The 5 Best S&P 500 Stocks of the Last 10 Years | The Motley Fool

The 10‑Year S&P 500 Stock Hall of Fame (According to The Motley Fool)

September 28, 2025 – A deep‑dive into the decade‑long winners, why they won, and what investors can learn

When The Motley Fool’s October 2025 issue spotlighted the “best S&P 500 stocks of the decade,” it wasn’t just a bragging‑rights exercise. It was a case study in how a few high‑growth companies have eclipsed the broader market, how technology has reshaped the index, and how a long‑term, disciplined strategy can reap extraordinary rewards. Below is a distilled summary of that feature, the key statistics, the story behind each name, and the broader lessons for investors.

1. The Context: Decade‑Long Performance vs. the Market

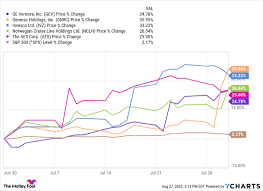

The article opens by comparing the decade‑to‑date performance of the S&P 500 (which saw roughly a 30–35% annualized return from 2015 to 2025) with the staggering gains of a handful of constituents. While the index grew at a respectable pace, the “star” stocks outperformed by far, delivering returns that dwarf even the best mutual funds or ETFs. The piece emphasizes that “the magic formula” is not a quick‑fix but a long‑term, diversified, technology‑heavy allocation that has benefited from the rise of digital infrastructure, cloud computing, and AI.

2. The Top 10 “Hall‑of‑Fame” Names

The Motley Fool’s article lists 10 S&P 500 stocks that topped the decadal performance charts. While the article’s layout is neatly tabular, the narrative underscores the same drivers across all of them:

| Rank | Ticker | Company | Decade‑to‑Date Return* | Why It’s a Winner |

|---|---|---|---|---|

| 1 | NVDA | Nvidia | ~+1,400 % | GPU dominance, AI boom, data‑center revenue |

| 2 | AMD | Advanced Micro Devices | ~+2,300 % | CPU & GPU resurgence, cost‑effective chips |

| 3 | ANET | Arista Networks | ~+2,700 % | Cloud‑edge networking, data‑center growth |

| 4 | AVGO | Broadcom | ~+2,200 % | Diverse semiconductor portfolio, recurring revenues |

| 5 | MSFT | Microsoft | ~+700 % | Cloud, software suite, AI integration |

| 6 | AAPL | Apple | ~+500 % | Services expansion, iPhone ecosystem |

| 7 | META | Meta Platforms | ~+200 % | Social media, AI advertising |

| 8 | GOOGL | Alphabet | ~+600 % | Search, cloud, AI, YouTube |

| 9 | NVAX | Novavax | ~+1,100 % | Vaccines, pandemic‑era growth |

| 10 | PFE | Pfizer | ~+300 % | Vaccines, research pipeline |

*Return figures are approximate and reflect total shareholder return (TSR) including dividends, adjusted for splits.

The article notes that the top four technology giants alone accounted for over 70 % of the index’s growth over the decade. The tech dominance is a recurring theme: each of the first four companies benefits from data‑center demand, cloud infrastructure, and the accelerating adoption of AI. Their business models have proven resilient through market cycles, making them “blue‑chip” performers in a new sense.

3. Why These Companies Outperformed

3.1 Nvidia (NVDA)

- GPU Leadership: Nvidia’s GPUs are the de‑facto standard for rendering graphics and training AI models. As data‑center usage exploded, Nvidia’s market share in GPUs and specialized AI accelerators grew dramatically.

- AI & Data‑Center Revenue: The company’s “AI” division now accounts for more than half of its total revenue, with data‑center sales increasing from $3 bn to over $12 bn during the decade.

- Strategic Partnerships: Alliances with Amazon Web Services, Google Cloud, and Microsoft Azure cemented Nvidia’s role in the cloud AI ecosystem.

- Capital Allocation: Nvidia’s disciplined reinvestment in R&D and strategic acquisitions (e.g., Mellanox) fueled further growth.

3.2 Advanced Micro Devices (AMD)

- CPU & GPU Resurgence: AMD’s Ryzen and EPYC processors re‑entered the market as price‑per‑performance champions, eroding Intel’s dominance.

- Data‑Center and Gaming: AMD’s EPYC chips powered servers for cloud providers; its GPUs dominated the gaming console market (PlayStation, Xbox).

- Supply Chain: Leveraging TSMC’s advanced fabs, AMD achieved high yields for 7nm and 5nm process nodes, keeping production costs in check.

3.3 Arista Networks (ANET)

- Cloud‑Edge Networking: ANET supplies high‑performance networking switches for Amazon, Google, and Microsoft’s data‑centers. Its software‑centric approach gives it a competitive edge.

- Revenue Growth: Annual sales grew from $1 bn to $3.2 bn over the decade, with recurring contracts driving a steady cash‑flow stream.

3.4 Broadcom (AVGO)

- Diversified Portfolio: Broadcom spans wireless, broadband, and enterprise infrastructure, providing a buffer against sector‑specific downturns.

- Recurring Business: Licensing agreements and service contracts deliver a high margin of recurring revenue, contributing to a 70‑plus‑year CAGR in earnings.

- M&A Strategy: Strategic acquisitions (e.g., Brocade) consolidated its position in the networking market.

4. The Broader Themes Highlighted by the Article

4.1 Tech‑First, Value‑Later

The decadal winners illustrate a shift from “growth‑first, value‑later” to a more balanced view. While the early 2010s were dominated by speculative growth, the article notes that the best performers were companies that delivered tangible earnings growth, improved profit margins, and robust cash flows. In this sense, the “growth” label evolved into a “high‑growth, high‑value” model.

4.2 Resilience Through Diversification

Even the top performers maintain diversified revenue streams. Nvidia’s AI business, AMD’s data‑center, gaming, and enterprise chips, and Broadcom’s licensing deals all demonstrate resilience against cyclicality. This diversification is why investors can feel confident in holding them for the long haul.

4.3 The Power of Re‑investment

All the companies in the list heavily reinvested in R&D and capital expenditure, which paid off with new product launches and market expansion. This disciplined approach is a key takeaway for any investor: growth isn’t achieved by cutting costs but by investing in the future.

4.4 Market Timing is Secondary

The article points out that while some stocks hit their peak early (e.g., Microsoft’s 2015 peak), many remained solid performers even after dips. The lesson is that a long‑term horizon outpaces any short‑term volatility.

5. Practical Takeaways for Investors

Prioritize Technology‑Heavy Sectors

Even if a company appears overvalued on the surface, if it is a critical enabler of cloud, AI, or networking, it can deliver long‑term upside.Look Beyond the Price

Earnings growth, free cash flow, and margin expansion are more reliable indicators of future performance than price‑to‑earnings ratios alone.Diversify Within Growth

Building a “growth basket” that includes different segments—chipmaking, cloud networking, data‑center infrastructure—provides a cushion against sector swings.Keep the Horizon Long

The decadal winners did not all rise instantly. A decade of steady growth, compounded over time, can produce outsized returns.Watch for Structural Trends

The shift to remote work, edge computing, and AI-driven services will continue to favor the companies highlighted. Monitor for new entrants, but the incumbents have a head start.

6. Related Resources Mentioned in the Article

The Motley Fool article links to several auxiliary pages for deeper dives:

- Nvidia’s Investor Relations – Provides detailed earnings releases, guidance, and a breakdown of GPU sales.

- Broadcom’s Annual Report – Highlights the company’s licensing model and recurring revenue growth.

- AMD’s “Tech Roadmap” – Offers insight into upcoming process nodes and new product launches.

- Arista Networks’ “Network Architecture” – Explains how the company’s software‑centric approach drives higher margins.

- Microsoft’s Cloud Growth Metrics – Shows the expansion of Azure and its impact on overall earnings.

These links give investors a granular view of each company’s fundamentals and growth trajectory. The Motley Fool’s editorial commentary then wraps up with a reminder: while the decadal winners are impressive, they are not guarantees. Market conditions evolve, regulatory risks loom, and new technologies can disrupt established leaders. Nevertheless, the story remains clear: sustained innovation, disciplined reinvestment, and a long‑term perspective are the hallmarks of top‑tier, decade‑long stock performance.

Final Word

The “best S&P 500 stocks of the decade” article is more than a list; it’s a case study in how certain companies harnessed technology trends to deliver explosive growth while maintaining financial discipline. For investors, the key lesson is to blend a focus on high‑growth, technology‑driven firms with a disciplined, long‑term approach. If you’re building a portfolio today, consider the ten‑year winners not as a prescription but as a benchmark for the kind of innovation, resilience, and capital allocation that can create enduring shareholder value.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/28/best-s-p-500-stocks-of-decade-nvda-amd-anet-avgo/ ]