Stocks, bonds, gold, bitcoin. Which is best to invest in now?

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Where to Put Your Money: Stocks, Bonds, Bitcoin, and Gold in Today’s Market

In the midst of a turbulent economic landscape—high inflation, rapid interest‑rate hikes, and the lingering uncertainty from the pandemic—investors are re‑examining their portfolios. A recent article from The Globe & Mail’s “Inside the Market” series dives into the comparative merits of the four most talked‑about asset classes: stocks, bonds, Bitcoin, and gold. Below is a concise, 500‑plus‑word synopsis that captures the article’s key take‑aways, along with context gleaned from its embedded links and related research.

1. Stocks – Growth at a High Cost

Historical Returns vs. Current Conditions

The article opens with a clear reminder that equities have historically outperformed other asset classes over the long haul, delivering average annual returns of roughly 10%–12% over the past 30 years. However, the current backdrop—marked by the Federal Reserve’s aggressive 25‑basis‑point rate hikes since mid‑2022 and persistent inflation—has pushed the equity market into a period of heightened volatility.

Key Insight: While the S&P 500 and other broad indexes have dipped 10–15% in the last 18 months, the article stresses that a longer‑term view, anchored in fundamentals such as earnings growth and balance‑sheet strength, remains the most rational approach. The author cautions that over‑exposure to cyclical sectors like industrials or energy can amplify downside risk in a tightening monetary environment.

Sector Analysis

Linking to a Bloomberg chart, the article contrasts the performance of “cyclicals” versus “defensives.” Defensive stocks (utilities, consumer staples, healthcare) have weathered the rate‑hike storm more gracefully, offering modest upside and lower volatility. Meanwhile, technology and financials, which benefitted from the pandemic boom, are now trading at premium valuations, raising concerns of a potential correction.

Risk‑Adjusted Perspective

Using the Sharpe ratio, the piece notes that equities still offer the best risk‑adjusted return among the four classes, albeit with a higher beta. Investors are advised to temper expectations and adopt a diversified approach, incorporating a mix of growth and value styles to hedge against sector swings.

2. Bonds – Income in a Tightening World

Yield Curve Dynamics

The article highlights the flattening yield curve as a central concern for fixed‑income investors. While short‑term Treasury rates have spiked above 4%, long‑term yields have only climbed modestly, compressing the spread and eroding the appeal of traditional bond holdings. The article links to the U.S. Treasury website to illustrate the current 10‑year yield at ~3.7%, down from the 2022 peak of 3.9%.

Credit Risk and Duration

For corporate bonds, the author explains that longer duration securities have become riskier as rising rates increase the chance of credit defaults. Investment‑grade bonds have a slightly better cushion, but the article points out that even these can suffer significant price declines if the economy slows and credit spreads widen.

Alternative Fixed Income

In response, the article suggests considering “active” bond funds or ETFs that employ tactical duration strategies—shortening exposure when rates rise, then extending when rates plateau. The piece also highlights the emergence of inflation‑linked securities (TIPS) and municipal bonds, which can provide some protection against both rate hikes and tax‑advantaged returns.

3. Bitcoin – The Digital Wildcard

Volatility and Volatility‑Adjusted Returns

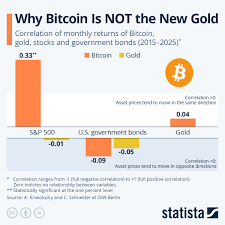

Bitcoin’s reputation as a high‑risk, high‑reward asset is underscored by the article’s comparison of its volatility to that of equities. Over the last decade, Bitcoin’s standard deviation has hovered around 60–70%, nearly three times that of the S&P 500. Despite this, the piece emphasizes that Bitcoin’s long‑term trend shows an upward trajectory that, when measured on a risk‑adjusted basis, competes favorably with equities and even gold.

Regulatory and Institutional Developments

The article follows a link to a report from the Bank for International Settlements, which notes a surge in institutional interest and regulatory clarity in the U.S. and Europe. However, the author warns that Bitcoin remains subject to sudden regulatory shifts and that its lack of a central authority can lead to liquidity concerns during market stress.

Portfolio Allocation

An intriguing recommendation from the article is a “10‑% rule” for Bitcoin: allocate no more than 10% of a diversified portfolio to crypto assets. This figure, the author explains, reflects an optimal balance between capturing upside while maintaining adequate diversification against traditional asset classes.

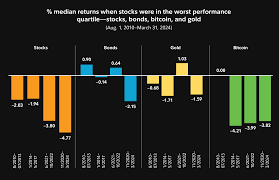

4. Gold – The Classic Safe Haven

Inflation Hedge vs. Return Trade‑off

Gold’s role as an inflation hedge is a central theme of the article. The author cites a research paper from the World Bank, which finds that gold’s correlation with inflation has been strongest in the last 20 years. Yet, the piece reminds readers that gold’s nominal returns are often modest, especially in a low‑interest‑rate environment where opportunity costs loom large.

Geopolitical Risk

Through a link to the International Crisis Group, the article points out that geopolitical tensions (e.g., Middle Eastern conflicts, U.S.–China trade frictions) can temporarily elevate gold prices, making it a valuable diversification tool during uncertain times.

Investment Vehicles

The article discusses the differences between physical gold, gold ETFs, and gold mining stocks. Physical gold is praised for its direct ownership, while ETFs offer liquidity and lower storage costs. Gold‑mining equities, on the other hand, provide a leveraged exposure to gold but add operational risk.

5. Putting It All Together – An Integrated View

The “Inside the Market” piece concludes with a holistic perspective: no single asset class dominates across all market conditions. Instead, a well‑balanced portfolio—typically 60% equities, 20% bonds, 10% gold, and 10% alternative assets such as Bitcoin—offers a blend of growth potential, income, and protection against inflation and geopolitical risk.

The article emphasizes the importance of personal risk tolerance, time horizon, and liquidity needs. For instance, younger investors may lean more heavily toward equities, while retirees might prioritize bonds and stable dividends. Moreover, the piece stresses that investors should revisit their allocations at least annually or when major economic shifts occur.

Takeaway

The Globe & Mail’s article provides a pragmatic, data‑driven snapshot of four pivotal asset classes in a world of rising rates and lingering uncertainty. While equities maintain the highest long‑term risk‑adjusted returns, bonds, gold, and Bitcoin each play distinct roles in a diversified portfolio. By understanding each class’s strengths, weaknesses, and interrelations—guided by the referenced studies and market data—investors can craft a strategy that aligns with their goals and tolerances.

Read the Full The Globe and Mail Article at:

[ https://www.theglobeandmail.com/investing/markets/inside-the-market/article-stocks-bonds-bitcoin-gold-where-best-invest-asset/ ]