2026 IPO Boom: Opportunities and Risks

Locales: CANADA, UNITED STATES

By Stephen Petherick, The Globe and Mail, February 10, 2026

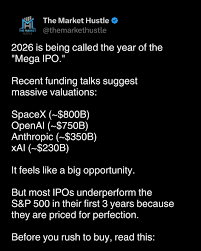

The year 2026 is shaping up to be a landmark period for Initial Public Offerings (IPOs), promising a surge of new investment opportunities but also demanding heightened investor caution. After a period of relative calm, the market is poised for a significant influx of companies seeking public funding, creating both potential for substantial gains and increased risk. This article delves into the factors driving this boom, the types of companies expected to go public, and, crucially, how investors can navigate this complex landscape.

The Confluence of Favorable Conditions

The anticipated IPO wave isn't a sudden event; it's the result of converging economic and corporate factors. The global economic outlook, while still subject to monitoring regarding persistent inflation, is demonstrably more stable than the turbulence experienced in recent years. The projected stabilization of interest rates provides a more predictable financial environment, encouraging companies to move forward with long-delayed IPO plans. Many firms deliberately postponed their public debuts during the pandemic and the ensuing market uncertainty, opting to consolidate and prepare for more favorable conditions. Now, that window of opportunity appears to have opened.

"We're seeing a pent-up demand," explains Sarah Chen, a senior equity analyst at RBC Capital Markets. "Companies have spent the last few years building resilience and demonstrating sustainable growth. They've been carefully watching market signals and are now confident enough to access public capital."

Who's Leading the Charge? Sectors to Watch

The IPO pipeline is diverse and robust, but certain sectors are expected to dominate the flow. High-growth technology companies, particularly those specializing in Artificial Intelligence (AI) and Financial Technology (Fintech), are leading the charge. The relentless advancement of AI across various industries has fueled innovation and created numerous privately held companies ripe for public listing. Fintech, too, continues to disrupt traditional financial services, attracting significant investor interest.

Beyond technology, the healthcare sector is also poised for a strong showing. Companies developing innovative therapies, advanced diagnostic tools, and personalized medicine solutions are actively seeking public funding to accelerate research and development and bring their products to market. Furthermore, a significant number of businesses previously held by private equity firms are looking to capitalize on current valuations and exit their investments through IPOs. This represents a different dynamic - established businesses with proven track records, but also potentially higher price tags.

The Risks Inherent in IPO Investing

While the potential rewards of IPO investing can be considerable, it's vital to acknowledge the inherent risks. IPOs lack the historical data available for established publicly traded companies, making accurate valuation more challenging. Initial valuations can often be inflated due to hype and investor enthusiasm, creating a bubble that eventually bursts. The speculative nature of the market means that share prices can be highly volatile, leading to substantial losses for those who aren't prepared.

David Miller, a portfolio manager at CIBC Asset Management, emphasizes the importance of due diligence. "It's easy to get caught up in the excitement surrounding a hot IPO, but remember that it's still a risky investment. Don't follow the crowd - do your research and invest in companies with solid fundamentals."

Essential Considerations for Prudent Investors

- Underlying Business Strength: Prioritize companies with sustainable business models, demonstrable revenue growth, and a clear path to profitability. Avoid those reliant on unsustainable hype or overly optimistic projections.

- Competitive Differentiation: Seek out companies offering unique products or services that provide a significant competitive advantage. A strong moat around their business is crucial for long-term success.

- Leadership Quality: Thoroughly assess the experience, expertise, and track record of the company's management team. Strong leadership is essential for navigating challenges and executing growth strategies.

- Realistic Valuation: Be wary of IPOs with excessively high valuations compared to their peers or industry averages. Understand the metrics justifying the price and assess whether it's sustainable.

- Regulatory Awareness: The regulatory landscape surrounding IPOs is constantly evolving. Stay informed about any changes that could impact your investment.

- Institutional Dynamics: Recognize that institutional investors often wield significant influence over IPO pricing and allocation. Understanding their involvement can provide valuable insights into potential demand and future price movements.

A Call for Calculated Investment

The 2026 IPO surge presents a compelling opportunity for investors, but it demands a disciplined and informed approach. Beyond the hype, remember that investing in IPOs requires thorough research, a long-term perspective, and a willingness to accept calculated risks. It's about understanding the underlying business, carefully assessing the potential downsides, and investing with conviction.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Consult with a qualified financial advisor before making any investment decisions.

Read the Full The Globe and Mail Article at:

[ https://www.theglobeandmail.com/investing/article-trade-secrets-how-to-invest-in-a-year-of-blockbuster-ipos/ ]