Verizon: Reliable Telecom with 6.5% Yield?

Locales: Delaware, Texas, Pennsylvania, Illinois, UNITED STATES

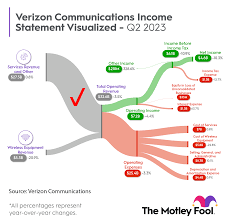

1. Verizon (VZ): The Telecom Giant - Still a Reliable Option?

Verizon, a stalwart in the telecommunications industry, historically boasted a competitive dividend yield, often exceeding 6%. While the 5G rollout faced initial hurdles, by 2026, Verizon had largely completed its network expansion and was focusing on monetizing its investment through new services and subscriptions. The stability of the telecom sector, coupled with Verizon's subscriber base, meant it remained a reliable dividend payer. However, increasing competition from T-Mobile and potential disruptors meant investors should continually monitor its market share and subscriber growth. The company's dividend yield around 6.5% would still have made it an appealing option for income-focused investors, but careful evaluation of subscriber acquisition costs and competitive pressures was key.

2. Duke Energy (DUK): Powering a Consistent Income Stream

Utilities like Duke Energy are often considered defensive investments, meaning they tend to perform relatively well even during economic downturns. Demand for electricity and natural gas is generally consistent, providing a stable revenue base for these companies. Duke Energy's consistent history of increasing its dividend for over three decades demonstrated its commitment to returning capital to shareholders. In 2026, with a dividend yield around 4.7%, it continued to be a solid, albeit slower-growth, option. The transition towards renewable energy sources presented both opportunities and challenges for Duke Energy. Investors needed to assess the company's investment in renewable infrastructure and its ability to navigate the evolving energy landscape.

3. Wells Fargo (WFC): A Turnaround Story - Assessing the Risks and Rewards

Wells Fargo had been working to overcome past scandals and rebuild its reputation. By 2026, the bank had made significant progress in addressing these issues and improving its risk management practices. While still facing regulatory scrutiny, the bank's financial performance had improved, allowing it to maintain a dividend yield of approximately 6.2%. However, the financial sector remained sensitive to interest rate fluctuations and economic conditions. Investors needed to carefully consider the potential impact of these factors on Wells Fargo's earnings and dividend payments. It represented a higher-risk, higher-reward opportunity compared to Verizon or Duke Energy.

Building a Diversified Dividend Portfolio with $2,000

Investing $2,000 doesn't afford a massive allocation to any single stock. A diversified approach is crucial. Here's a potential allocation strategy:

- Verizon (VZ): $700 - A core holding for stable income.

- Duke Energy (DUK): $600 - Adding defensive exposure to the portfolio.

- Wells Fargo (WFC): $400 - A smaller allocation to a turnaround play with higher potential, but also higher risk.

- Remaining $300: Consider an Exchange Traded Fund (ETF) focused on dividend stocks for broader diversification.

Important Reminders:

- Due Diligence: This is not financial advice. Thoroughly research any stock before investing, considering your own risk tolerance and investment goals.

- Long-Term Perspective: Dividend investing is a marathon, not a sprint. Be patient and focus on the long-term growth potential of these companies.

- Reinvest Dividends: Consider reinvesting your dividends to purchase additional shares, accelerating the power of compounding.

- Monitor Regularly: Stay informed about the companies you invest in and be prepared to adjust your portfolio as needed.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/got-2000-to-invest-in-december-these-dividend-stoc/ ]