Palantir Poised to Outperform Nasdaq

Locales: California, Delaware, UNITED STATES

Saturday, January 24th, 2026 - Palantir Technologies (PLTR) has consistently drawn attention within the investment community, oscillating between periods of intense enthusiasm and considerable skepticism. While past performance has been volatile, a compelling argument suggests that Palantir is strategically positioned to significantly outperform the Nasdaq Composite index in the coming years. This assessment, developed over the past few months analyzing Palantir's performance and industry trends, highlights the company's strengths and mitigates concerns surrounding its future growth.

The Enduring Strength of Government Contracts

Palantir's foundation remains firmly rooted in providing sophisticated data analytics solutions to government agencies. These aren't your typical contracts; they're often complex, long-term partnerships crucial for national security and intelligence operations. As of late 2025, government contracts still represent over 50% of Palantir's total revenue, showcasing the continued importance of this sector. The geopolitical landscape, characterized by increasing cyber threats and a renewed emphasis on national defense, ensures a consistent demand for Palantir's data integration and analysis capabilities. The ongoing need for robust data security solutions, compounded by increasingly complex global challenges, provides a remarkably stable revenue stream.

Commercial Expansion: Diversifying for Long-Term Stability

Recognizing the inherent risks of over-reliance on government spending, Palantir has proactively invested in expanding its commercial footprint. The company's platforms, originally designed for government use, have proven remarkably adaptable to a wide range of industries including healthcare, finance, manufacturing, and even the automotive sector. This diversification strategy is paying off, with the commercial segment demonstrating consistently faster growth rates than the government segment in recent quarterly reports. The ability to apply Palantir's core analytics capabilities to diverse business problems positions them favorably to capture a broader market share and lessen vulnerability to shifts in governmental funding priorities.

Artificial Intelligence: Palantir's Core Differentiator

The current era is undeniably shaped by the rapid advancement of artificial intelligence. Palantir isn't just participating in the AI revolution; they're building the infrastructure to facilitate it. Their platforms excel at handling massive datasets, extracting meaningful insights, and automating complex decision-making processes - all critical functions for leveraging the power of AI. Palantir's Foundry and Gotham platforms are increasingly integrated with advanced AI models, allowing clients to automate tasks previously requiring significant human intervention. This trend is accelerating, with new AI-powered features being added on a quarterly basis, driving both increased client adoption and higher per-user revenue. The development of Palantir's own AI models, though nascent, shows promise for future competitive advantage.

Navigating the Risks: Valuation and Government Dependency

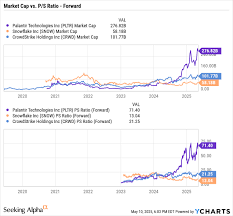

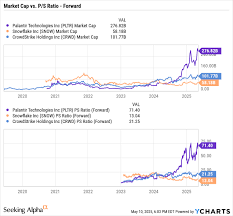

Despite the positive outlook, potential investors must acknowledge the risks. Palantir's valuation remains a point of contention, with some analysts arguing that it's still premium given the company's profitability profile. Investor sentiment remains a significant factor influencing the stock price, making it susceptible to market fluctuations. Furthermore, while the government segment is currently robust, any substantial shifts in government spending priorities could negatively impact revenue. Regulatory hurdles related to data privacy and security also present ongoing challenges. Ongoing scrutiny regarding Palantir's ethical considerations, particularly around data usage, requires careful management and transparency.

Looking Ahead: A Compelling Investment Opportunity

Palantir Technologies is a unique entity, combining the stability of government contracts with the dynamism of commercial expansion and a laser focus on artificial intelligence. While the risks associated with high valuation and government dependency are undeniable, the company's strategic positioning and ongoing innovation suggest significant upside potential. Analysts at several firms are now projecting a composite annual growth rate exceeding the Nasdaq's average over the next five years, positioning Palantir as a potential outperformer. The ability to continue executing its growth strategy, coupled with leveraging its AI capabilities to address real-world challenges, makes Palantir an investment worthy of serious consideration, especially for those with a long-term investment horizon.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/24/prediction-this-ai-stock-could-outperform-the-magn/ ]