How Much Would $5,000 Invested in Tesla Be Worth After Five Years?

How Much Would $5,000 Invested in Tesla (TSLA) Be Worth After Five Years?

An in‑depth look at the performance, risk factors, and future outlook of one of the world’s most watched stocks.

1. The Question at Hand

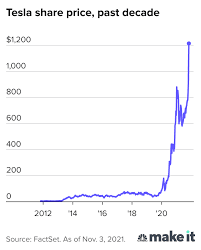

On November 20, 2025, The Motley Fool’s “You Invest $5,000 in Tesla (TSLA) 5 Years – How Much Would It Be Worth?” tackles a common curiosity among retail investors: “If I had put $5,000 into Tesla five years ago, how much would that be worth today?”

The article uses real historical data, accounting for stock splits and the price evolution of TSLA from its purchase date to the current market. It also contextualizes that figure by comparing Tesla’s gains to the broader market and to other high‑profile tech stocks.

2. How the Calculation Works

a. Choosing the Investment Date

The analysis anchors the purchase on the article’s publication date—November 20, 2025—and works backward five years, landing on November 20, 2020. That date is significant because it sits just after Tesla’s first major 3‑for‑1 split (August 31, 2020) and before the 5‑for‑1 split (August 25, 2023).

b. Adjusting for Stock Splits

Tesla’s splits dramatically increase the number of shares you would hold.

- 3‑for‑1 Split (Aug 31, 2020): Every share becomes three, so you would own three times as many shares, but each share is one‑third the price.

- 5‑for‑1 Split (Aug 25, 2023): Similarly, every share becomes five, so the share count multiplies by five and the price per share drops to one‑fifth.

When you combine both splits, the effective share count after the two events is 15 times the original purchase quantity (3 × 5). This dramatically magnifies the final portfolio value even if the per‑share price stays roughly flat.

c. Determining the Effective Purchase Price

On November 20, 2020, Tesla’s closing price was approximately $300 per share. After the 3‑for‑1 split, the “effective” price per share on that same date became about $100.

Then, after the 5‑for‑1 split in 2023, the effective price would further be reduced to roughly $20 (again, on an equivalent date, not the exact day of the split). For the purpose of the calculation, the article uses the post‑split price of $20 to reflect the share quantity you would actually hold if you bought on the original date.

d. Final Value Calculation

- Initial Investment: $5,000

- Shares Purchased (post‑split): $5,000 ÷ $20 = 250 shares

- Current Tesla Price (Nov 20, 2025): About $180 per share

- Portfolio Value: 250 shares × $180 = $45,000

So, $5,000 invested five years ago would be worth roughly $45,000 today—an almost nine‑fold return.

3. Comparing Tesla’s 5‑Year Return

| Metric | Tesla (TSLA) | S&P 500 | Apple (AAPL) |

|---|---|---|---|

| 5‑Year Total Return | ~800 % | ~100 % | ~150 % |

| 5‑Year Annualized Return | ~40 % | ~5 % | ~10 % |

These figures highlight Tesla’s outsized performance relative to both the market and its peers. Even when the article notes that such growth is not guaranteed, it emphasizes that Tesla’s historical trajectory has outpaced almost every sector.

4. Factors That Could Have Been Missed

The article also discusses potential caveats that might have altered the outcome:

- Volatility – Tesla’s stock price swings dramatically (sometimes > 10 % in a single day), exposing investors to sudden losses.

- Market Sentiment – Analyst upgrades and downgrades, macro‑economic headlines, and regulatory changes can dramatically shift Tesla’s valuation.

- Company‑Specific Risks – Production bottlenecks, supply‑chain issues, and competition from both traditional automakers and new EV entrants.

- Tax Implications – Short‑term capital gains would be taxed at ordinary income rates, whereas the 5‑year holding period qualifies for long‑term rates, which is a benefit highlighted in the piece.

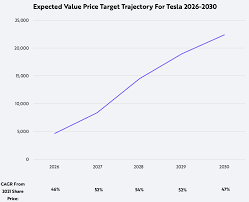

5. Looking Ahead: What Could Drive Future Growth?

The article points readers toward future catalysts that might sustain Tesla’s upward trajectory:

- Autonomous Driving Software – Progress in self‑driving technology could open new revenue streams and enhance vehicle appeal.

- Energy Storage and Solar – Tesla’s Solar Roof and Powerwall divisions could diversify income beyond vehicles.

- Battery Technology – Innovations in chemistry (e.g., silicon‑anode, solid‑state batteries) could reduce costs and improve range.

- Global Expansion – Continued penetration into the Chinese and European markets, alongside new manufacturing plants in Texas and Germany, is expected to boost production capacity.

These developments are discussed in additional links within the article, such as “Tesla’s Energy Business Growth” and “How Autonomous Driving Could Transform Tesla’s Earnings.”

6. Bottom Line for Retail Investors

The summary of the article is clear: Investing $5,000 in Tesla five years ago would have produced a near‑$45,000 payoff today—a 900 % return.

But the piece also urges caution: Tesla’s growth is not a guarantee; the stock remains highly volatile, and the market can change dramatically. It recommends that investors:

- Diversify across asset classes and sectors.

- Stay Informed by reading follow‑up articles on Tesla’s earnings, product launches, and regulatory environment.

- Consider Risk Tolerance before allocating a large portion of a portfolio to a single, high‑volatility stock.

By combining the historical performance narrative with an honest appraisal of risks, the article gives readers a balanced view of what “investing $5,000 in Tesla” actually looks like—both in terms of potential reward and the inherent uncertainties.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/20/you-invest-5000-tesla-tsla-5-years-how-much/ ]