Self-Storage Sector Signals Shift from Pandemic Boom

Locales: Maryland, Virginia, UNITED STATES

WASHINGTON - Public Storage's recent Q4 2025 earnings report provides a crucial snapshot of the self-storage industry, revealing a sector at a pivotal moment. While the nation's leading self-storage operator and REIT demonstrated stability, the results signal a shift from the rapid growth experienced during the pandemic years to a more normalized, and increasingly competitive, landscape. The report underscores the delicate balancing act facing self-storage companies - managing costs amidst softening rental rates and a growing supply of storage units.

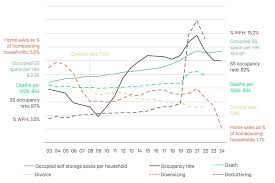

The modest decline in same-store net operating income (NOI) isn't necessarily a cause for alarm in isolation, but a significant indicator of changing market dynamics. NOI, a key performance indicator for REITs, reflects the profitability of existing properties. The fact that Public Storage, a traditionally robust performer, experienced a dip signals broader pressures impacting the entire sector. Increased operational expenses - driven by factors like rising property taxes, insurance costs, and labor demands - are undeniably squeezing margins. However, the concurrent softening of rental rates suggests demand is no longer keeping pace with supply in certain key markets.

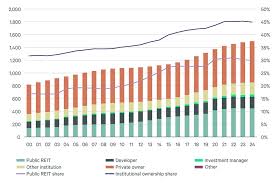

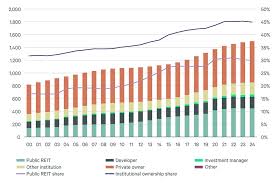

This shift is largely attributed to two primary factors. Firstly, the unprecedented surge in demand witnessed during the COVID-19 pandemic, fueled by relocation, downsizing, and a general desire for decluttering, is waning. Secondly, a wave of new self-storage facilities, built in anticipation of continued pandemic-era growth, are now coming online. This increased supply is creating a more competitive environment, forcing operators to adjust pricing strategies to attract and retain customers.

Public Storage CEO Matthew Jan de Vries acknowledged this "cooling effect" during the investor call, noting the company is proactively "managing pricing to maintain competitiveness." This suggests a move away from aggressive rate increases and towards more nuanced pricing strategies, potentially including targeted promotions and flexible rental options. The emphasis on maintaining occupancy rates, even at the expense of some rental income, highlights the importance of keeping units filled in a more saturated market.

However, Public Storage isn't simply reacting to the headwinds; it's actively adapting. The company's continued focus on operational efficiencies - streamlining processes, leveraging technology, and controlling costs - is crucial for mitigating the impact of rising expenses. This includes investments in automated systems for property management, customer service, and security, all designed to reduce reliance on labor and improve overall efficiency.

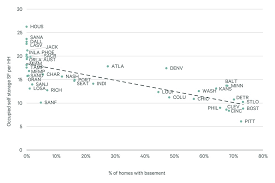

Beyond internal improvements, strategic acquisitions remain a cornerstone of Public Storage's growth strategy. The company is carefully targeting expansion into high-growth markets - areas experiencing population influx, strong economic activity, and limited existing self-storage options. This allows them to capitalize on emerging opportunities and diversify their portfolio. Identifying these markets requires sophisticated data analysis, considering factors like demographic trends, housing starts, and consumer spending patterns.

Looking ahead to 2026, the outlook for the self-storage sector remains cautiously optimistic. Public Storage anticipates continued headwinds, but the company's strong balance sheet and disciplined approach to capital allocation provide a degree of resilience. The long-term fundamentals of the self-storage industry - driven by factors like increasing urbanization, downsizing trends, and the ongoing need for storage solutions - remain intact. However, success in the coming years will depend on a company's ability to navigate the evolving market dynamics, control costs, and differentiate itself from the competition. The focus will be on providing value-added services, such as moving assistance, packing supplies, and insurance options, to attract and retain customers. The era of easy growth in the self-storage sector is over; the next phase will be defined by strategic adaptability and operational excellence.

Investors will be closely watching Public Storage's performance in the coming quarters to gauge the overall health of the self-storage industry and assess the effectiveness of the company's strategies. The Q4 2025 report serves as a critical benchmark, illustrating the challenges and opportunities that lie ahead for this key segment of the real estate market.

For a detailed review of the earnings report, visit the Public Storage investor relations website: [ https://www.publicstorage.com/investors ]

Read the Full WTOP News Article at:

[ https://wtop.com/news/2026/02/public-storage-q4-earnings-snapshot/ ]