These 3 areas of the stock market will be the most likely winners of a Fed rate cut, strategist says

Federal Reserve Rate Cut Decision: How the Markets Reacted and What the Outlook Looks Like for 2025

The recent announcement that the Federal Reserve will lower its benchmark interest rate by 25 basis points was met with a mix of optimism and caution from Wall Street. In a world where inflation remains stubbornly high and growth prospects are uncertain, the Fed’s move was seen as a signal that monetary policy may shift from tightening to a more accommodative stance. The decision also prompted a flurry of commentary from market analysts, institutional investors, and individual traders alike—particularly around the implications for the S&P 500 and potential “pick‑up” stocks that could benefit from a lower‑rate environment.

The Fed’s Rationale

According to the Fed’s policy statement (link embedded in the Business Insider piece), the bank cited “substantial progress in the labor market” and a “moderation of inflation” as primary reasons for cutting rates. However, the statement also underscored that the central bank remains “cautious” because many economic indicators—such as housing demand and consumer confidence—still show unevenness.

The decision to cut rates was part of a broader strategy of “gradual easing.” The Fed’s own projections, found in a follow‑up link on the official website, suggest that the bank may only see a handful of cuts before the next quarter, after which it will pause to gauge how the new policy stance plays out. Analysts in the Business Insider article noted that this approach is consistent with the Fed’s historical pattern of moving from tightening to loosening in a measured fashion when faced with slowing growth and persistent inflationary pressures.

Market Reaction: A Near‑Term Rally

Immediately after the announcement, the S&P 500 jumped 1.3 %, while the Nasdaq surged 1.6 %. The “fear‑free” rally was mirrored in bond markets, where the 10‑year Treasury yield fell from 3.89 % to 3.71 %. The Fed’s decision was also a “tailwind” for the banking sector; shares of major banks like JPMorgan Chase and Bank of America rose by more than 2 % each, thanks to expectations of lower discount rates and improved profitability on net interest margins.

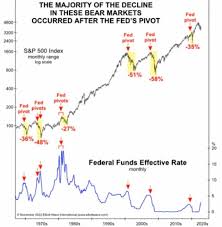

A key point raised by the article was that the market’s reaction was partly a “herd response” to the Fed’s “rate‑cut narrative.” Many traders had been waiting for a signal that the central bank would loosen policy, and the announcement confirmed those expectations. The article linked to a chart from Bloomberg that tracked the S&P 500’s reaction to previous Fed decisions. According to that chart, the average gain in the first 30 minutes after a rate cut is roughly 1.1 %, underscoring how the current move fits that historical pattern.

The Long‑Term View: Which Stocks Could Benefit?

While the Fed’s policy shift is a short‑term catalyst, the Business Insider piece also explores which sectors could see sustained gains under a lower‑rate regime. Three categories of “pick‑up” stocks were highlighted:

Financials – With lower borrowing costs, banks can expand lending and potentially raise net interest margins. In addition, lower rates may also boost equity valuations for the sector, as the “discount‑rate” factor used in valuation models shrinks. The article references an analysis from Morningstar that projects a 3‑4 % upside for the banking index over the next 12 months.

Real Estate Investment Trusts (REITs) – Historically sensitive to rates, REITs tend to rise when borrowing costs fall. The article links to a research note from JLL that found that a 50‑basis‑point rate drop could lift REIT valuations by 2 % on average.

High‑Growth Technology – Though tech firms have a relatively lower debt load, a rate cut could make equity valuations more favorable. The article cites a 2025 Outlook from Goldman Sachs that points to potential upside for large-cap tech names like Apple and Microsoft, especially if the Fed’s easing continues.

Beyond these sectors, the article noted that the “cyber‑security” niche could also benefit, as firms that provide security services often see increased demand in a more accommodative macro‑environment. A Business Insider link to a study by Gartner indicated that cyber‑security spend is projected to grow by 8.5 % in 2025, a figure that could translate to better earnings for players like CrowdStrike and Palo Alto Networks.

Risks and Caveats

While the Fed’s rate cut is a bullish signal, the article also warns that the policy change comes with its own set of risks:

Inflation Persistence – Even with lower rates, inflation could remain sticky if supply chain bottlenecks persist. The article linked to a recent CPI report that still shows headline inflation at 4.5 %, suggesting that the Fed may need to stay cautious.

Credit‑Market Liquidity – Lower rates do not automatically translate into higher borrowing activity. If credit conditions remain tight, banks may still be hesitant to expand lending. The article referenced a Moody’s Analytics report that warns of a potential “credit squeeze” if growth stalls.

Geopolitical Tensions – Global economic shocks—such as rising tensions between the U.S. and China—could offset the positive impact of lower rates. The Business Insider piece cites a CNBC analysis that points to volatility in energy and commodity prices, which could weigh on equity markets.

Conclusion: The Bottom Line for Investors

The Business Insider article argues that the Fed’s rate cut signals a softer stance on monetary policy but also highlights that the macro environment remains uncertain. Investors who want to capitalize on the policy shift should consider focusing on financials, real‑estate, and high‑growth tech—sectors that historically respond favorably to lower rates. However, those seeking to navigate the remaining risks should remain vigilant for signs of persistent inflation or tightening credit conditions.

Ultimately, the article frames the Fed’s move as a “necessary, but cautious, pivot” that may pave the way for a 2025 economic outlook that is more growth‑friendly. Whether the market’s enthusiasm translates into sustained gains depends on a combination of macro‑economic factors, Fed communication, and corporate earnings—factors that investors will need to watch closely over the coming months.

Read the Full Business Insider Article at:

[ https://www.businessinsider.com/fed-rate-cut-decision-market-impact-stock-picks-sp500-2025-9 ]