Verizon: 5G Infrastructure & Solid Dividend

Locales: Delaware, Texas, California, UNITED STATES

Verizon (VZ): The 5G Infrastructure Play with a Solid Dividend

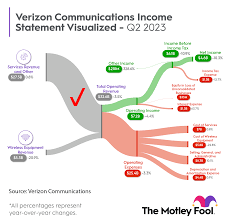

Verizon, the dominant force in the U.S. wireless carrier market, remains a cornerstone for income-seeking investors. The company's significant investment in 5G network infrastructure represents a crucial long-term growth driver. While the initial rollout and infrastructure buildout require substantial capital expenditure, the eventual payoff - increased bandwidth, faster speeds, and expanded service capabilities - promises significant returns for both Verizon and its shareholders. The rollout of 5G technology is far from complete, and Verizon's continued investment positions them to capture a significant share of this burgeoning market.

Currently, Verizon offers a dividend yield of approximately 6.7%, a particularly attractive return given the still relatively low-interest-rate environment of 2026. This yield signifies the company's commitment to rewarding its investors, and provides a tangible return while the underlying infrastructure investments mature.

The robustness of Verizon's dividend payout is underpinned by several factors. Primarily, the company boasts substantial and consistent cash flow, vital for sustaining dividend payments and funding ongoing capital expenditures. Furthermore, Verizon maintains a "fortress balance sheet," indicative of financial stability and a reduced risk of dividend cuts even during economic downturns. Finally, Verizon's track record - a long and consistent history of dividend payments - inspires confidence in its commitment to income generation.

Realty Income (O): Monthly Dividends and a Legacy of Growth

For investors seeking a steady and predictable income stream, Realty Income (O) presents a compelling alternative. As a Real Estate Investment Trust (REIT), Realty Income specializes in owning and operating retail properties, generating revenue through lease agreements. What sets Realty Income apart is its reputation for paying dividends on a monthly basis, a feature highly appealing to income-focused investors. The current dividend yield stands at around 4.6%.

Realty Income's appeal isn't just about the monthly payments; it's about the company's remarkable history of consistent dividend growth. A proud member of the Dividend Aristocrats, Realty Income has successfully increased its dividend payout for an impressive 25 consecutive years. This longevity showcases the company's resilience and commitment to rewarding shareholders over the long term.

Mitigating risk is a priority for Realty Income, and the company achieves this through diversification. Its portfolio encompasses a wide array of retail properties, minimizing reliance on any single tenant or geographic location. This diversification helps insulate the company from localized economic downturns or shifts in consumer behavior that could negatively impact specific properties.

Considerations for the Savvy Investor

While both Verizon and Realty Income present attractive opportunities for dividend investors, it's crucial to conduct thorough due diligence. The ongoing economic climate, interest rate fluctuations, and evolving technological landscape can all impact these companies' performance. For Verizon, the pace of 5G adoption and the company's ability to monetize its infrastructure investments are key factors to monitor. For Realty Income, tracking the health of the retail sector and the potential impact of online shopping trends remain essential.

Remember, investments always involve risk. A diversified portfolio, coupled with professional financial advice, remains the cornerstone of a sound investment strategy. Consider your own risk tolerance and financial goals before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/23/2-top-dividend-stocks-to-buy-on-the-dip-in-2026-an/ ]