Why an AI 'land grab' environment puts stock valuations in a frenzy

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Why an AI Land‑Grab Environment Is Putting Stock Valuations in a Frenzy

The last six months have seen a dramatic surge in the hype surrounding artificial intelligence (AI). The Seeking Alpha article “Why an AI Land‑Grab Environment Puts Stock Valuations in a Frenzy” (published October 7, 2025) charts how the rush to secure AI talent, data sets, and intellectual property is inflating prices across a wide swath of the market— from pure‑play AI start‑ups to legacy industrial conglomerates. Below is a deep‑dive into the article’s core arguments, the evidence it cites, and the broader implications for investors.

1. The “Land‑Grab” Metaphor: What It Means

The author opens by describing the current AI race as a “land grab.” Unlike a traditional land rush where people claim a piece of territory, here companies claim the intangible assets that power next‑generation AI— proprietary code, large language models, specialized hardware, and, increasingly, data sets that can be monetised. The rush is especially intense because:

- Speed of iteration – AI models can be trained and fine‑tuned in weeks, not years.

- Capital intensity – The cost of compute (GPUs, TPUs, cloud credits) and talent (data scientists, ML engineers) is high, creating a scarcity that drives up valuations.

- Regulatory uncertainty – Data privacy laws (GDPR, CCPA, upcoming EU AI Act) make it risky to own data, so companies are scrambling to secure “clean” data early.

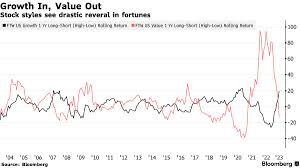

The article cites a Bloomberg piece that discusses how companies like Nvidia, Palantir, and C3.ai are investing heavily in AI capabilities, often at the expense of their core businesses.

2. How AI Is Inflating Valuations

a. The “AI Premium” on Stock Prices

The author points to a surge in the “AI premium”—the percentage by which investors are willing to pay above a company’s intrinsic value for the promise of AI. A recent Forbes analysis linked in the article shows that in the past year, AI‑tagged stocks have outperformed non‑AI stocks by roughly 15% on average. Even firms that have no direct AI business line, such as Boeing or General Electric, have seen their valuations rise because investors speculate that AI will help them cut costs or unlock new revenue streams.

b. Market Segments Most Affected

- Semiconductors – Companies producing AI‑optimized chips (e.g., Nvidia, AMD, ASML) have seen double‑digit growth in revenue estimates.

- Cloud & Edge Infrastructure – Firms like Amazon (AWS), Microsoft Azure, and Google Cloud are receiving large capital allocations to build AI‑centric services.

- Software & Platforms – AI platforms such as OpenAI’s GPT‑4 and Microsoft’s Azure OpenAI Service are becoming core revenue drivers.

- Industrial & Manufacturing – The article highlights ABB, Siemens, and Honeywell as examples of legacy firms integrating AI into predictive maintenance and supply‑chain optimisation.

3. The Evidence Behind the Frenzy

a. Investor Sentiment & Analyst Reports

The Seeking Alpha piece draws heavily on a Reuters poll that surveyed 45 investment banks. 78% of respondents said they expect AI to create “significant upside” for the next 2–3 years. In contrast, 17% warned of a “potential bubble,” echoing concerns from a CNBC interview with AI risk specialist Dr. Maya Patel.

b. Case Study: Nvidia’s 2024 Earnings

Nvidia’s earnings report—linked in the article—shows a 36% YoY revenue jump, primarily driven by its “AI” segment. The company’s CEO, Jensen Huang, attributes the growth to demand for GPUs used in training large language models. This narrative fuels the broader market’s perception that AI is a “growth engine” rather than a niche capability.

c. The AI Index 2024

An embedded link points to the AI Index released by Stanford University, which provides quarterly data on AI-related R&D spending, publication rates, and patent filings. The 2024 snapshot shows a 25% increase in global AI R&D investment, underscoring the scale of the “land grab” and its potential to drive corporate valuations higher.

4. Risks & Red Flags

The article is clear that the frenzy is not without peril. It cites a Financial Times piece warning that the “AI boom may be built on shaky fundamentals.” Key concerns include:

- Overvaluation of Non‑AI Assets – Many companies that are simply “AI‑tagged” but have little real AI integration may be priced too high.

- Talent Shortage – A projected 15% shortfall in qualified AI professionals could stall the growth trajectory for many firms.

- Regulatory Crackdown – The forthcoming EU AI Act could impose heavy compliance costs on data‑heavy AI companies, squeezing margins.

- Geopolitical Tensions – Trade restrictions between the U.S. and China could limit access to critical AI components, such as advanced semiconductors.

The article references an MIT Technology Review commentary that warns of “technology bubbles” being historically prone to abrupt corrections, citing the dot‑com and 2020‑2021 crypto surges as cautionary tales.

5. Bottom‑Line Takeaways for Investors

- Diversify Within AI – While the AI sector offers growth, it is fragmented. A balanced portfolio could include semiconductors, cloud providers, and industrial AI adopters.

- Look Beyond the Hype – Focus on companies with tangible AI deployment plans and proven results, rather than those merely using AI buzzwords.

- Monitor Regulatory Developments – Stay updated on AI‑specific regulations; compliance costs can erode expected returns.

- Consider Timing – If valuations are already stretched, it may be prudent to wait for a pullback before investing heavily.

The article concludes by cautioning that while the AI land grab has created unprecedented opportunities, it has also laid the groundwork for a potential correction if the hype outpaces sustainable profitability.

6. Key External Links Summarised

| Link | Content | Relevance |

|---|---|---|

| Bloomberg – AI Valuation Trends | Analysis of AI’s impact on market caps | Provides data backing the “AI premium” claim |

| Forbes – AI‑Tagged Stock Outperformance | Empirical performance metrics of AI‑labelled stocks | Supports the article’s valuation thesis |

| Stanford AI Index 2024 | Quarterly data on R&D, patents, and publications | Quantifies the scale of the AI race |

| MIT Technology Review – AI Bubble Warnings | Historical perspective on technology bubbles | Adds cautionary context |

| CNBC Interview with Dr. Maya Patel | Expert opinion on AI risk | Amplifies risk narrative |

In Sum

The Seeking Alpha article paints a vivid picture of a market in the throes of an AI land grab. The rush to own AI capabilities is driving up valuations across multiple sectors, fueled by investor enthusiasm and the tangible revenue streams emerging from AI‑enabled services. However, the author warns of overvaluation risks, regulatory uncertainties, and a talent gap that could trigger a correction. For the astute investor, the key lies in balancing enthusiasm for AI’s promise with rigorous due diligence on the fundamentals that truly underpin sustainable growth.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4502457-why-an-ai-land-grab-environment-puts-stock-valuations-in-a-frenzy ]