Dividend Aristocrats: A Look at Consistent Growers

Locales: Delaware, Connecticut, Ohio, Pennsylvania, UNITED STATES

The Power of the Streak: Identifying Dividend Aristocrats

The companies listed - Bank of America (BAC), Illinois Tool Works (ITW), Procter & Gamble (PG), 3M (MMM), and Verizon Communications (VZ) - all share a common trait: a lengthy history of increasing dividends. Procter & Gamble and 3M stand out as 'Dividend Aristocrats,' boasting 67 and 66 years of consecutive dividend increases respectively. This isn't merely a historical quirk; it demonstrates a deeply ingrained corporate culture prioritizing returning capital to shareholders, even through challenging economic cycles. These companies have weathered recessions, technological disruptions, and changing consumer preferences while still delivering consistent dividend growth. This commitment signals financial discipline and a robust business model. Illinois Tool Works, with a 30-year streak, and Verizon with 17 years, represent strong, though slightly shorter-term, commitment to dividend growth. Bank of America's 12-year streak is the shortest amongst the group, but its recent performance and financial health suggest continued growth potential.

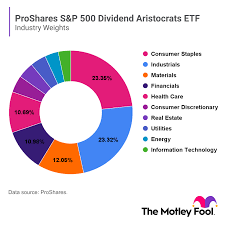

Sector Spotlight: What Drives Dividend Reliability?

The sectors these companies represent also provide insight into their reliability. Procter & Gamble's position in the consumer staples sector is particularly noteworthy. Demand for essential goods - cleaning supplies, personal care products, and household items - remains relatively stable regardless of economic conditions. This 'defensive' characteristic provides a predictable revenue stream, allowing P&G to consistently fund and increase its dividend. Similarly, Verizon, operating in the telecommunications sector, benefits from the essential nature of its services. In today's interconnected world, mobile and internet services are considered necessities, ensuring a steady flow of revenue.

Bank of America, as a financial institution, is tied to the health of the overall economy. While the banking sector can be cyclical, Bank of America's robust financials and strategic diversification have positioned it well for sustained growth and dividend increases. However, investors should remain mindful of interest rate fluctuations and regulatory changes affecting the financial sector.

Illinois Tool Works and 3M, both industrial conglomerates, offer a different type of stability. Their diversified product portfolios mitigate risk; a downturn in one industry can be offset by growth in another. However, 3M's recent legal battles concerning PFAS contamination represent a notable risk factor. While the company continues to pay its dividend, these legal challenges could impact future growth and shareholder returns.

Dividend Yield vs. Growth Rate: Balancing Current Income and Future Potential

As of December 12, 2025, Verizon boasted the highest dividend yield at 6.9%, followed by 3M at 4.1% and Procter & Gamble at 3.7%. Bank of America (2.3%) and Illinois Tool Works (2.1%) offered lower yields. However, yield alone shouldn't be the sole determinant. A high yield can sometimes signal underlying problems with the company's fundamentals. It's crucial to consider the dividend growth rate alongside the yield. While Verizon offers a high current income, its growth rate might be slower compared to Bank of America, which has demonstrated accelerating dividend increases in recent years.

Looking Ahead: The Future of Dividend Growth

The future of dividend growth will likely be shaped by several factors, including inflation, interest rates, and global economic conditions. Companies with strong balance sheets, resilient business models, and a commitment to shareholder returns are best positioned to navigate these challenges and continue delivering consistent dividend growth. Investors should carefully evaluate each company's fundamentals, industry outlook, and potential risks before making any investment decisions. Diversification is also key. Rather than relying on a single dividend stock, building a portfolio of reliable dividend payers across different sectors can help mitigate risk and maximize long-term returns.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in dividend stocks involves risk, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/12/12/proven-income-generators-ranking-the-most-reliable-dividend-growth-stocks/ ]