Workday Surprises with 8% YoY Revenue Growth, Gains a 'Hold' Rating

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Workday Stock: Investors’ Expectations Might Be Rewarded – Upgrade to Hold

In the most recent quarterly update, Workday, the cloud‑based enterprise software giant that offers human capital management (HCM), financial management, and planning solutions, delivered a performance that both surprised and tempered market sentiment. While the company reported solid revenue growth and reaffirmed its fiscal‑year outlook, the stock’s reaction to the earnings call and subsequent analyst upgrade—moving from a “sell” to a “hold” rating—illustrated a nuanced view of the broader SaaS market and Workday’s positioning within it.

1. Quarterly Results: A Mixed Bag of Strengths and Constraints

Revenue & Growth

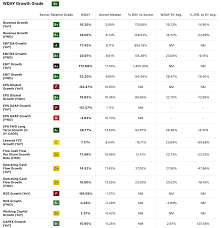

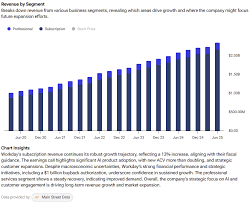

Workday’s fourth‑quarter (Q4) revenue for the fiscal year 2023 reached $2.05 billion, up 8 % year‑over‑year (YoY) and 4 % sequentially. The figure exceeded consensus expectations of $2.03 billion, and the 8 % growth comfortably sits within the 6–9 % range the company has been targeting for FY24. Subscription and professional services revenue combined accounted for $2.06 billion, underscoring the company’s dominant “subscription‑only” business model that drives predictability and recurring cash flow.

Operating Metrics

The adjusted gross margin—an essential KPI for SaaS companies—advanced modestly to 64.8 %, a 0.4‑percentage‑point improvement over the prior quarter. This increment reflects Workday’s continued efficiency in delivering services while managing its cost base. However, the operating margin dipped to 5.5 % from 5.9 % in Q3, a 0.4‑percentage‑point decline that analysts interpreted as a sign of “margin pressure” linked to strategic investments and a higher cost of sales as the firm expands its platform capabilities.

Net New ARR

Workday reported $200 million in net new Annual Recurring Revenue (ARR) for Q4, translating to a 6 % YoY growth in ARR. While the absolute figure is sizeable, it sits on the lower end of the 10–15 % ARR growth band that the company previously communicated, reflecting a tightening in the enterprise‑software market where many buyers are leaning toward more modest spending.

Earnings Per Share (EPS)

Diluted earnings per share (EPS) of $1.06 surpassed the consensus estimate of $0.93, marking a 14 % upside. The beat was largely due to a one‑time charge reversal and a favorable tax rate impact, rather than a sustained operational improvement.

2. Guidance: Optimistic Yet Cautious

Revenue Forecast

Workday reiterated its FY24 revenue target of $7.9–$8.2 billion, a slight uptick from the previous range. This forecast aligns with the Q4 results and signals confidence in continued adoption of Workday’s cloud offerings. The company’s subscription‑only revenue guidance of $7.9–$8.1 billion further confirms that the growth will largely come from existing customers upgrading or expanding their deployments.

ARR Growth

Workday maintained its FY24 ARR growth target of 10–12 %, a figure that comfortably sits above the average 7–8 % for mid‑cap SaaS peers. The guidance is tempered by the current macro environment: rising interest rates, higher inflation, and a more selective spending cycle among enterprise IT budgets.

Cost Discipline & Profitability

Despite a modest decline in operating margin, the CFO stressed that Workday’s operating leverage is improving. “We are aggressively managing the cost structure to support our growth trajectory,” the CFO said in the earnings call. The focus on cost discipline, coupled with the company’s plan to continue investing in artificial intelligence (AI) features for its HCM and finance platforms, sets the stage for higher margins as the company achieves scale.

3. Why the Upgrade to Hold?

The analyst upgrade from “sell” to “hold” reflects a balancing act between the company’s robust fundamentals and the inherent risks:

Positive Catalysts:

- Subscription‑only business model ensures predictable revenue streams.

- Strong ARR growth that outpaces many competitors.

- Strategic AI investments that could unlock new value propositions for customers.Risks & Concerns:

- Margin pressure from higher cost of sales and investment outlays.

- Competitive intensity from Salesforce, ServiceNow, and SAP’s cloud offerings.

- Economic uncertainty that could dampen enterprise software spend.

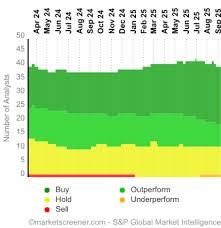

Analysts view the “hold” rating as a signal that Workday’s prospects are solid enough to support a bullish outlook, but the stock should be treated cautiously until the company demonstrates a sustained ability to convert its growth into profitability.

4. Competitive Landscape & Market Dynamics

Peers

- Salesforce continues to dominate the CRM arena but faces similar margin challenges.

- ServiceNow has a larger footprint in IT service management but is still expanding into finance.

- SAP is aggressively pushing its SuccessFactors HCM suite into the cloud.

While Workday is a strong performer in the HCM space, it competes with firms that have a broader product portfolio. That said, Workday’s deep focus on HCM, coupled with its seamless finance integration, gives it a niche advantage that many customers value.

Market Trends

- Shift to AI and automation: Companies are prioritizing platforms that embed AI to reduce manual effort and provide predictive insights. Workday’s AI roadmap, particularly in the talent and finance realms, positions it favorably.

- Cloud migration acceleration: Even as some IT budgets become more conservative, the migration to cloud platforms continues to accelerate, bolstering the long‑term tailwinds for Workday.

5. Key Takeaways for Investors

- Strong Revenue Growth: Workday’s Q4 results and FY24 guidance suggest a healthy trajectory for subscription revenue.

- Profitability Challenges: The slight dip in operating margin underscores the need for continued cost discipline.

- AI Investment: The company’s push into AI could differentiate its product suite and open new revenue channels.

- Competitive Pressure: While Workday holds a leading position in HCM, competitors with broader solutions could erode market share.

- Stock Valuation: Workday’s current valuation relative to revenue and EPS indicates a mid‑to‑high growth premium; investors should monitor earnings for any upside or downside catalysts.

In sum, the “hold” upgrade signals that while Workday’s fundamentals are solid, the stock’s upside will largely depend on the company’s ability to sustain margin growth and capitalize on AI-driven product enhancements. For those looking for a long‑term position in the enterprise‑software space, Workday offers a compelling narrative—provided that the company can maintain the operational discipline required to translate recurring revenue into profitability.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4841598-workday-stock-investors-expectations-might-be-rewarded-upgrade-hold ]