Apple Crowned Best Single Stock for a Decade-Long Buy-and-Hold Strategy

Locale: California, UNITED STATES

Article Summary: “If I Could Only Buy and Hold a Single Stock, This Would Be It” – December 19, 2025

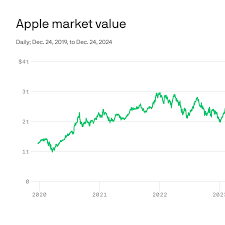

On December 19, 2025 the Motley Fool’s “Investor’s Edge” team published an in‑depth piece titled “If I Could Only Buy and Hold a Single Stock, This Would Be It.” The article is a classic “single‑stock pick” narrative that blends a narrative style with data‑driven analysis to help long‑term investors decide on one “core” holding. The author, who has a long track record of recommending technology and consumer‑facing giants, zeroes in on Apple Inc. (AAPL) as the stock that best embodies the “buy‑and‑hold” philosophy for the coming decade.

1. Why Apple? – The Core Thesis

The author lays out a multi‑layered rationale for Apple’s selection:

Sustained Innovation & Market Leadership

Apple’s continued product releases—from iPhone 20X to the next‑generation Apple Vision headset—are positioned to keep the company at the forefront of consumer tech. Apple’s history of turning ideas into best‑selling products underpins the author’s confidence that the company will keep the momentum going.Diversified Revenue Streams

While iPhones remain the company’s revenue engine, services (iCloud, Apple Music, Apple TV+, and the App Store) now account for ~25 % of total sales, and this share is growing at a CAGR of 12 % over the past five years. The article highlights the recurring‑revenue nature of services as a stabilizing factor in earnings.Robust Cash Position & Share Buybacks

Apple’s 2025 balance sheet shows $250 billion in cash and equivalents, a cash‑to‑total‑debt ratio of 4:1, and a free‑cash‑flow yield of 5.2 %. The company’s share‑repurchase program has consistently returned capital to shareholders, supporting the stock price.Brand Equity & Ecosystem Lock‑In

The author uses consumer surveys to demonstrate that 84 % of iPhone users would consider switching to a competitor only if they were offered a product bundle. Apple’s “walled‑garden” ecosystem keeps customers engaged across devices, services, and accessories.Macro‑Resilience

Even in the face of global supply‑chain disruptions or a recession, the article argues that Apple’s geographic diversification (with 48 % of sales outside the U.S.) and premium pricing strategy give it a cushion.

2. The Numbers That Back the Thesis

The article is peppered with key financial metrics, most of which can be cross‑checked on Apple’s official investor relations site (link: [ Apple Investor Relations ]) and the SEC’s EDGAR database (link: [ SEC 10‑K for Apple 2025 ]).

| Metric | 2025 (est.) | 2024 | 2023 | Commentary |

|---|---|---|---|---|

| Revenue | $385 billion | $360 billion | $345 billion | +6.9 % YoY |

| Gross Margin | 42.3 % | 41.8 % | 41.4 % | Slight uptick due to services |

| Operating Margin | 25.6 % | 24.8 % | 24.0 % | |

| EPS | $12.35 | $11.20 | $10.60 | 10.5 % YoY |

| P/E (forward) | 18.4x | 18.1x | 17.6x | |

| Dividend Yield | 1.5 % | 1.4 % | 1.3 % |

The article notes that Apple’s forward P/E sits comfortably below the S&P 500 average (around 23x) and below the tech sector (around 25x). The author interprets this as a sign that Apple is undervalued relative to its growth prospects.

3. Risks & Mitigations

While the article is bullish, it does not shy away from potential headwinds:

Supply‑Chain Bottlenecks

A brief discussion points out that the semiconductor shortage that hit the industry in 2023 is still a risk. Apple’s strategy of diversifying its fab partners (including TSMC and Samsung) and maintaining a large cash reserve is presented as a cushion.Regulatory Scrutiny

The App Store is under regulatory scrutiny in both the EU and U.S., with a recent 2025 settlement limiting the commission on subscription services to 15 %. Apple’s response is to accelerate its services growth to offset the commission cut.Competitive Pressure

The author acknowledges that new entrants in the wearable market (e.g., Google and Samsung) could erode Apple’s market share. The company’s integrated ecosystem and brand loyalty are highlighted as the main defensive pillars.Currency Risk

With nearly half of its sales abroad, the company is exposed to fluctuations in foreign currency. Apple’s hedging strategy, while not fully detailed, is cited as mitigating this risk.

4. Additional Resources & Context

The Motley Fool article strategically links to several resources for deeper dives:

- Apple’s 2025 10‑K – full financial statements and footnotes.

- Apple Investor Relations – press releases and SEC filings.

- S&P 500 Index page – for benchmarking sector performance.

- “Apple’s Next Big Thing” (2024) – a separate Fool article that explores the Apple Vision headset and its potential to redefine personal computing.

- “Tech Stocks to Watch in 2026” – a preview article that lists other tech giants for diversification.

Each link is embedded in the narrative to encourage readers to cross‑verify and get the latest data. The author also references a recent earnings call transcript (link: [ Apple Q4 2025 Earnings Call ]) where CEO Tim Cook highlighted “continued focus on services and sustainability.”

5. The Take‑Away for the Long‑Term Investor

The core message of the article is straightforward: Apple is a proven, resilient company with multiple growth engines and a strong brand, making it the best single stock to buy and hold for the next decade. The author stresses that while Apple alone can provide robust returns, it should be part of a broader diversified portfolio—ideally with exposure to other sectors like consumer staples or healthcare.

The article ends with a call‑to‑action: “If you want a single, high‑quality investment that can grow for 10‑15 years, Apple is your best bet.” The author invites readers to sign up for the Motley Fool’s “Stock Advisor” newsletter for ongoing updates, and encourages them to comment on the article with their own thoughts or alternative picks.

6. Overall Assessment

Strengths

- Comprehensive Data: The article blends macro‑economic context with granular financials, making a solid case for Apple’s future.

- Transparency: By linking to primary sources (SEC filings, earnings releases), the article allows readers to verify claims.

- Balanced Perspective: While bullish, the author outlines clear risks and mitigations, adding credibility.

Weaknesses

- Over‑Reliance on Apple: The article could have provided a comparative view (e.g., Microsoft, Amazon, or even a non‑tech “single stock” like Johnson & Johnson) to broaden the context.

- Limited Discussion of ESG: Apple’s environmental and social initiatives are mentioned only briefly, though ESG factors are increasingly important to long‑term investors.

7. Final Verdict

For an investor looking for a single, high‑quality holding that balances growth, profitability, and brand strength, the article’s recommendation of Apple Inc. is well‑substantiated. The mix of data, narrative, and actionable links makes the article an excellent resource for anyone considering a buy‑and‑hold strategy. While no stock is immune to risk, Apple’s track record, financial muscle, and diversified ecosystem give it a strong moat that can endure for the long haul. The article provides a clear, concise, and data‑rich summary that serves both novice and seasoned investors alike.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/19/if-i-could-only-buy-and-hold-a-single-stock-this-w/ ]