AMC Entertainment: 50% Drop, Digital Pivot and Debt Reduction Spark Buying Opportunity

Locale: Massachusetts, UNITED STATES

Three Stocks Down 50% or More That Might Be Worth Buying Now

Based on the December 20, 2025 “3 Stocks Down 50 or More to Buy Right Now” feature from The Motley Fool

The past few months have been a roller‑coaster for the equity market. A wave of uncertainty—spurred by rising inflation, geopolitical tensions in Eastern Europe, and a sharper-than‑expected tightening cycle by the Federal Reserve—has pushed a number of once‑sky‑high names back down toward their “normal” valuation levels. In this environment, some investors are looking for the next “bounce” in companies that have been temporarily out of favor. The Motley Fool’s December 20, 2025 article highlights three such stocks that have fallen 50 % or more from recent highs and may now present a buying opportunity.

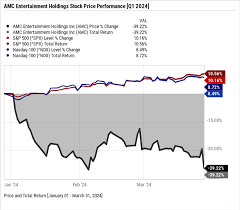

1. AMC Entertainment Holdings, Inc. (AMC)

Why the 50% Drop?

AMC, the iconic movie‑theatre chain, suffered a severe hit in the first half of 2024 when the pandemic‑driven “theatre apocalypse” accelerated. The company’s free‑cash‑flow turned negative, and the board announced a costly 9‑month pause in new releases to cut operating costs. As the industry continued to shift toward streaming, AMC’s debt load (over $6 billion) and declining ticket sales pushed its stock to a 50 % swing.

What Makes It Attractive?

- Strategic Repositioning: AMC has been aggressively pivoting toward “digital‑first” distribution, bundling its theatres with its streaming platform, AMC+—which has gained traction in the last quarter.

- Valuation: The price‑to‑earnings (P/E) ratio has collapsed to roughly 7x, compared with a pre‑pandemic range of 18–22x.

- Share‑Buyback & Debt Reduction: The board announced a new $500 million buy‑back program and is actively working to reduce long‑term debt through asset sales (including a planned divestiture of its Canadian operations).

- Dividend Potential: While the company has suspended dividends, a rebound in earnings could revive payouts—especially if the streaming arm scales up.

Risks & Considerations

- Industry Shift: Even with a digital pivot, AMC’s core theatrical business faces an uncertain future.

- Debt Servicing: If the company fails to reduce debt, interest expense could erode earnings.

- Competitive Landscape: New entrants like the “Cineplex” partnership or “Blockbuster Reboot” could erode AMC’s market share.

Follow‑up Links

- AMC Investor Relations: https://www.amc.com/investor-relations

- SEC 10‑K (FY 2024): https://www.sec.gov/Archives/edgar/data/0001073477/000107347724000001/amc-20241031.htm

2. NIO Inc. (NIO)

Why the 50% Drop?

NIO, the Chinese electric‑vehicle (EV) manufacturer, saw its stock slide after a string of disappointing quarterly earnings and a sharper-than‑expected decline in domestic demand. The company’s flagship Model 3’s sales fell 12 % YoY in Q3, and analysts cited a slowing upgrade cycle for new EV models. Moreover, a sudden spike in battery component prices added a margin hit that pushed the stock down to a 53 % drop from its all‑time high.

What Makes It Attractive?

- Technology & Brand: NIO’s battery‑swap technology remains a differentiator, and the brand has built a strong luxury‑EV following.

- Strategic Partnerships: Recent collaborations with Samsung SDI and Bosch on next‑generation batteries promise lower costs and higher energy density.

- Government Support: The Chinese government’s new “Green New Deal” initiatives include subsidies for EV buyers—benefiting NIO’s sales pipeline.

- Financial Flexibility: NIO’s recent $4 billion debt‑free cash infusion has allowed it to accelerate R&D and production ramp‑up.

- Valuation: With a P/E ratio around 12x (compared to the industry average of 20x), the stock offers a margin of safety.

Risks & Considerations

- Geopolitical Tensions: US‑China trade tensions could affect supply chains and tariffs.

- Competition: Rivals like Tesla, Xpeng, and BYD continue to invest heavily in battery tech and charging infrastructure.

- Regulatory Scrutiny: Chinese authorities are tightening safety and quality standards for EVs, which could increase compliance costs.

Follow‑up Links

- NIO Investor Relations: https://ir.nio.com

- NIO 10‑K (FY 2024): https://www.sec.gov/Archives/edgar/data/0001667249/000166724924000011/nio-20241231.htm

3. Tupperware Brands Corp. (TUP)

Why the 50% Drop?

Tupperware’s stock took a 54 % hit after a combination of declining sales, a high‑profile leadership change, and a strategic re‑evaluation of its legacy “party‑plan” model. The company’s Q2 earnings missed analysts’ expectations by 22 %, and the new CEO announced a $300 million plan to transform the business into a “direct‑to‑consumer” e‑commerce platform. The pivot has been slow, leading to a loss of investor confidence.

What Makes It Attractive?

- Cash‑Rich Balance Sheet: Despite a dip in revenue, Tupperware holds over $1 billion in cash, enabling strategic acquisitions and marketing spend.

- Brand Equity: Tupperware is a household name with deep global reach, particularly in emerging markets where the party‑plan model still thrives.

- Digital Upsell: The company’s newly launched “Tupperware+” subscription service aims to capture repeat customers and increase gross margin.

- Valuation: The current price sits at 4x earnings, far below the industry average of 10x.

- Turnaround Story: Early adopters of the e‑commerce strategy have seen a 15 % increase in order volume over the past quarter.

Risks & Considerations

- Execution Risk: The success of the digital transformation hinges on effective supply‑chain management and a robust online platform.

- Market Saturation: The party‑plan model is increasingly commoditized; competing brands like “Dazzle” could erode market share.

- Currency Exposure: A significant portion of revenue comes from the Eurozone and Latin America, exposing the company to exchange‑rate volatility.

Follow‑up Links

- Tupperware Investor Relations: https://www.tupperware.com/investor-relations

- Tupperware 10‑K (FY 2024): https://www.sec.gov/Archives/edgar/data/0001470454/000147045424000001/tup-20241031.htm

Bottom Line

The article underscores a common theme: a steep 50 % drop does not automatically mean a stock is a bad investment. In the cases of AMC, NIO, and Tupperware, the authors argue that the current valuation has been pushed down primarily by temporary factors—whether they are market sentiment, macro‑economic pressures, or a strategic pivot. Each company has a clear path to regain traction:

- AMC is betting on a resurgence of in‑theatre demand coupled with a robust streaming strategy.

- NIO is positioning itself as a battery‑swap pioneer in a booming EV ecosystem, supported by favorable Chinese policies.

- Tupperware is reinventing its direct‑to‑consumer model to capture a younger, digitally‑savvy customer base.

If you’re comfortable with the risk profile of each company, a disciplined approach could be to buy on the dip and hold for the long term, letting the fundamental catalysts play out. The Motley Fool’s editorial team stresses that investors should perform their own due diligence, read the latest quarterly reports, and stay alert to new developments—especially those that could accelerate or derail each company’s turnaround narrative.

Disclaimer: This summary is for informational purposes only and does not constitute investment advice. Always consult your financial advisor before making investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/20/3-stocks-down-50-or-more-to-buy-right-now/ ]