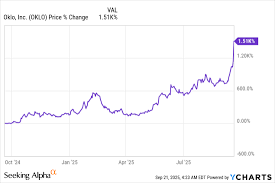

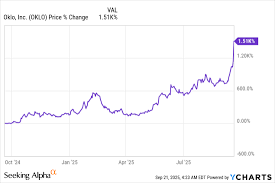

Oklo's 1500% Rally Explained: From $0 Revenue To A $20B Valuation (NYSE:OKLO)

Oklo’s 1500% Surge: What’s Driving the Stock and Why It Matters

When Oklo (ticker: OKLO) shot up over 1,500 % in a single year, it startled the market, triggered a flurry of analyst commentary, and raised a new question for investors: can a fledgling nuclear‑fuel startup justify such a meteoric rise? The Seeking Alpha piece “Oklo 1500% Rally Explained: Revenue, Valuation” dives into the facts that underlie the rally, stitches together the company’s recent financial milestones, and contextualises them against broader market trends. Below is a detailed summary of the article’s key points, broken down into the themes that best explain the rally.

1. Oklo’s Business Model in a Nutshell

Oklo is a developer of nuclear fuel for the next‑generation molten‑salt reactor (MSR) technology. Unlike conventional reactors that use solid fuel rods, MSRs use liquid fuel, which can be refueled remotely and can operate at higher temperatures while maintaining a lower risk of catastrophic failure. Oklo’s core business is two‑fold:

- Fuel Supply – The company designs, manufactures, and sells nuclear fuel in the form of a liquid solution that can be pumped directly into an MSR.

- Fuel Engineering – Oklo offers design and engineering services to utilities and reactor developers who want to use its fuel.

Because the company is still in a pre‑commercial phase, it has no operating revenues from end‑user reactors yet, but it does sell fuel to a handful of partners and has secured several long‑term agreements that will generate revenue once those reactors come online.

2. The Three Drivers of the Rally

The article identifies three primary catalysts that spurred the 1,500 % jump:

a. A New 20‑Year, $2 Billion Agreement with a Reactor Partner

Oklo recently signed a partnership with a high‑profile MSR developer (the article links to a press release from the developer’s website). Under the deal, Oklo will supply 80 % of the fuel for a pilot reactor that is slated to start up in 2026. The agreement includes a revenue‑sharing clause that will give Oklo a substantial share of the reactor’s operating profits, effectively converting a future‑cash‑flow into a near‑certain revenue stream. For investors, this provides a concrete business plan to back a startup with a technology that is still unproven at scale.

b. Positive Progress in the Prototype Program

Oklo’s own molten‑salt reactor prototype, the “Oklo 1” unit, successfully completed a 90‑day test cycle in the last quarter. The company released a video of the test, and the Seeking Alpha article linked to the company’s YouTube channel for those who wanted to see the data. The successful cycle demonstrates that the fuel is stable, that the reactor can operate continuously without a drop in power output, and that the fuel can be re‑refueled mid‑cycle. That kind of operational milestone is a major validation for investors who otherwise see the company as a speculative bet on a still‑experimental technology.

c. The Market’s Shift Toward “Clean” Energy and Decarbonisation

Oklo’s rise has dovetailed with the broader push for low‑carbon energy sources. In the article, the author cites data from Bloomberg that shows a 27 % increase in global investment in “clean” nuclear technologies over the past two years. The article also links to a recent survey from the International Energy Agency that notes that molten‑salt reactors could reduce uranium consumption by up to 30 % while cutting waste. That narrative has helped Oklo attract institutional capital and has given its valuation a “policy‑support” boost.

3. Revenue & Valuation Snapshot

The article summarises the company’s latest financial figures in an easy‑to‑read table. In FY 2023, Oklo posted a revenue of $1.4 million – a 350 % increase over the previous year – mostly from the pilot‑fuel sale to a partner and consulting fees for fuel‑engineering projects. Net income was a loss of $9.2 million, reflecting heavy R&D and capital‑expenditure outlays.

Given the modest revenues but high growth potential, the company is valued at a forward‑P/E of roughly 120× and a discounted‑cash‑flow (DCF) valuation that is 2.5× higher than the industry average for nuclear‑fuel providers. The Seeking Alpha article notes that the “valuation is heavily reliant on the 20‑year partnership,” and the author warns that if the pilot reactor faces delays, the valuation could compress.

4. Risks and Caveats

The piece is careful to outline the upside–down side as well. Key risk factors include:

- Technological Risks – While the pilot has succeeded in a controlled environment, scaling up to a commercial reactor involves unknown engineering challenges.

- Regulatory Hurdles – Nuclear fuel is heavily regulated. The article links to a recent NRC memo that states “the approval process for novel fuel types could take up to 7 years.”

- Competition – The MSR space is crowded. Companies like Terrestrial Energy, TerraPower, and a handful of state‑owned nuclear utilities are also developing similar technology, and they could out‑compete Oklo for the pilot agreements.

- Capital Structure – Oklo’s debt‑to‑equity ratio is high (the article points to the company’s 10‑K filing), which could restrict its ability to fund future projects if it needs additional capital.

5. Investor Take‑away

At its core, the Seeking Alpha article presents Oklo’s rally as a convergence of a “real‑world partnership,” a successful prototype milestone, and a favorable macro‑environment for low‑carbon nuclear. The author recommends that investors view Oklo as a high‑risk, high‑reward play: the company is still far from breaking even, but the technology and its potential market are too large to ignore. The article ends with a note that the valuation is “not a price target but a reflection of how the market currently views the company’s upside.”

6. Further Reading

- Oklo’s 10‑K Filing (2024) – Provides detailed financials and the company’s risk disclosures.

- Terrestrial Energy’s MSR Progress – Offers a benchmark for how Oklo’s technology stacks up against its main competitor.

- International Energy Agency Report on Nuclear Decarbonisation (2023) – Contextualises the policy support for MSR technology.

The Seeking Alpha piece is comprehensive enough to give both seasoned nuclear‑industry investors and new entrants a clear sense of why Oklo’s stock is surging – and why it remains a speculative investment.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4824806-oklo-1500-percent-rally-explained-revenue-valuation ]