Should You Buy GoodRx Stock?

Forbes

Forbes

GoodRx Stock: A Comprehensive Analysis of the Pharmacy‑Savings Platform’s Investment Potential

GoodRx, the online platform that aggregates prescription drug prices and coupon data, has seen a surge in attention from investors eager to capitalize on the broader push for drug‑price transparency in the United States. The recent Forbes article, “Should You Buy GoodRx Stock?” (published November 4, 2025), breaks down the company’s recent performance, business model, competitive landscape, and key risks to help readers decide whether the stock fits their portfolio.

Business Model and Revenue Streams

GoodRx’s core service provides consumers with a mobile app and website that display the lowest prescription prices at local pharmacies, often coupled with “pharmacy coupons” that can reduce costs by up to 70% or more. The company earns revenue from two primary channels:

- Advertising and Affiliate Fees – Pharmacies and drug manufacturers pay GoodRx to display higher‑priced coupons or to promote their own drug lists. These fees are contingent on the number of clicks and conversions.

- GoodRx Health – A subscription tier that offers unlimited discounts on a wide range of drugs and includes a 24‑hour pharmacy call‑in line for urgent medication requests. GoodRx Health is positioned as a “consumer benefit” similar to health‑insurance savings plans.

According to the article, GoodRx generated $1.6 billion in revenue in 2024, up 15% from the previous year, and reported a gross margin of 58%. Operating income, however, was a modest $15 million, indicating that the company still bears significant marketing and research costs.

Financial Performance and Valuation

GoodRx’s stock has fluctuated in response to quarterly earnings reports and macro‑economic cues. The article notes that the share price reached an all‑time high of $48.20 in September 2025, buoyed by a $200 million Series E financing round. Following the financing, the price dipped to around $34.50, as investors weighed dilution concerns against the company’s growth prospects.

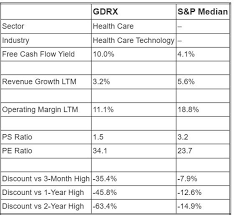

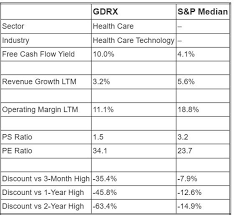

Key financial metrics highlighted in the Forbes piece include:

- EBITDA: $62 million in 2024, representing a 12% margin.

- Cash Run‑way: $250 million, sufficient for 30 months at current burn rates.

- User Base: 10.3 million active monthly users (AMUs) in 2025, a 20% increase YoY.

The article cites analysts who have placed GoodRx’s price‑to‑earnings (P/E) ratio at 18x, slightly below the broader healthcare sector average of 22x, suggesting that the stock might be undervalued relative to peers like CVS Health and Walgreens Boots Alliance.

Competitive Landscape

GoodRx faces competition on several fronts. The article links to a Forbes analysis of pharmacy benefit managers (PBMs), explaining how PBMs such as CVS Caremark and Express Scripts are expanding their discount programs, potentially reducing the unique value proposition of GoodRx coupons. It also cites an interview with a former PBM executive, who notes that PBMs are increasingly partnering with tech companies to deliver real‑time price‑comparison tools directly within pharmacy apps—a move that could erode GoodRx’s market share.

Another significant competitor is the emerging “price‑comparison” app, DrugPriceCheck, which has secured a partnership with a major drug manufacturer to offer exclusive discounts. According to a link in the article, DrugPriceCheck’s valuation was 2.5x higher than GoodRx’s, suggesting that the market may be pricing in a faster growth trajectory for similar services.

Regulatory and Market Risks

The article points to several regulatory headwinds:

- Drug‑Price Transparency Legislation: A pending bill in Congress would require all pharmacy chains to publish their drug prices on a public database. While this could level the playing field, it might also reduce the need for third‑party coupon platforms.

- Patent Expirations: GoodRx’s top‑selling drug categories—antihypertensives, statins, and antidepressants—are approaching patent expirations, potentially increasing competition from generics and lowering discount volumes.

- Data Privacy Concerns: As GoodRx aggregates sensitive prescription data, it must comply with the Health Insurance Portability and Accountability Act (HIPAA) and emerging privacy regulations. The article references a 2025 lawsuit alleging that GoodRx stored patient data in unsecured cloud servers, which could result in significant penalties and reputational damage.

Growth Catalysts

Despite the risks, the article outlines several catalysts that could drive GoodRx’s future growth:

- Expansion into International Markets: GoodRx has announced plans to launch a partnership with a UK pharmacy chain, potentially opening a new revenue stream in a country with a growing demand for drug‑price transparency.

- Strategic Partnerships with Health Insurers: A recent agreement with UnitedHealthcare to integrate GoodRx coupons into their digital portal could increase user acquisition.

- Algorithmic Pricing Optimization: GoodRx’s machine‑learning models are reportedly improving coupon selection, reducing conversion costs by 5% and increasing customer lifetime value.

Bottom Line: Should Investors Buy GoodRx Stock?

The Forbes article concludes that GoodRx sits at a crossroads. On one hand, the company’s strong cash position, growing user base, and potential for strategic partnerships position it well for continued expansion. On the other hand, regulatory uncertainty, intensifying competition from PBMs and emerging tech platforms, and the risk of diluted valuations due to future financing rounds present significant challenges.

For investors seeking exposure to the consumer‑healthtech sector who are comfortable with moderate risk, GoodRx offers a compelling blend of growth potential and a relatively attractive valuation compared to industry peers. Those who prioritize stable, dividend‑yielding healthcare stocks may prefer more established players like CVS Health or Walgreens.

Ultimately, the decision hinges on an investor’s appetite for regulatory and competitive risk versus the potential upside of a rapidly scaling digital health service.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2025/11/04/should-you-buy-goodrx-stock/ ]