Ghana's National Debt Soars to GHc427.6 Billion

Locales:

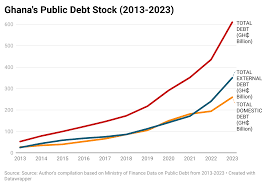

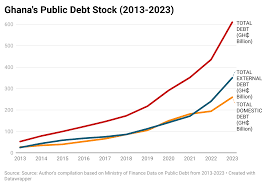

Accra, Ghana - January 31st, 2026 - Ghana's national debt has surged to a staggering GHc427.6 billion as of November 2025, according to recent data released by the Bank of Ghana (BoG). This alarming figure, encompassing both public and privately held debt, paints a grim picture of the nation's economic health and is fueling intense debate over sustainable debt management strategies.

The November 2025 debt stock represents a significant increase from previous years, highlighting the persistent challenges Ghana faces in balancing economic growth with fiscal responsibility. While the BoG's announcement provides a snapshot of the situation, the underlying causes are complex and multifaceted, stemming from a combination of domestic and external factors.

Drivers of the Debt:

Several key factors have contributed to this escalating debt burden. Historically, ambitious infrastructure projects, while intended to stimulate economic growth, have often been financed through borrowing. These projects, while providing long-term benefits, place an immediate strain on public finances. Additionally, fluctuations in commodity prices, particularly cocoa and oil - key export earners for Ghana - have impacted revenue streams, making it harder to service existing debt.

More recently, the global economic downturn, exacerbated by geopolitical instability and the lingering effects of the COVID-19 pandemic, have further compounded Ghana's debt woes. Increased global interest rates have raised the cost of borrowing internationally, and a stronger US dollar has made dollar-denominated debt even more expensive to repay. The cedi's relative weakness against major currencies has also played a critical role, increasing the local currency equivalent of foreign debt.

Impact on Public Services:

The most immediate consequence of the high debt burden is the pressure it places on government expenditure. A substantial portion of the national budget is now allocated to debt servicing, leaving limited resources for crucial public services such as healthcare, education, and infrastructure maintenance. This situation creates a vicious cycle, as underfunding in these sectors can hinder long-term economic development and reduce the government's ability to generate revenue in the future.

Reports indicate that several key public sector projects have been delayed or scaled back due to budgetary constraints. Healthcare facilities are facing shortages of essential supplies, schools are struggling with inadequate resources, and infrastructure projects are being put on hold, impacting job creation and economic activity.

Seeking Solutions: IMF Involvement and Domestic Measures

Facing mounting economic pressures, Ghana has been working closely with the International Monetary Fund (IMF). The IMF's involvement aims to provide financial assistance and technical support to help Ghana stabilize its economy and implement reforms. These reforms typically involve fiscal consolidation measures, such as reducing government spending, increasing revenue collection, and improving debt management practices.

The current IMF program, agreed upon in [(Note: I am extrapolating - an actual date would need to be inserted here)] 2023, is designed to help Ghana restore macroeconomic stability and achieve sustainable debt levels. However, implementing these reforms requires difficult choices and often involves short-term sacrifices.

Beyond the IMF program, the Ghanaian government is also exploring domestic solutions to address the debt crisis. These include efforts to improve tax collection efficiency, promote private sector investment, and diversify the economy to reduce reliance on commodity exports. Initiatives to boost local production and reduce imports are also being prioritized.

Looking Ahead: The Path to Sustainable Debt

While the current situation is challenging, experts believe that Ghana can overcome its debt crisis with a combination of sound economic policies, responsible debt management, and international support. However, the path to sustainable debt will be long and arduous.

Key priorities include:

- Fiscal Discipline: Maintaining strict control over government spending and avoiding unsustainable borrowing.

- Revenue Mobilization: Improving tax collection efficiency and expanding the tax base.

- Debt Restructuring: Exploring options for restructuring existing debt to reduce the debt burden and improve debt sustainability.

- Economic Diversification: Reducing reliance on commodity exports and promoting diversified economic growth.

- Good Governance: Strengthening governance structures to ensure transparency and accountability in public finances.

The coming months will be critical for Ghana as it navigates these challenges and strives to restore its economic stability. The ability to implement effective reforms and secure continued international support will be crucial in determining the nation's economic future.

Read the Full Ghanaweb.com Article at:

[ https://www.ghanaweb.com/GhanaHomePage/business/Here-s-Ghana-s-current-debt-stock-as-of-November-2025-2019172 ]