Berkshire Hathaway Outperforms S&P 500 Significantly Since 1965

MarketWatch

MarketWatchLocales: Nebraska, New York, UNITED STATES

Berkshire Hathaway vs. The S&P 500: A Tale of Two Returns

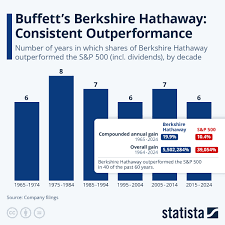

The sheer scale of Berkshire Hathaway's outperformance is striking when compared to the broader market. Since 1965:

- Berkshire Hathaway: CAGR of 19.6%

- S&P 500: CAGR of 11.7%

While a $1,000 investment in the S&P 500 in 1965 would have grown to approximately $23,000 today - a respectable return in its own right - it pales in comparison to the $32 million potential from Berkshire Hathaway. This demonstrates not just good investing, but exceptional investment acumen.

A History of Splits and Dividends

Berkshire Hathaway's growth wasn't just organic; it was also facilitated by a series of stock splits designed to make the shares more accessible to a wider range of investors. These splits, combined with consistent dividend payments, amplified the returns for long-term shareholders. Here's a recap:

- 1966: 9-for-1 split

- 1972: 5-for-1 split

- 1979: 2-for-1 split

- 1984: 3-for-1 split

- 1998: 3-for-1 split

- 2000: 2-for-1 split

- 2006: 2-for-1 split

The Buffett Philosophy: Value Investing and Long-Term Thinking

But what fueled this extraordinary growth? The answer lies in Warren Buffett's renowned value investing philosophy. He consistently sought out undervalued companies possessing strong fundamentals - robust balance sheets, consistent profitability, and competent management. Crucially, he adopted a long-term holding period, resisting the temptation to chase short-term gains. Buffett famously avoided investments in businesses he didn't thoroughly understand, emphasizing the importance of staying within one's circle of competence.

His annual letters to shareholders are filled with wisdom, repeatedly stressing the virtues of patience and discipline. Buffett advocates against attempting to 'time' the market, a futile exercise for most investors. Instead, he champions the strategy of identifying quality companies at fair prices and holding them indefinitely, allowing the power of compounding to work its magic.

Berkshire Today: A Conglomerate Giant

Today, Berkshire Hathaway is no longer a textile company, but a sprawling conglomerate with a diverse portfolio spanning insurance (GEICO), railroads (BNSF Railway), energy (Berkshire Hathaway Energy), and consumer goods (See's Candies, Dairy Queen, and many others). It is one of the world's largest companies, boasting a market capitalization exceeding $780 billion.

While replicating Berkshire Hathaway's historic performance is likely unrealistic in the future, the company remains a formidable force, expertly managed with a strong track record. Despite approaching 94 years of age, Buffett remains involved (although a succession plan is in place), and the principles of value investing that have guided Berkshire Hathaway for over half a century continue to underpin its strategy. For investors seeking long-term, stable growth, Berkshire Hathaway remains a solid, if premium-priced, consideration.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/would-you-have-invested-in-berkshire-hathaway-stock-at-the-start-of-warren-buffetts-career-533af7a1 ]