Palantir Stock Plummets Amid Contract Loss

Locales: UNITED STATES, UNITED KINGDOM

By Alex Johnson | Fri, January 30, 2026, 2:17 PM

Image source: Placeholder - actual image would depict Palantir HQ.

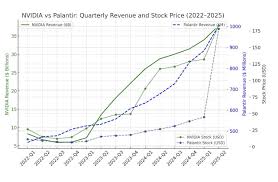

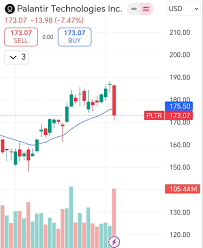

Palantir Technologies (NYSE: PLTR) experienced a significant stock decline today, shedding approximately 8% of its value by mid-morning, despite a generally positive trend in the broader market. This downturn arrives amidst growing anxieties surrounding the company's reliance on governmental contracts and a potential shift in how the U.S. government approaches AI and data analytics procurement.

The immediate catalyst for the slump was the announcement that the U.S. Army will not be renewing its contract with Palantir for Project Maven, an artificial intelligence and machine learning (AI/ML) platform designed to analyze vast datasets for intelligence gathering. While the financial impact of this specific contract is relatively modest, representing roughly 5% of Palantir's total revenue, the symbolic implications are causing considerable concern among investors.

Project Maven, launched in 2017, was a key early adopter of Palantir's technology within the defense sector. Its non-renewal isn't simply a loss of revenue; it's being interpreted by many as a potential signal of broader strategic changes within the Department of Defense. The Army's decision suggests a possible move away from Palantir's bespoke, project-based model and toward more standardized, off-the-shelf solutions, or a greater emphasis on in-house development. This is particularly troubling given Palantir's business model, which heavily relies on securing long-term contracts for its specialized data integration and analysis platforms.

The core of Palantir's offering lies in its ability to integrate disparate data sources, a capability crucial for complex operations like those undertaken by the military and intelligence communities. However, this specialization comes at a cost. Unlike companies providing more generic software solutions, Palantir's platforms often require significant customization and ongoing support, leading to higher contract values but also potentially limiting scalability and interoperability with other systems. The Army's decision could indicate a preference for solutions that integrate more seamlessly with existing infrastructure and avoid vendor lock-in.

Beyond the Maven contract, the current market environment is exacerbating investor concerns. Fears of potential interest rate hikes continue to loom, putting downward pressure on growth stocks like Palantir. Rising interest rates make future earnings less attractive, as the present value of those earnings decreases. This sensitivity to macroeconomic conditions adds another layer of risk for Palantir investors.

However, despite today's negative performance, many analysts remain cautiously optimistic about Palantir's long-term potential. The company's growing commercial business segment, which caters to industries like finance, healthcare, and manufacturing, is seen as a key driver of future growth. Palantir has been actively expanding its commercial footprint, demonstrating its ability to adapt its technology to diverse applications beyond the defense sector. The success of these commercial ventures will be critical in diversifying Palantir's revenue streams and reducing its dependence on government contracts.

Furthermore, Palantir continues to secure new government contracts, albeit with a potentially evolving landscape. The company's focus on data-driven decision-making and its ability to handle sensitive information remain valuable assets for government agencies.

The next few quarters will be crucial for Palantir. Investors will be closely watching the company's earnings reports for signs of momentum in its commercial business and any further developments regarding its government contracts. The ability to demonstrate sustainable growth outside of its traditional defense sector will be key to reassuring investors and regaining market confidence. The Army's decision on Project Maven has undoubtedly shaken the foundations, but Palantir's future ultimately hinges on its ability to innovate, adapt, and prove the enduring value of its data analytics platforms in a rapidly changing technological and geopolitical environment.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/29/why-palantir-technologies-stock-slumped-today/ ]