Verizon and Duke Energy: Dividend Opportunities in 2026

Locale: Not Specified, UNITED STATES

The Appeal of Dividend Aristocrats and Stable Utilities

The allure of dividend stocks lies in their ability to provide a consistent income stream, often independent of broader market volatility. 'Dividend aristocrats,' companies that have consistently increased their dividends for at least 25 consecutive years, are particularly attractive due to their demonstrated commitment to shareholder returns. Furthermore, utility companies, with their essential services and typically regulated environments, are often perceived as safer, more stable investments, offering a reliable base for dividend payouts. However, the stability of utilities and the sustained growth of telecom giants are no longer guaranteed.

Verizon: Riding the 5G Wave and Maintaining Dividend Strength

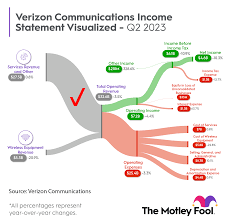

Verizon, a leading telecom giant, remains a compelling option for dividend-focused investors. The company's provision of both wireless and wireline communications services positions it within a sector experiencing sustained demand. Notably, Verizon's status as a Dividend Aristocrat, having increased its dividend for the past 17 years (and 25 years for qualifying companies), signals a commitment to rewarding shareholders. In early 2026, Verizon boasts a dividend yield of 6.8%, significantly exceeding the average yield of the S&P 500. While this yield appears attractive, a closer look at the evolving telecom landscape is essential.

The rollout of 5G technology continues to be a significant driver of revenue growth for Verizon. However, increased competition from rivals like T-Mobile and AT&T, alongside the substantial capital expenditures required to maintain and expand 5G infrastructure, present potential headwinds. While Verizon's current payout ratio of 46% is comfortably low, future capital allocation decisions and potential regulatory changes could impact its ability to maintain its current dividend yield and growth trajectory. Investors should closely monitor Verizon's success in monetizing its 5G investments and managing competition.

Duke Energy: Stability and Infrastructure Investment in a Regulated Environment

Duke Energy, a utility providing electricity and natural gas services across the Southeast and Midwest, represents a different, yet equally compelling, dividend investment opportunity. The utility sector's inherent stability, driven by the essential nature of its services and regulation by state and federal agencies, provides a foundation for consistent dividend payouts. Duke Energy's 4.4% dividend yield in early 2026 is attractive, although lower than Verizon's. The company's payout ratio stands at 69%, slightly higher than Verizon's. This requires more scrutiny of their financials and future project outlooks.

Duke Energy's investment in infrastructure projects is crucial for future earnings and dividend growth. These investments, often involving renewable energy sources and grid modernization, are essential for meeting evolving regulatory requirements and consumer demand. However, these projects carry significant financial risk, and delays or cost overruns could negatively impact profitability and dividend payments. Furthermore, rising interest rates - a persistent concern in early 2026 - can impact utility companies' borrowing costs, potentially squeezing profit margins and impacting their ability to sustain dividend growth.

Beyond the Numbers: Key Considerations for 2026

While Verizon and Duke Energy appear promising, several broader economic and market factors should inform any investment decision. These include:

- Interest Rate Environment: Continued volatility in interest rates poses a risk to both companies' profitability and dividend sustainability.

- Regulatory Landscape: Changes in regulations surrounding 5G deployment and utility pricing can significantly impact financial performance.

- Competition: Increasing competition in the telecom sector and shifting consumer preferences could erode Verizon's market share.

- Energy Transition: Duke Energy's successful transition to renewable energy sources is critical for long-term sustainability and regulatory approval.

- Inflationary Pressures: Persistent inflation could impact operating costs and consumer spending, affecting both companies' revenue streams.

Conclusion

Verizon and Duke Energy offer compelling dividend-focused investment opportunities in early 2026. Their strengths - Verizon's 5G leadership and Duke Energy's stable utility business - are balanced by potential challenges. As always, thorough due diligence and a keen awareness of the evolving economic and regulatory landscape are crucial for making informed investment decisions. Diversification remains paramount. Relying solely on these two stocks, or any single sector, carries inherent risk.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/13/2-top-dividend-stocks-to-buy-and-hold-in-2026/ ]