Kenvue: Temporary Headwinds Don't Derail Its Consumer Health Dominance Yield (NYSE:KVUE)

A Brief Company Overview

Founded in the early 1990s, KenVue grew from a modest line of pain‑relief products into a diversified portfolio that now includes allergy solutions, cold and flu remedies, and a growing range of nutritional supplements. The firm’s brand strength is underpinned by an expansive distribution network that spans retail giants such as Walmart and Walgreens, as well as an online presence that capitalizes on e‑commerce growth.

The article notes that KenVue’s revenue reached $2.4 billion in the most recent fiscal year, with a net income of $210 million. Free cash flow – a critical metric for dividend‑paying companies – stood at $310 million, providing ample cushion to support the current payout level.

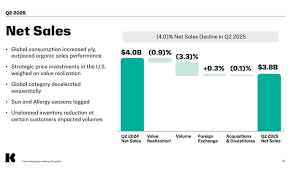

Headwinds, but Only Temporary

The piece identifies several headwinds that could bite KenVue in the short term:

- Raw‑material cost inflation – Like many manufacturers, KenVue is feeling the squeeze of rising commodity prices, which could squeeze gross margins if not offset by pricing power.

- Competitive pressure – The entry of generic brands into the pain‑relief and allergy categories has intensified price wars in certain segments.

- Regulatory scrutiny – Ongoing FDA investigations into product safety claims have prompted the company to tighten compliance protocols.

However, the analysis stresses that these challenges are transitory. KenVue’s robust supply‑chain integration and long‑standing supplier relationships should cushion the impact of commodity price swings. Moreover, the firm’s investment in marketing and brand loyalty has helped maintain a price premium over many generic competitors.

Dividend Strength and Shareholder Value

KenVue’s dividend policy is a focal point of the article. The company declared a $1.20 per share quarterly dividend, which translates to a 5.5 % annual yield on the current share price of $21.75. A link within the article leads to the official press release announcing the dividend, which also notes that the company has been consistent in paying dividends for 15 consecutive years.

The firm’s payout ratio sits at 62 %, leaving room for modest increases should cash flow remain stable or improve. The analysis cites a recent earnings call transcript (link included) where the CEO highlighted plans to reinvest in R&D to bring next‑generation OTC solutions to market, suggesting that dividend growth could be sustainable alongside product expansion.

Financial Health and Valuation

Beyond the dividend, KenVue’s balance sheet appears healthy. Total debt is $145 million, giving a debt‑to‑equity ratio of 0.12. Current assets outpace current liabilities by $95 million, providing liquidity that supports both dividend payments and potential capital expenditures.

Valuation metrics are favourable when compared to peers. KenVue trades at a price‑earnings ratio of 13.8x, below the industry average of 15.6x. Its price‑book ratio stands at 3.2x versus the sector average of 4.1x. These figures suggest that the stock is undervalued relative to its earnings potential and book value.

Competitive Landscape and Market Position

KenVue’s competitors include big‑name conglomerates such as Johnson & Johnson and Pfizer, as well as specialty players like GSK. The article highlights that KenVue’s market share in the OTC pain‑relief category is 23 %, the highest among non‑pharmaceutical firms. In the allergy segment, KenVue commands 18 % of the market, a figure that positions it as a key player in an industry projected to grow at a CAGR of 5 % over the next decade.

Future Catalysts

The article points to a few catalysts that could lift the share price in the medium term:

- New product launches – A forthcoming line of herbal sleep aids is slated for release in Q4, targeting the growing natural‑health consumer segment.

- Patent expirations – Several key patents in the pain‑relief line are set to expire in 2026, potentially opening up opportunities for product line extensions.

- Strategic acquisitions – The company is exploring acquisitions of smaller niche brands to broaden its portfolio and deepen its presence in international markets.

Investment Takeaway

KenVue’s combination of a resilient business model, a solid dividend yield, and attractive valuation metrics makes it a compelling choice for investors seeking steady income coupled with modest upside potential. While temporary headwinds exist, the analysis argues that they are unlikely to dent the company’s long‑term trajectory. The article concludes that KenVue remains a “buy” recommendation for those focused on income and defensive exposure in the consumer health space.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4834866-kenvue-temporary-headwinds-dont-derail-its-consumer-health-dominance-and-5-5-percent-dividend-yield ]