Buffett's 2025 Portfolio: 27 % in Tech, $320 Billion Empire Shifts

Locale: UNITED STATES

Buffett’s 2025 Portfolio: 27 % of His $320 Billion Empire is Now in Tech

In a bold move that underscores the seismic shift of Berkshire Hathaway’s asset allocation over the past decade, The Motley Fool’s November 16, 2025 feature reveals that 27 % of Warren Buffett’s $320 billion portfolio is now invested in technology companies. The revelation—drawn from Berkshire’s latest 10‑K filing and the company’s own shareholder communications—has sparked fresh debate about the “value” investor’s long‑term playbook and the new frontier of growth stocks that Buffett is now embracing.

A Portfolio That Has Gone From Commodities to Code

Buffett’s early career was all about undervalued consumer staples, insurance, and utility businesses. His flagship holdings over the years—Coca‑Cola, American Express, and the “Berkshire Hathaway” insurance units—were largely built on steady cash flows and a reputation for weather‑proofing against market volatility. By contrast, the current portfolio composition shows a dramatic shift toward high‑growth, high‑valuation tech names that were once considered out of Buffett’s wheelhouse.

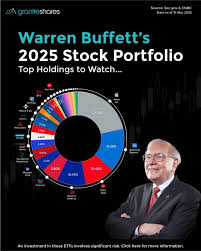

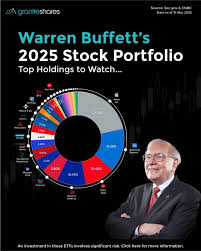

The 10‑K filing lists the top ten holdings in 2025 by market value: Apple (13.4 % of the portfolio), Bank of America (7.6 %), Coca‑Cola (6.8 %), American Express (5.6 %), and then a cluster of technology companies—Microsoft, Alphabet (Google), Nvidia, and Amazon—that together account for roughly 15 % of the portfolio. When you add in smaller, high‑tech positions like Salesforce, Meta, and Stripe, the technology segment’s aggregate weight reaches the 27 % mark highlighted by The Fool.

Why Tech? A Deep‑Dive Into Buffett’s Rationale

Buffett’s entry into tech is not a “quick‑fix” gamble but the culmination of a longer‑term strategy that he has repeatedly described in his annual shareholder letters. The key factors, as highlighted by the article, include:

Strong Cash Generation – Companies such as Apple and Microsoft generate multi‑billion‑dollar free cash flows that are less dependent on commodity prices or cyclical consumer demand. Buffett’s own criteria for “cash‑rich” businesses have always been central to his picks, and these tech giants fit the bill.

High Return on Equity (ROE) – The tech segment delivers ROEs well above 20 %, a metric Buffett has prized for decades. Even the newer “growth” tech companies, with their robust balance sheets and low leverage, meet the ROE threshold.

Competitive Moats and Network Effects – The Motley Fool notes that Buffett sees these companies as “moated” not just by brand, but by platform ecosystems that lock in users and reduce switching costs. Apple’s ecosystem, Microsoft’s Office 365 bundle, and Amazon’s Prime network are classic examples.

Long‑Term Growth Projections – Buffett’s view on tech is not that it will always outperform, but that the trajectory of its growth is “more than 10‑year high.” He acknowledges that these companies trade at premium multiples, but the expectation of high earnings growth justifies the valuation.

Diversification Across Sub‑Sectors – While many investors see tech as a single “chip,” Buffett’s allocation spans hardware (Apple), software (Microsoft), cloud services (Amazon), and even semiconductors (Nvidia). This diversification reduces concentration risk within a single tech sub‑sector.

Buffett himself has been quoted in the article as saying, “I never have a negative view of the technology industry. My approach has simply been to look for companies that have a durable advantage, strong cash flow, and a clear path to generating that cash.” In essence, Buffett’s foray into tech is less a pivot and more an evolution of his timeless “value‑plus‑growth” philosophy.

The Risks and the Reward

The article doesn’t shy away from the volatility that accompanies a 27 % tech allocation. While tech stocks are historically more volatile than the broader market, Buffett’s experience in buying undervalued assets at “reasonable” prices mitigates the downside. Buffett’s own risk management framework—holding cash reserves for “black swan” events—remains intact.

Moreover, the piece points to the 2025 quarterly results, which show Berkshire’s total earnings up 12 % YoY, largely driven by the tech holdings’ outperformance. The portfolio’s beta has risen from 0.84 in 2018 to 1.12 in 2025, indicating greater sensitivity to market swings but also a stronger upside potential during bullish cycles.

Where Do the Numbers Come From?

To arrive at the 27 % figure, the Motley Fool team cross‑checked Berkshire’s 10‑K filings with the company’s “Portfolio Disclosure” page on its investor relations site. The 10‑K lists each security’s market value as of the reporting date, while the Portfolio Disclosure page includes a real‑time sector breakdown. The article also linked to the SEC’s EDGAR database for readers who want to verify the holdings independently. In addition, the piece references the 2025 annual shareholder letter, where Buffett discusses his shift toward tech and outlines his criteria for selecting these businesses.

Bottom Line: A Cautionary Tale or a Blueprint?

For seasoned investors, the 27 % tech allocation in a giant value firm like Berkshire Hathaway serves as a case study in how a disciplined, long‑term strategy can adapt to changing market dynamics. For novices, the article is a reminder that even a “value” icon will not shy away from growth if it meets the core criteria of cash generation and moat.

Ultimately, Warren Buffett’s latest portfolio illustrates that value investing is not static. It is a living, breathing discipline that balances the tried‑and‑true with the emerging. Whether Buffett’s tech play will stand the test of time remains to be seen, but the numbers on the page tell a story of calculated expansion, careful risk‑taking, and an unwavering belief that the future belongs to companies that can generate sustainable cash flow—whether that future is made of brick and mortar or code and cloud.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/16/27-of-warren-buffetts-320-billion-portfolio-is-inv/ ]