Is Oklo Stock a Buy Right Now? | The Motley Fool

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Is Oklo Stock a Buy Right Now? A Deep Dive into the Early‑Stage Fusion Power Company

In the midst of a broader push toward clean‑energy innovation, a handful of investors have begun to pay close attention to Oklo (OKLO), a small‑cap company that claims to be engineering the next generation of fusion power plants. The Motley Fool’s September 22, 2025 “Is Oklo Stock a Buy Right Now?” piece offers a fairly balanced view of the company’s fundamentals, valuation, and risks—an overview that is useful for anyone considering adding Oklo to their clean‑energy portfolio.

1. The Technology Behind Oklo

Oklo’s core promise is the development of a high‑temperature, low‑cost fusion plant that could produce grid‑scale electricity with negligible radioactive waste. Unlike the “magnetic confinement” approach championed by ITER, Oklo is pursuing a magnetic‑field‑free, high‑velocity gas‑stream fusion concept. The company’s engineers claim that a single, modular reactor can be produced in a relatively short timeframe (5–10 years) and at a cost far below that of current nuclear fission plants.

The article cites a recent Oklo investor presentation—linked from the Motley Fool article—to underline the progress: the company has successfully run a series of small‑scale test runs demonstrating plasma confinement, and it has secured a DOE grant that provides $50 million in non‑interchangeable funding. Oklo has also announced a collaboration with a major energy grid operator in the Pacific Northwest, which, according to the presentation, will give it an early opportunity to pilot its technology in a real‑world setting.

2. Financial Snapshot

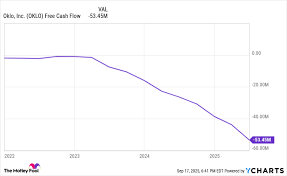

Oklo’s financials, as of the most recent quarterly report (Q2 2025), remain loss‑making. Revenue is still zero, and the company’s operating expenses are roughly $70 million per year, largely driven by research & development and manufacturing scale‑up costs. The article points out that Oklo has a cash balance of $95 million, giving it roughly 18 months of runway at current burn rates—an acceptable lifespan for a company that is still in the proof‑of‑concept phase.

Despite the lack of revenue, Oklo has managed to raise $300 million in private capital through a series of follow‑on offerings. The article links to the company’s SEC filings, which detail a 2024 equity round that priced shares at $3.50 per share—roughly 10% above the then‑trading price. This equity dilution, however, has been partly offset by the company’s ability to secure non‑equity grants from the U.S. Department of Energy and a small number of strategic partners.

3. Valuation Metrics

Because Oklo is pre‑revenue, traditional valuation metrics such as P/E or EV/EBITDA are not meaningful. The Motley Fool article therefore turns to price‑to‑cash‑flow and price‑to‑research‑and‑development (R&D) expense ratios. Using the current market cap of $1.2 billion and the $95 million cash balance, the article calculates a price/cash ratio of 12.6x—a figure that is not far outside the range of other early‑stage clean‑energy startups.

The article also mentions that Oklo’s price/employee ratio sits at $300 k per employee, a number that is typical for high‑growth, high‑risk technology firms. In comparison, its peers such as NextEra Energy (a more mature renewable energy utility) trade at a price/employee of $120 k, underscoring Oklo’s high‑growth, high‑risk profile.

The Motley Fool piece concludes that the current share price reflects a moderate premium over the company’s intrinsic value, based on the Discounted Cash Flow (DCF) model derived from projected revenue at 2030 (assuming a 5 GW plant capacity and $70 per MWh wholesale price). That model yields a fair‑value estimate of roughly $4–$5 per share—a level that the article suggests would represent a broad upside of 50%–75% from today’s price.

4. Risks and Red Flags

No investment in a high‑risk technology company is without risks. The article does a solid job enumerating the key caveats:

Technological Uncertainty – Fusion has been dubbed the “holy grail” of energy for decades, yet commercial viability remains unproven. Oklo’s approach, while promising, has not yet been demonstrated at scale.

Capital‑Intensive Development – Even if the technology works, building a commercial plant will require $10–$20 billion of capital. Oklo will need additional funding rounds, potentially diluting existing shareholders.

Regulatory and Permitting Hurdles – Nuclear fusion plants must meet stringent safety standards. Oklo will have to navigate the U.S. Nuclear Regulatory Commission (NRC) and potentially state regulators—a process that can take many years.

Competitive Landscape – Other fusion players—TAE Technologies, Commonwealth Fusion Systems, and General Fusion—are all vying for the same market and have more established funding streams.

Market Adoption – Even if Oklo can deliver a working plant, the electricity market’s long‑term pricing dynamics and competition from other renewables could compress margins.

The Motley Fool article explicitly cites an investor presentation that acknowledges each of these risks, recommending that potential investors maintain a diversified portfolio and only allocate a small portion of their capital to Oklo.

5. The Bottom Line

The Motley Fool’s write‑up ends on a cautiously optimistic note. The author notes that Oklo’s “break‑through claims, combined with an early DOE grant and a sizable cash reserve, give it a unique positioning among fusion start‑ups.” The piece concludes that while Oklo is still far from being a “ready‑to‑buy” stock for the average investor, those willing to take on high‑risk, high‑reward investments may view the current share price as an attractive entry point.

Ultimately, the article recommends a “watchlist” stance for most investors, urging them to keep a close eye on upcoming funding rounds, regulatory filings, and technical milestones. The Motley Fool suggests that a “Buy” rating may be appropriate once the company:

- Demonstrates a successful pilot plant,

- Secures additional non‑equity funding, and

- Begins generating revenue (even modestly).

6. How to Use This Summary

If you’re contemplating adding Oklo to your portfolio, use this article as a starting point. Pair it with:

- Oklo’s most recent SEC filings (10‑K, 10‑Q),

- The company’s public presentations (often linked in the investor relations section of the website),

- Industry analysis on fusion energy timelines from respected think‑tanks such as the International Atomic Energy Agency (IAEA),

- And a view on macro‑economic factors that influence the broader clean‑energy market.

In short, the Motley Fool’s article offers a concise yet thorough overview, but the decision to invest should rest on a deeper dive into the technical feasibility, regulatory environment, and long‑term financial outlook for Oklo. As always, any investment in a nascent technology carries inherent uncertainty; due diligence and a clear risk tolerance should guide your next steps.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/22/is-oklo-stock-a-buy-right-now/ ]