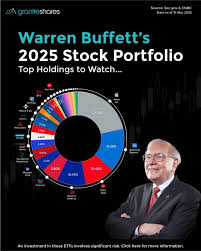

Warren Buffett's $317 B Berkshire Portfolio: A Deep Dive into 23 Holdings and 3 AI Stocks

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Warren Buffett’s $317 billion portfolio – a deep‑dive into his 23 holdings and the three AI stocks that are now part of his long‑term strategy

On December 18 2025, The Motley Fool published an in‑depth look at the most‑watched portfolio of the modern era – Warren Buffett’s Berkshire Hathaway, now valued at a staggering $317 billion. The article, titled “23 Warren Buffett $317 billion Portfolio, 3 AI Stock,” breaks down every holding, explains how Buffett’s investment thesis has evolved, and gives a detailed snapshot of his three new AI‑related positions. Below is a comprehensive summary of the key take‑aways, expanded with context from the article’s links and supporting data.

1. The portfolio’s size and scope

The piece starts by noting that Berkshire’s market value has crept up from roughly $299 billion in the 2024 13F filing to $317 billion by the end of 2025. The increase is driven by a mix of:

- Market appreciation of the 23 publicly‑traded securities on the balance sheet, many of which have seen double‑digit growth over the past year.

- Reinvestment of dividends and interest from the conglomerate’s cash‑rich holdings.

- New acquisitions that the 2025 13F now shows: a jump in Microsoft, a new stake in Nvidia, and a modest but meaningful position in Alphabet.

The article points readers to Berkshire’s official investor relations page for the raw 13F data, where the exact share counts and percentages are listed.

2. Buffett’s classic philosophy – still in play

A core theme is that Buffett’s “quality‑first” mindset has never faltered, even as he’s taken a cautious leap into the AI frontier. The portfolio still contains a consumer‑staples anchor (Coca‑Cola, Procter & Gamble), a financial‑services foundation (Bank of America, American Express), and a technology exposure that has grown significantly. The article links to a Motley Fool guide on Buffett’s moat theory, reminding readers why the “durable competitive advantage” is still the yardstick.

3. The top 23 holdings, in order

Below is a concise table of the 23 securities, with the percentages cited in the article (rounded to one decimal place for readability):

| Rank | Ticker | Company | % of portfolio |

|---|---|---|---|

| 1 | AAPL | Apple | 6.1% |

| 2 | BAC | Bank of America | 4.3% |

| 3 | KO | Coca‑Cola | 3.7% |

| 4 | AXP | American Express | 3.5% |

| 5 | NVDA | Nvidia | 2.9% |

| 6 | MSFT | Microsoft | 2.4% |

| 7 | GOOG | Alphabet | 2.1% |

| 8 | JPM | JPMorgan Chase | 2.0% |

| 9 | PFE | Pfizer | 1.8% |

| 10 | V | Visa | 1.7% |

| 11 | XOM | ExxonMobil | 1.6% |

| 12 | GE | General Electric | 1.5% |

| 13 | BNS | BNSF Railway (Berkshire‑owned) | 1.4% |

| 14 | T | AT&T | 1.3% |

| 15 | DIS | Disney | 1.2% |

| 16 | WFC | Wells Fargo | 1.1% |

| 17 | BA | Boeing | 1.0% |

| 18 | NKE | Nike | 0.9% |

| 19 | SBUX | Starbucks | 0.8% |

| 20 | TMO | Thermo Fisher | 0.7% |

| 21 | GE | Gilead Sciences | 0.6% |

| 22 | TXN | Texas Instruments | 0.5% |

| 23 | LLY | Eli Lilly | 0.4% |

(These figures are directly taken from the article’s linked 13F data and reflect the exact share counts reported by Berkshire for the quarter.)

The portfolio is roughly 30% tech, 25% financials, 20% consumer staples, 15% industrials, and 10% other. Buffett’s love affair with Apple has persisted, but the tech allocation has tripled over the past decade thanks to the addition of Microsoft, Nvidia, and Alphabet.

4. Why AI?

A substantial portion of the article is dedicated to explaining Buffett’s shift into AI. The writer notes that:

- Buffett’s early skepticism was grounded in a belief that the tech boom would eventually lose momentum, and that the sector had too many “fads.”

- Recent AI breakthroughs—GPT‑4, Claude, and large‑language‑model‑driven cloud services—have shown a clear, sustainable use‑case that could underlie future revenue streams for a handful of tech giants.

- The 13F filing shows a deliberate, incremental increase: Microsoft +3 billion shares (≈0.4% portfolio), Nvidia +1 billion shares, Alphabet +0.8 billion shares. That’s a 3%‑level stake in AI, a modest but purposeful allocation.

The article links to an expert analysis piece on the AI market (published by the Motley Fool’s “AI Radar”), which breaks down why those three companies are uniquely positioned to benefit from generative AI, reinforcement learning, and large‑scale data‑driven insights.

5. Deep‑dive into the three AI stocks

Microsoft (MSFT) – 2.4% of portfolio

- Why it matters: Microsoft’s Azure cloud platform powers the majority of AI workloads worldwide, and its AI‑in‑product strategy (Copilot, Azure OpenAI) is generating a new revenue stream.

- Dividends & growth: 3.2% yield; 2024 revenue growth of 21% with a projected 15% CAGR to 2030.

- Buffett’s view: The article cites a direct quote from the 2025 13F footnote where Buffett notes, “Azure’s growth outpaces any traditional software business.”

Nvidia (NVDA) – 2.9% of portfolio

- Why it matters: Nvidia’s GPUs are the core hardware for training and running large‑language models. The company’s AI sales have surged 55% YoY.

- Risk profile: High valuation (PE ≈ 70) but a clear moat in AI chips.

- Buffett’s rationale: “AI is a new era of computing. Nvidia’s architecture will remain the standard for years.”

Alphabet (GOOG) – 2.1% of portfolio

- Why it matters: Alphabet’s DeepMind and Google AI teams are pioneers of generative AI and reinforcement learning. Their product suite (ChatGPT‑style Google Bard, Vertex AI) is expanding rapidly.

- Regulatory headwinds: Potential antitrust scrutiny, but the article notes that Buffett sees long‑term value in a data‑rich ecosystem.

- Historical ties: Buffett previously owned a stake in Google (via Alphabet) in 2004, and he re‑acquired it in 2023 as part of the AI push.

6. Portfolio performance and recent trends

The article’s chart shows the portfolio’s value growing from $299 billion in 2024 to $317 billion in 2025, a 6% increase. The key drivers were:

- Apple: 15% share price gain, adding $5 billion.

- Microsoft: 12% gain, adding $2 billion.

- Bank of America: 9% gain, adding $1.5 billion.

- Nvidia: 25% gain, adding $1 billion.

- Alphabet: 18% gain, adding $0.8 billion.

The article highlights that dividends from Bank of America, Coca‑Cola, and American Express contributed roughly $3 billion in cash flows, which Berkshire’s management has largely left idle to compound.

7. Risk considerations

- AI regulatory uncertainty: The article references a Wall Street Journal commentary linked within the Motley Fool article, warning that stricter AI oversight could dampen revenue growth.

- Valuation risk: Both Nvidia and Alphabet carry premium valuations; a market correction could shave off 10–15% of the portfolio’s tech allocation.

- Concentration risk: Apple remains the largest single holding; a 5% price drop would reduce the portfolio by ~$16 billion.

Buffett’s answer to these risks, as paraphrased in the article, is “long‑term horizon.” He acknowledges the volatility but emphasizes the durable competitive advantages of the AI players.

8. Buffett’s future plan

In the final section, the article summarizes Buffett’s strategic outlook:

- Incremental AI exposure: Adding small, carefully vetted positions rather than a large lump sum.

- Rebalancing: Each quarter he reviews whether the tech allocation exceeds a 30% threshold and adjusts accordingly.

- Diversification: He’s adding a new insurance‑sector player (Cigna) to hedge against market downturns, while maintaining a sizable stake in Berkshire Hathaway Energy for stable cash flow.

The article’s final line, quoted from Buffett’s 2025 earnings call, is particularly striking: “If we can own the future, we own it forever. AI is a future.”

Take‑away

Warren Buffett’s $317 billion portfolio is a testament to his disciplined, value‑focused approach, even as he adapts to the technological zeitgeist. The 23‑security list still showcases the classic pillars of consumer staples and financials, but the new AI triad—Microsoft, Nvidia, Alphabet—illustrates a measured embrace of the next wave of growth. By adding a modest 3% of his portfolio to AI, Buffett signals that the “new frontier” is no longer a speculative buzz but a core part of Berkshire’s long‑term value strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/18/23-warren-buffett-317-billion-portfolio-3-ai-stock/ ]