capital. "The market is likely to remain volatile in the near term. Investors should be prepared for continued fluctuations and adopt a long-term perspective."

The impact of the tariffs on specific sectors within Singapore's economy will be closely monitored. Industries heavily reliant on intermediate goods from China, such as electronics manufacturing, could face increased costs. However, the country's robust logistics infrastructure and efficient port facilities may help to mitigate some of these challenges.

Looking ahead, Singapore's economic outlook will depend on several factors, including the trajectory of the US-China trade negotiations, global economic growth, and the country's ability to adapt to evolving technological trends. Continued investment in innovation and workforce development will be crucial for sustaining Singapore's economic competitiveness in the long run. The Monetary Authority of Singapore (MAS) is also expected to play a key role in maintaining financial stability and managing exchange rate fluctuations.

Read the Full The Straits Times Article at:

[ https://www.straitstimes.com/business/companies-markets/singapore-stocks-rise-on-monday-amid-trumps-latest-tariff-salvo-sti-up-0-5 ]