South Korea scraps plan to expand tax on stock investments

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

South Korea Repeals Plan to Broaden Tax‑Exempt Stock Investment Accounts

In a surprise move that has sent ripples through the Seoul‑based capital markets, the South Korean finance ministry announced on September 11 that it will scrap its earlier proposal to expand tax‑exempt stock‑investment accounts. The decision comes after months of debate among lawmakers, regulators, and market participants, and it marks a significant shift in the government’s approach to encouraging equity participation among Korean households.

The Original Proposal: A “NISA‑Style” Expansion

South Korea’s policy initiative, first unveiled in early 2024, was modeled on Japan’s “NISA” (Nippon Individual Savings Account) and the United Kingdom’s “ISAs.” It sought to broaden the scope of the existing “tax‑exempt investment accounts” (often called “K‑ISA” in Korean policy circles) by:

- Expanding Eligible Securities – The proposal would have allowed investors to hold not only domestic stocks but also a wider range of foreign equities, thereby creating a more diversified investment base.

- Widening the Participant Base – The plan aimed to open the accounts to a broader age group and lower income thresholds, thereby encouraging first‑time and younger investors.

- Increasing the Annual Contribution Cap – Under the original scheme, the annual limit was set at ₩5 million (about $3,800). The proposal would have lifted this cap to ₩10 million, effectively doubling the amount that could be invested tax‑free each year.

Proponents argued that the changes would “unlock new capital for the domestic market, increase liquidity, and reduce the fiscal burden of the pension system by shifting a portion of savings into productive assets.” The Korean Investment Management Corporation (KIMCO), which administers the tax‑exempt accounts, projected a potential inflow of roughly ₩2 trillion (US$1.5 billion) over the next decade.

Concerns That Sparked the Withdrawal

Despite the apparent benefits, the proposal hit several snags:

Fiscal Impact

The tax‑reduction would result in an estimated loss of ₩3.2 trillion (US$2.4 billion) in revenue over five years. Analysts in the Ministry of Finance warned that the projected cost would outpace the anticipated gains in capital market depth.Regulatory Risk

Expanding the product’s reach, especially to foreign equities, would expose Korean investors to cross‑border regulatory inconsistencies and potentially increase the risk of market manipulation. The Financial Supervisory Service (FSS) voiced concerns about the capacity of local regulators to monitor foreign‑listed securities that are now held in tax‑exempt accounts.Public Perception

A recent poll by the Korean Economic Research Institute found that only 32 % of respondents believed that expanding tax‑exempt accounts would benefit the average citizen. Critics argued that the policy might disproportionately favor high‑net‑worth individuals, contrary to the government’s stated goal of broadening financial inclusion.Political Opposition

The Democratic Party, which currently holds the majority in the National Assembly, flagged the expansion as “unfair and fiscally irresponsible.” The opposition’s lawmakers argued that the policy would widen the wealth gap and undermine the integrity of Korea’s tax system.

The Decision to Repeal

In a press briefing held at the Ministry of Finance’s headquarters, Finance Minister Han Sang‑woo explained that after an exhaustive review of the fiscal, regulatory, and social implications, the ministry decided to abandon the expansion. He stated that “the long‑term sustainability of our tax system and the stability of the financial markets outweigh the short‑term gains that the expansion would provide.”

While the policy will be shelved, Minister Han emphasized that the government is not abandoning its broader goal of encouraging private investment in equities. Instead, the ministry will focus on refining existing mechanisms—such as tightening compliance requirements for K‑ISA administrators, providing better financial literacy programs, and exploring alternative incentives for small and medium‑sized investors.

Market Reaction

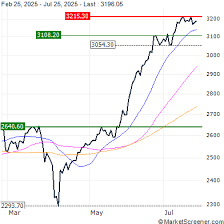

The Seoul Stock Exchange (KRX) saw a mixed response on the day the announcement was made. KOSPI closed up 0.4 % at ₩1,235, whereas KOSDAQ, which is more sensitive to small‑cap listings, slipped 0.7 %. Analysts from Korea Investment & Securities noted that “the reaction was muted, suggesting that traders had already priced in the possibility of a repeal.”

In a separate statement, KIMCO’s CEO Park Ji‑hoon said that the organization remains “prepared to adjust its product offerings in alignment with the ministry’s directives.” He added that the company would continue to advocate for the introduction of a limited, targeted tax‑benefit program that focuses on low‑income households.

Broader Context

South Korea’s decision fits into a broader narrative of fiscal prudence and market regulation that has emerged in recent years. In 2023, the government introduced a 1 % surcharge on capital gains for overseas investors to curb speculative capital flows. The same year, the FSS announced tighter surveillance of “shadow banking” activities following a series of high‑profile regulatory breaches.

In addition, the Korean government has been keen to reduce its reliance on foreign borrowing. By limiting large tax breaks on equity investments, the ministry hopes to maintain a more predictable revenue base, thereby giving it greater flexibility in pursuing macroeconomic stability measures.

What’s Next for Korean Investors?

Although the expansion will not go forward, several alternatives may still be on the table:

- Incentivized Retirement Accounts – The Ministry of Economy and Finance is reportedly exploring a revised version of the “NEX‑ISA” that would focus on long‑term retirement savings rather than general investment.

- Targeted Grants for First‑Time Investors – A pilot program that provides a small cash grant to young adults who open a brokerage account and complete a financial‑literacy course.

- Regulatory Reforms – Streamlining the K‑ISA approval process to reduce administrative burdens, thereby making the existing program more attractive.

Industry observers say that the next major announcement is likely to come in the next policy review cycle, which is scheduled for late 2026. The finance ministry will likely publish a revised white paper that balances the need for market stimulation with fiscal responsibility.

In Summary

South Korea’s finance ministry’s decision to scrap the proposed expansion of tax‑exempt stock investment accounts underscores the delicate balance policymakers must strike between stimulating private capital flows and maintaining fiscal and regulatory integrity. While the immediate plan to broaden the K‑ISA framework is shelved, the government remains committed to enhancing financial inclusion through other avenues—an effort that will shape the trajectory of South Korea’s equity market in the coming years.

Read the Full reuters.com Article at:

[ https://www.reuters.com/sustainability/boards-policy-regulation/south-korea-scraps-plan-expand-tax-stock-investments-2025-09-11/ ]