Big Tech Faces 'Perfect Storm' of Challenges

Locales: UNITED STATES, INDIA

Unpacking the Perfect Storm

For years, Big Tech enjoyed a period of unprecedented growth, fueled by innovation, expanding markets, and low interest rates. However, the economic landscape has shifted dramatically. The primary driver of the current turmoil is the aggressive monetary policy implemented by the Federal Reserve to combat inflation. Rising interest rates increase the cost of borrowing, impacting tech companies that often rely on debt to fund growth and innovation. This, in turn, compresses valuations, particularly for growth stocks which are valued on future earnings potential.

Beyond interest rates, a growing wave of regulatory scrutiny adds another layer of complexity. Antitrust concerns are mounting, with governments worldwide investigating potential monopolistic practices and seeking to limit the market power of these tech giants. Any significant regulatory action could stifle innovation, increase compliance costs, and ultimately hinder growth.

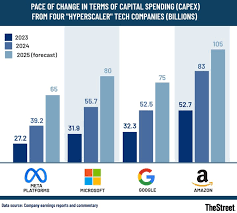

The burgeoning field of Artificial Intelligence (AI), while presenting enormous opportunities, also introduces a significant degree of uncertainty. While many see AI as the next major growth engine, the substantial investment required to develop and deploy these technologies, coupled with the potential for disruption across various sectors, creates volatility. Investors are now assessing which companies are truly positioned to capitalize on AI and which are likely to fall behind.

Expert Perspectives: A Divided Landscape

Leading financial institutions offer varied perspectives on the current situation. JP Morgan's Mislav Skoblar is advocating for a reduction in exposure to US mega-cap stocks, citing stretched valuations and an unattractive risk-reward profile. Goldman Sachs' David Kostin echoes this sentiment, pointing to decelerating earnings growth as a key concern, while Morgan Stanley's Michael Wilson remains firmly bearish, anticipating continued pressure from slowing consumer spending and high interest rates.

However, not all analysts are pessimistic. Bank of America, for instance, maintains a more optimistic outlook, highlighting the innovative capabilities and dominant market positions of Big Tech. They argue that these companies possess the resources and talent to navigate the current challenges and emerge stronger in the long run. This divergence in opinion underscores the complexity of the situation and the difficulty in predicting future market movements.

Navigating the Turbulence: Strategies for Investors

Given this complex landscape, a blanket approach to investing in Big Tech is unwise. Experts suggest a nuanced strategy that considers individual risk tolerance, investment goals, and the specific fundamentals of each company. A complete exodus may prove premature, particularly for long-term investors, but indiscriminate holding is equally risky.

Selective trimming of overvalued positions and diversification into other sectors are considered prudent steps. Investors should focus on companies demonstrating strong fundamentals - consistent profitability, healthy cash flow, and a clear path to sustainable growth. Examining competitive advantages, such as brand recognition, network effects, and proprietary technology, is also crucial. Companies that are actively adapting to the changing technological landscape and demonstrating a commitment to innovation are more likely to weather the storm.

Looking Ahead: Long-Term Implications

The current downturn may represent a necessary correction after years of inflated valuations. While short-term volatility is likely to persist, the long-term prospects for Big Tech remain generally positive. These companies continue to play a pivotal role in shaping the future of technology and driving economic growth. However, investors must acknowledge that the era of effortless gains may be over. Future returns are likely to be more modest and dependent on factors such as execution, innovation, and adaptation to a changing regulatory environment. The shift towards higher interest rates and increased regulation signals a new era of accountability for Big Tech, demanding a more disciplined and fundamental approach to investing.

Disclaimer: This article provides general information and should not be considered investment advice. Consult with a qualified financial advisor before making any investment decisions.

Read the Full The Financial Express Article at:

[ https://www.financialexpress.com/market/the-big-tech-rout-continues-should-you-exit-it-stocks-or-hold-for-long-term-market-experts-weigh-in-4141328/ ]