2025: US Stocks Soar, International Markets Struggle

Investopedia

InvestopediaLocales: UNITED STATES, JAPAN, CHINA, GERMANY, UNITED KINGDOM, INDIA, BRAZIL

2025: A Year of Contrasts

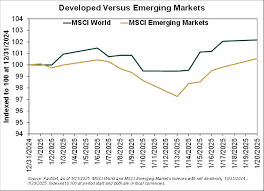

As previously reported, U.S. stocks led the charge in 2025, demonstrating consistent gains fueled by robust earnings, a surprisingly resilient domestic economy, and a moderation of inflationary pressures. This performance significantly outpaced international stocks, which struggled under the weight of slower global growth, escalating geopolitical tensions (particularly in Eastern Europe and the South China Sea), and unfavorable currency fluctuations. The strength of the US dollar proved particularly challenging for international investors.

The technology sector remained the star performer, driven by the relentless innovation in artificial intelligence (AI), the expansion of cloud computing, and the continued growth of the electric vehicle (EV) market. While concerns about valuation lingered, the fundamental growth prospects of these companies kept investors enthusiastic. Interestingly, small-cap stocks demonstrated a notable advantage over their large-cap counterparts. This suggests that improved economic conditions and a revival in consumer spending favored smaller, more agile companies.

On the downturn side, emerging markets underperformed, hampered by mounting debt concerns and political instability in several key regions. The ripple effects of higher US interest rates also impacted these economies, leading to capital outflows. The real estate sector experienced considerable headwinds, as rising interest rates squeezed margins and declining commercial property values created uncertainty. The shift towards remote work arrangements continued to weigh heavily on office space demand, exacerbating the downturn. Bonds faced a challenging year with negative returns, a direct consequence of the Federal Reserve's ongoing efforts to combat inflation through interest rate hikes.

Deeper Dive into the Key Drivers

Several interconnected factors shaped the investment landscape in 2025. While economic growth remained positive in the U.S., other major economies, notably Europe and China, experienced significant slowdowns. Inflation, although moderating towards the end of the year, remained a persistent concern, forcing central banks to maintain a hawkish stance on monetary policy. The Federal Reserve's series of interest rate increases, while aimed at controlling inflation, had a cascading effect on various asset classes, particularly bonds and real estate.

Geopolitical tensions acted as a constant source of market volatility. The ongoing conflicts and political uncertainties not only disrupted supply chains but also eroded investor confidence. The increasing use of economic sanctions and trade barriers further complicated the global economic outlook. This led to a flight to safety, benefitting the U.S. dollar and U.S. Treasury bonds (despite the rising interest rates).

Implications for 2026 and Beyond

Looking ahead to 2026, several key themes are likely to dominate the investment landscape. The first is continued, albeit potentially slower, US economic growth. The second is the ongoing evolution of AI, and its increasing integration into various sectors of the economy. Investors should carefully consider exposure to companies positioned to benefit from this trend.

Diversification remains paramount. While U.S. stocks performed well in 2025, over-concentration in a single market or asset class carries significant risk. Investors should consider diversifying their portfolios across different geographies, sectors, and asset classes. Active management may prove valuable in identifying opportunities and mitigating risks in a complex market environment. Skilled fund managers can potentially capitalize on specific sector trends and regional disparities.

A long-term perspective is essential. Short-term market fluctuations are inevitable, and investors should avoid making impulsive decisions based on short-term noise. Focusing on fundamental value and long-term growth prospects is crucial. Finally, exploring alternative investments, such as private equity and hedge funds, can provide diversification and potentially enhance returns. However, these investments typically come with higher fees and liquidity constraints, so careful consideration is required.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/the-investment-scorecard-for-2025-top-performers-and-biggest-decliners-11877829 ]