Duke Energy: A Reliable Dividend Cornerstone

Locales: Connecticut, Texas, Pennsylvania, Illinois, UNITED STATES

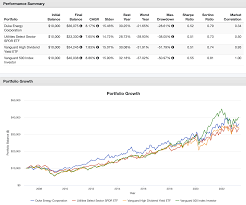

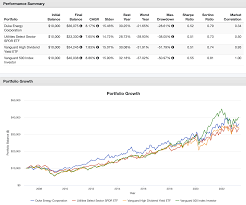

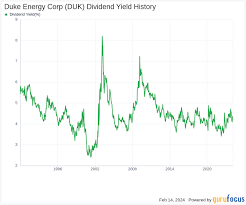

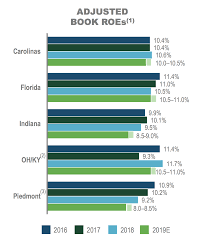

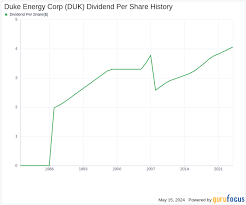

1. Duke Energy (DUK): The Steady Utility Backbone

Duke Energy remains a cornerstone of Cramer's dividend selections. Utilities, by their nature, provide essential services, generating consistent revenue regardless of economic fluctuations. This translates to predictable earnings and the ability to reliably fund dividend payouts. In 2026, the continued infrastructure investment within the US, especially relating to renewable energy integration, reinforces Duke's position as a long-term, stable dividend payer. Recent regulatory approvals for smart grid technology upgrades, finalized late 2025, are expected to enhance operational efficiency and further support dividends.

2. Public Storage (PSA): REIT Resilience and Growth

Public Storage's inclusion highlights the appeal of Real Estate Investment Trusts (REITs). REITs are legally required to distribute a significant portion of their taxable income as dividends, making them inherently attractive for income-focused investors. Public Storage's consistent dividend growth demonstrates a robust business model and effective management. While the commercial real estate sector faced headwinds in the mid-2020s due to shifts in work patterns, Public Storage has successfully adapted, emphasizing self-storage solutions catering to evolving consumer needs. The current stabilization of the office market has, in turn, positively impacted the broader real estate landscape.

3. ExxonMobil (XOM): Energy Sector Rebound and Dividend Potential

ExxonMobil's presence on Cramer's list reflects the remarkable recovery of the energy sector. Following a period of volatility, oil and gas prices have stabilized, boosting ExxonMobil's financial performance and enabling increased dividend payouts. The transition to alternative energy sources is, of course, an ongoing and crucial factor. However, the continued global demand for oil and gas, coupled with ExxonMobil's significant investments in carbon capture and emissions reduction technologies, suggest a continued role for the company in the energy mix, thereby maintaining dividend support. Recent announcements regarding advancements in hydrogen production have further bolstered investor confidence.

4. Verizon Communications (VZ): Telecom Stability and Cash Flow

Verizon's consistent dividend payments and robust cash flow are hallmarks of its appeal to income investors. The telecommunications industry benefits from recurring revenue and relatively inelastic demand. While competition remains fierce, Verizon's strategic investments in 5G infrastructure have solidified its position in the market. The rollout of 6G technology in the latter half of 2025 is expected to drive future growth and strengthen Verizon's financial standing.

5. Wells Fargo & Company (WFC): Banking Recovery and Efficiency Gains

Wells Fargo's inclusion signals a rebound in the banking sector, following earlier challenges. Cramer's emphasis on the bank's improving efficiency reflects management's commitment to streamlining operations and enhancing profitability. While regulatory scrutiny remains a factor for all major banks, Wells Fargo's progress in rebuilding trust and enhancing its risk management practices positions it as a viable dividend investment. The recent interest rate environment, while complex, has also contributed to improved net interest margins for Wells Fargo.

Beyond the Picks: A Broader Strategy

Cramer's recommendations offer a valuable lesson: dividend investing isn't simply about chasing the highest yield. It's about identifying financially sound companies with a proven track record of sharing their success with investors. Diversifying across sectors--utilities, real estate, energy, telecommunications, and banking--can help mitigate risk and create a more resilient income portfolio. As we navigate the evolving economic landscape of 2026, a focus on dividend-paying stocks can provide a measure of stability and a steady stream of income, offering a welcome buffer against market volatility.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/12/29/jim-cramer-names-his-favorite-dividend-stocks/ ]