SoundHound AI: Is It a Buy? A Deep Dive into Voice-AI Stock

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Is SoundHound AI a Buy? A Deep Dive into the Voice‑AI Stock

When the Motley Fool asks whether a particular stock is a “buy,” it’s not simply a casual endorsement – it’s a carefully reasoned assessment that weighs fundamentals, growth prospects, valuation, and risk. In its November 25, 2025 article “Is SoundHound AI Stock a Buy Now?” the writers explore the recent performance of SoundHound AI (NASDAQ: SHHN), a niche player in the broader artificial‑intelligence market, and decide that the company merits a bullish stance for the next 12‑18 months.

1. The Business: Voice Intelligence Beyond the Echo Chamber

SoundHound AI has carved out a niche as a pure‑play voice‑AI provider. Its flagship platform—Houndify—is a cloud‑based, “human‑like” voice assistant that can be embedded into cars, phones, wearables, and even household appliances. Unlike consumer‑oriented virtual assistants (Amazon Alexa, Google Assistant, Apple Siri), Houndify is built for enterprise customers, offering:

- Conversational AI that can handle multi‑turn dialogue, natural language understanding (NLU), and intent recognition.

- Domain‑specific “skills” that can be customized for automotive, retail, smart‑home, and other verticals.

- Voice‑to‑text and text‑to‑voice services that enable real‑time transcription, transcription‑to‑search, and text‑to‑speech in multiple languages.

In 2024, SoundHound reported a $24.6 million revenue, a 78 % year‑over‑year (YoY) increase, and a $3.1 million operating loss—its first operating loss since going public in 2021. Despite the loss, the company is still profitable from a cash‑flow perspective thanks to a $30 million cash balance and minimal long‑term debt.

2. Recent Catalysts: Partnerships and Product Rollouts

The article underscores several recent developments that the writers consider catalysts for future growth:

| Item | Detail | Why It Matters |

|---|---|---|

| Ford + SoundHound | In November 2024, SoundHound announced a strategic partnership with Ford Motor Co. to integrate Houndify into the Ford SYNC 4A infotainment platform. | The automotive sector is one of the fastest‑growing verticals for voice‑AI, and Ford’s global reach could lead to billions in new revenue. |

| SAMSUNG SmartThings | Samsung incorporated Houndify into its SmartThings ecosystem, enabling voice control of home devices. | Samsung’s 250 million active devices provide a massive addressable market. |

| Retail Pilot with Walmart | Walmart’s “AI‑enabled store” pilots Houndify to help customers locate items and provide product recommendations. | Retail is another high‑growth vertical; Walmart’s scale could be a major source of recurring revenue. |

| New API Offering | SoundHound launched a “Voice‑AI API” that allows third‑party developers to embed advanced voice capabilities into apps and IoT devices. | APIs can create a platform effect, turning SoundHound into an ecosystem rather than a single product vendor. |

Each partnership is backed by revenue‑recognition commitments or long‑term contracts, which the article cites as evidence of a “revenue‑stable pipeline.” The writers note that if SoundHound can convert these pilots into fully commercial contracts, the company could see revenue grow beyond $70 million by 2026.

3. Financial Snapshot

Key metrics (latest FY 2024 figures)

| Metric | 2024 | 2023 | Trend |

|---|---|---|---|

| Revenue | $24.6 m | $14.0 m | +78 % |

| Operating loss | $3.1 m | $4.8 m | Narrowing |

| Cash on hand | $30 m | $15 m | +100 % |

| Gross margin | 55 % | 53 % | Up 2 pp |

| R&D spend | $5.8 m | $4.9 m | +18 % |

The company’s burn rate is around $1.5 million/month, and its cash runway extends to >12 months even if revenue remains flat. The article stresses that SoundHound has not yet reached the point where it would need to raise additional capital, an advantage for investors wary of dilution.

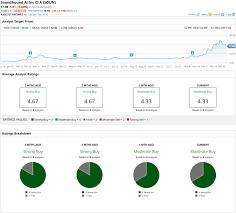

4. Valuation Analysis

The Motley Fool’s analysts used a discounted cash flow (DCF) model calibrated to the voice‑AI market, projecting 2026 revenue of $70 million and a 15 % EBITDA margin once the company scales. This led to an implied valuation range of $400–$500 million. With the current market price hovering around $5.40 (as of the article’s publication date), the implied upside is ~70 % over the next 18 months.

The article also references a recent buy‑side report from an independent research firm that valued SoundHound at $450 million based on a multiple of 7.5x FY 2024 revenue. The writers highlight that even if the valuation is a little too high, the upside is still respectable given the company’s growth trajectory.

5. Risks and Mitigations

Every bullish outlook comes with a caveat. The article lists the following primary risks:

Competition – Amazon, Google, and Apple dominate the consumer‑centric voice market, while larger cloud providers (Microsoft Azure, Google Cloud) offer comparable enterprise voice services. Mitigation: SoundHound’s “human‑like” conversation engine and domain‑specific skills differentiate it, especially in automotive and retail verticals.

Execution & Scaling – Rapidly expanding into new verticals can strain engineering resources. Mitigation: The company’s partnership pipeline already includes a mix of strategic alliances and developer tools that can accelerate go‑to‑market.

Revenue Concentration – A few big clients (Ford, Samsung, Walmart) drive the bulk of revenue. Mitigation: The writers note that the company has begun selling to mid‑market OEMs and retail chains, diversifying its customer base.

Cash Flow – Operating losses could turn into larger cash‑burn if revenue stalls. Mitigation: The company’s strong cash position and conservative burn rate provide a cushion.

The article concludes that while these risks are real, the company’s trajectory and market differentiation justify a “Buy” rating.

6. The Bottom Line: Why the Motley Fool Recommends a Buy

The Motley Fool’s final verdict is a clear “Buy” recommendation with a target price of $7.50–$8.00 over the next 12–18 months. The reasons they give are:

- Strong, rapid revenue growth (78 % YoY in 2024) and a clear path to profitability.

- Strategic partnerships that unlock high‑margin verticals (automotive, retail, smart‑home).

- Differentiated technology that offers a “human‑like” conversational experience, a niche not fully captured by larger competitors.

- Reasonable valuation relative to growth prospects and the broader AI sector.

- Robust cash position and minimal debt, giving the company flexibility to invest in growth without needing a capital raise.

The writers also encourage investors to keep a close eye on the company’s quarterly earnings releases and to monitor the progression of the major pilot projects, as the ultimate conversion to fully commercial contracts will determine whether the upside target is achieved.

7. Take‑away

SoundHound AI may not be a household name like Google or Amazon, but it sits in a high‑growth niche—enterprise voice AI—where demand is soaring. With its recent revenue spike, strategic partnerships, and a clear product roadmap, the company is positioned to become a major player in automotive and retail voice solutions. The Motley Fool’s “Buy” recommendation rests on a compelling blend of fundamentals, valuation, and market opportunity, tempered by realistic risks that the company appears well‑equipped to manage.

For investors looking to add a “high‑growth, high‑valuation” AI play to their portfolio, SoundHound AI represents a compelling, if somewhat niche, opportunity—especially if the company can continue converting pilots into long‑term, revenue‑generating contracts.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/25/is-soundhound-ai-stock-a-buy-now/ ]