A Concise Guide to Three Vanguard ETFs for Long-Term Investors

A Concise Guide to Three Vanguard ETFs for Long‑Term Investors

(Inspired by the Motley Fool’s “3 Vanguard ETFs to buy and hold for the long haul” article)

In a world where investors are constantly tempted by the latest high‑growth play or a “hot” sector pick, the Motley Fool’s recent piece cuts through the noise by pointing to three tried‑and‑true Vanguard exchange‑traded funds (ETFs). These are the kind of passive, diversified vehicles that many seasoned investors swear by for the long haul. Below is a distilled look at each ETF, why the author champions them, and how you can add them to your portfolio.

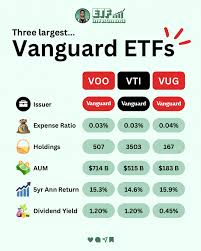

1. Vanguard Total Stock Market ETF (VTI)

What It Covers

VTI tracks the CRSP U.S. Total Market Index, giving investors exposure to nearly the entire U.S. equity universe—from large‑cap blue‑chip companies to small‑cap growth outfits. Roughly 4,800 stocks make up the fund, and it’s structured to mimic the performance of the U.S. market as a whole.

Why It’s a Long‑Term Favorite

- Broad Diversification: With such a wide spread of holdings, company‑specific risk is largely washed out.

- Low Cost: Vanguard’s hallmark expense ratio for VTI is a paltry 0.03% (as of the latest data), meaning most of the returns stay in your pocket.

- Simplicity: Instead of juggling dozens of individual stocks or sector funds, one ticker gives you a single, market‑wide position.

- Historical Performance: Over the past decade, VTI has delivered returns close to the overall U.S. market, proving its reliability as a core holding.

Buying Considerations

Most brokers allow VTI to be bought in fractional shares, which makes it easy to invest small amounts and steadily add over time. If you prefer a more active strategy, you can pair VTI with a sector‑focused ETF for a balanced mix.

2. Vanguard S&P 500 ETF (VOO)

What It Covers

VOO tracks the S&P 500 Index, the benchmark for the large‑cap segment of the U.S. equity market. The fund holds roughly 500 of the biggest and most liquid U.S. companies.

Why It’s a Long‑Term Champion

- Benchmark Status: Because so many performance studies revolve around the S&P 500, having VOO in your portfolio lets you match that benchmark directly.

- Cost Efficiency: Like VTI, VOO’s expense ratio is extremely low (about 0.03%).

- Concentration of Growth: Large‑cap stocks are typically well‑established but still exhibit growth potential, offering a blend of stability and upside.

- Liquidity: The S&P 500’s constituents are highly liquid, ensuring that VOO remains easy to trade without significant slippage.

Practical Tips

If you already own VTI, adding VOO can give you a “core‑plus” approach: VTI for full market exposure and VOO for a focused large‑cap overlay. You can also use VOO as a starting point for “core” holdings before diversifying into international or bond ETFs.

3. Vanguard Total International Stock ETF (VEA) (or Vanguard Total Bond Market ETF, BND)

The article presents two possible third‑tier choices. One is VEA, which extends your equity coverage worldwide, and the other is BND, a bond‑focused option for balance and income.

Option A: Vanguard Total International Stock ETF (VEA)

- What It Covers: VEA tracks the MSCI World ex‑US Index, encompassing developed markets outside the U.S. (e.g., Canada, Europe, Japan). It offers exposure to roughly 3,000 companies globally.

- Why It Matters: Global diversification reduces dependence on the U.S. economy alone. Historically, international markets have added volatility but also unique upside during periods when U.S. growth slows.

- Expense Ratio: VEA also boasts a low 0.05% expense ratio, keeping costs negligible.

Option B: Vanguard Total Bond Market ETF (BND)

- What It Covers: BND follows the Bloomberg U.S. Aggregate Float‑Adjusted Index, providing exposure to the broad U.S. investment‑grade bond market, including Treasuries, corporate bonds, and mortgage‑backed securities.

- Why It Adds Value: Bonds dampen portfolio volatility, provide a modest income stream, and can act as a hedge during equity market downturns.

- Cost Efficiency: With an expense ratio around 0.03%, BND keeps passive bond investing cheap.

Choosing Between VEA and BND

Your choice depends on your risk tolerance and investment horizon. If you’re comfortable with equity volatility and want a fully diversified global portfolio, VEA is ideal. If you’re looking for a blend of stability and income, BND can serve as a solid complement to the equity ETFs.

How to Build a “Buy‑and‑Hold” Portfolio

Allocate by Goal

- Aggressive, Growth‑Focused: 60% VTI, 20% VOO, 20% VEA

- Balanced, Risk‑Aware: 50% VTI, 20% VOO, 20% BND, 10% VEARebalance Periodically

Even with a buy‑and‑hold stance, rebalancing every 6–12 months ensures your allocation stays aligned with your risk profile.Consider Dollar‑Cost Averaging

Purchasing each ETF monthly (or weekly) reduces timing risk and harnesses market volatility for potential cost gains.Tax‑Efficiency

Holding these ETFs in tax‑advantaged accounts (IRA, 401(k), or Roth) can maximize long‑term growth. If you’re using a taxable brokerage, the ETFs’ low turnover usually keeps capital gains manageable.Stay Informed

While Vanguard’s low‑cost philosophy means you rarely need to adjust your holdings, keep an eye on macro events or changes in expense ratios that might impact your long‑term returns.

Final Takeaway

The Motley Fool’s recommendation circles back to the same principle that has guided many seasoned investors: keep it simple, keep it cheap, and keep it diversified. By owning VTI for full‑market U.S. exposure, VOO for a large‑cap overlay, and either VEA for global diversification or BND for bond stability, you’re essentially covering the major asset classes that have historically delivered the bulk of long‑term equity and income returns.

Whether you’re a 25‑year‑old student with a modest savings goal or a 65‑year‑old retiree looking to preserve capital, these three Vanguard ETFs can form the core of a low‑maintenance, robust portfolio. With their legendary low expense ratios, broad diversification, and ease of purchase, they epitomize the “buy‑and‑hold” philosophy that the Motley Fool has championed for decades.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/30/3-vanguard-etfs-to-buy-and-hold-for-the-long-haul/ ]