London IPO Market Faces FCA Scrutiny

Locales: England, UNITED KINGDOM

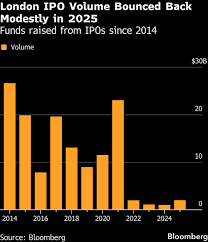

London, UK - February 10th, 2026 - The Financial Conduct Authority (FCA) is facing increasing scrutiny over the continued slump in Initial Public Offerings (IPOs) within London's financial market. A sustained period of decline has raised serious questions about the city's competitiveness against rival global financial hubs, particularly New York. Adding to the pressure, Rachel Reeves, Labour's Shadow Chancellor, has publicly indicated that a comprehensive review of London's listing rules is on the table should Labour assume power.

The decline has been stark. In recent years, London has consistently lost ground in attracting companies seeking to go public. The loss of prominent listings, most notably chip designer Arm choosing New York, has served as a wake-up call for regulators and policymakers. While the FCA maintains that global economic factors are partly to blame, the growing chorus of criticism suggests that regulatory factors are playing a significant, and potentially decisive, role.

Reeves' comments, made to the Financial Times, are the clearest signal yet that a Labour government would actively intervene to address the issue. "We've seen a real decline in London's IPO market and that's worrying," Reeves stated. "We need to look at the listing regime to make sure that London is a welcoming place for companies to list." This pledge signifies a commitment to actively fostering a business-friendly environment and signals a willingness to challenge existing regulations if necessary.

The FCA has already initiated some preliminary reforms. These include considering allowing dual-class share structures, which grant founders and key management greater control over the company even after it goes public. This aims to appease entrepreneurs who are hesitant to relinquish control, a key concern that has driven some companies to explore alternative listing venues. Loosening the rules around free floats - the minimum percentage of shares that must be made available to the public - is another area under consideration, intended to increase market liquidity.

However, the effectiveness of these proposed changes remains a point of contention. Critics argue that these reforms are insufficient to counteract the broader issues deterring companies from listing in London. Concerns extend beyond just regulatory burdens to encompass perceptions of bureaucratic complexity, the cost of compliance, and a lack of investor enthusiasm for certain sectors. Some believe that a more fundamental overhaul of the listing process is required, potentially involving a simplification of regulations and a more proactive approach to attracting international investors.

Investment bankers, caught in the middle of this debate, are voicing their concerns. "It's a very complex issue," one banker commented, requesting anonymity. "There's a lot of uncertainty around the regulatory environment and that makes it difficult to convince companies to list here." This uncertainty stems not just from the potential for further regulatory changes, but also from the broader geopolitical landscape, including the ongoing repercussions of the war in Ukraine and global inflationary pressures. The interplay of these factors creates a challenging environment for businesses considering an IPO.

The FCA has been quick to point out that external factors are significantly contributing to the downturn. They emphasize that the global economic climate, geopolitical instability, and rising interest rates all play a role. However, Reeves' stance suggests that Labour believes the FCA's response has been inadequate and that a more assertive approach is needed. The Labour party is facing pressure to demonstrate its understanding of the concerns of the financial sector and its commitment to maintaining London's position as a leading global financial center.

The discussion isn't just about attracting listings; it's about the long-term health and competitiveness of the UK economy. A vibrant IPO market is crucial for fostering innovation, creating jobs, and driving economic growth. A decline in IPO activity signals a potential loss of investment and a diminished capacity for entrepreneurial success.

Reeves' commitment to a "stable and predictable regulatory environment" is a crucial element of her party's proposed strategy. Businesses crave certainty, and any steps taken to provide that will be welcomed. However, achieving this will require careful consideration and a willingness to engage in constructive dialogue with the financial industry. The upcoming months promise to be pivotal in determining the future of London's IPO market and solidifying its status as a leading global financial hub. Further analysis will be needed to assess the specific proposals Labour intends to bring forward and the extent to which they address the underlying concerns of businesses and investors. The stakes are high, and the outcome will have significant implications for the UK economy as a whole.

Read the Full London Evening Standard Article at:

[ https://www.standard.co.uk/business/business-news/financial-conduct-authority-rachel-reeves-london-budget-ipos-b1261629.html ]