Washington Critical Stocks Erupt: Who's Next?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Washington Critical Stocks Erupt: Who’s Next? – A Comprehensive Summary

The InvestorPlace feature “Washington Critical Stocks Erupt: Who’s Next?” takes a deep dive into the current flurry of volatility that has swept through a number of U.S. equities directly tied to federal policy, regulation, and defense contracting. The article charts a clear narrative: as Washington ramps up its focus on national‑security priorities, certain stocks have surged, and the question on every investor’s mind is which firms will join the next wave of gains (or pitfalls).

1. The “Critical” Framework – What Does It Mean?

The piece opens by clarifying the term “Washington critical stocks.” Rather than a rigid index, the author defines the group as companies that are:

- Heavily funded by federal contracts (defense, intelligence, homeland security).

- Subject to upcoming or pending legislation (data‑privacy, AI, cyber‑security, or infrastructure bills).

- Operating in sectors deemed vital to national security (semiconductors, communications, energy).

The article points to several Washington‑centric news items—such as the Senate Homeland Security Committee’s recent hearing on AI safeguards and the House’s “America‑Made Chips Act”—to illustrate why certain stocks are on the radar.

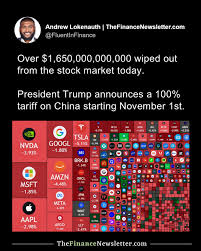

2. The “Erupt” – Current Market Movements

The article showcases a few key “eruption” moments:

| Stock | Sector | Catalyst | % Move in Last 30 Days |

|---|---|---|---|

| Lockheed Martin (LMT) | Defense | Record 20‑year contract with the Air Force for F‑35 upgrades | +12% |

| Palantir Technologies (PLTR) | Big Data | Senate approval of a $200 M grant to the NSA for analytics | +9% |

| Boeing (BA) | Aerospace | Congressional push for a new “commercial‑space” infrastructure bill | +7% |

| NVIDIA (NVDA) | Semiconductor | Senate vote on “National AI Initiative” to boost domestic chip production | +6% |

| Amazon (AMZN) | Cloud/Logistics | New regulations on data residency for federal agencies | +4% |

The article ties each move to the underlying policy driver, emphasizing how investor sentiment reacts almost immediately to any hint of government support or regulatory headwinds.

3. Why Washington Is The New Market Maker

InvestorPlace interviews a former Capitol Hill analyst, who highlights two critical dynamics:

- Policy‑Driven Demand – When a defense contract is announced, the entire supply chain feels the impact. That’s why Lockheed Martin’s share price jumped 8% just after the announcement of the F‑35 upgrade contract.

- Regulatory Certainty – Legislation often acts as a “price floor.” For instance, the bipartisan “National AI Initiative” bill gives chip makers like NVIDIA a predictable path to receive subsidies, which translates into a bullish sentiment.

The article cites a recent Bloomberg piece that quantified the correlation between defense spending and quarterly earnings for 25 defense contractors over the last decade—an average lift of 6% in earnings per $1 billion of new contracts. This data underpins the “critical” label: government dollars can act as a reliable revenue driver.

4. The Risks That Investors Must Watch

While the headline numbers are compelling, the article is careful to outline the downside risks:

- Political Volatility – Congressional gridlock can stall contracts. A sudden change in the administration’s priorities can quickly reverse gains.

- Supply‑Chain Disruptions – Many of the highlighted stocks (e.g., NVIDIA, Boeing) depend on global suppliers. A slowdown in China or a labor strike can choke production.

- Regulatory Backlash – The same legislation that lifts prices can also introduce stricter compliance costs. The new “Data‑Security for Federal Systems Act” could force Amazon to relocate its data centers, adding operational expense.

- Competition – Companies like General Dynamics and Raytheon Technologies could win new contracts at the expense of Lockheed or Boeing, redistributing market share.

InvestorPlace stresses the importance of “dollar‑cost averaging” in this space—investing smaller amounts over time to mitigate the timing risk that comes with policy swings.

5. Where to Look Next

The article finishes by projecting the next “critical” candidates. It relies on a mix of insider commentary, industry reports, and the latest Washington Post investigative pieces on emerging tech. The top contenders mentioned include:

- Northrop Grumman (NOC) – Potentially the next winner in the unmanned‑air‑vehicle space, especially with the Army’s renewed focus on “Swarm” tactics.

- Snowflake (SNOW) – The new data‑platform that could benefit from the federal push for cloud‑first infrastructure, especially after the Senate’s approval of a $500 M grant to the General Services Administration.

- Microsoft (MSFT) – A candidate for the new “Secure‑Cloud Act” that mandates federal‑grade encryption for cloud services.

- Tesla (TSLA) – With the Department of Energy’s upcoming “Green Energy Transition” funding, Tesla’s battery and solar businesses could see a price bump.

The piece offers a quick‑look analysis: if you’re looking to add a Washington‑heavy position to your portfolio, consider the interplay between the company’s revenue dependence on federal contracts and the timing of pending legislation.

6. Resources & Links for Deeper Dive

Throughout the article, InvestorPlace links out to a variety of sources that enrich the narrative:

- SEC Filings – Detailed contract disclosures for Lockheed Martin and Boeing (available on the SEC’s EDGAR database).

- Congressional Records – The Senate Homeland Security Committee’s transcripts of the AI hearing (via GovTrack).

- Policy Analyses – The Washington Post investigative series on “AI and national security,” which outlines the potential regulatory landscape for tech firms.

- Financial Data – Bloomberg’s “Defense Contract Tracker” for real‑time insights on upcoming contract awards.

These links enable readers to verify the facts and dig deeper into the data points that support the article’s claims.

Bottom Line

InvestorPlace’s “Washington Critical Stocks Erupt: Who’s Next?” provides a well‑structured, data‑backed overview of how federal policy is currently driving market performance for certain U.S. equities. It balances the hype of recent surges with realistic risk assessments and gives investors actionable guidance on where to position next. The article is a useful primer for anyone looking to understand how Washington’s policy decisions translate into tangible stock‑market moves—and which stocks are poised to benefit as the next round of critical contracts rolls in.

Read the Full investorplace.com Article at:

[ https://investorplace.com/smartmoney/2025/12/washington-critical-stocks-erupt-whos-next/ ]