PayPal's Scale Creates a Competitive Advantage

Locales: California, Washington, UNITED STATES

Scale and Dominance: A Foundation of Strength

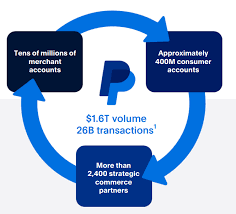

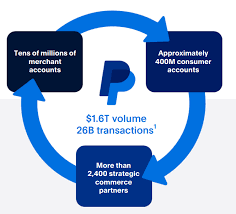

What truly distinguishes PayPal isn't just its history, but its sheer scale. The company proudly manages over 430 million active accounts, a vast network facilitating a staggering $350 billion in payment volume annually. This massive user base and transaction volume create a formidable barrier to entry for competitors and a significant competitive advantage. While the rise of alternatives like Apple Pay and Block's Cash App has undoubtedly disrupted the payment landscape, PayPal retains a substantial and loyal user base, proving the resilience of its brand and service.

It's easy to overlook the importance of scale in the digital economy. Scale isn't just about numbers; it's about network effects. The more people who use PayPal, the more valuable it becomes to each individual user, creating a virtuous cycle that reinforces its dominance. This principle applies across numerous platforms, but it's particularly pronounced in payment processing where trust and convenience are paramount.

Operational Efficiency: Responding to the Market

The financial markets are relentless, and PayPal's management has responded with a keen eye on profitability. Recognizing a need to improve margins, the company has embarked on a concerted effort to cut costs and streamline its operational processes. This isn't a reactive measure; it's a proactive strategy to ensure long-term sustainability. The stated commitment to margin expansion, combined with early signs of positive results, indicates a focused and effective management team adapting to the demands of investors and the evolving economic climate.

This renewed focus on efficiency signals a shift from a period of rapid, but potentially unsustainable, growth, to a stage of mature, profitable operations. Investors often prioritize efficiency as a sign of a company's ability to navigate economic downturns and deliver consistent returns.

The AI Advantage: Future-Proofing PayPal's Position

Innovation isn't merely a buzzword at PayPal; it's a strategic imperative. The company is significantly expanding its investments in artificial intelligence (AI) and emerging technologies. This commitment goes beyond simply adopting AI; it's about integrating it deeply into the core functions of the business. AI is being utilized to enhance fraud detection capabilities, providing a safer environment for users and merchants. It's also being employed to personalize customer experiences, creating a more engaging and sticky user base. Finally, AI contributes to operational efficiency, automating tasks and freeing up human resources for more strategic initiatives.

AI-powered personalization is becoming increasingly crucial in a crowded digital marketplace. Tailoring the user experience not only increases engagement but also builds loyalty, making PayPal a more desirable choice for both consumers and businesses.

Analyst Sentiment and Long-Term Outlook

Despite periods of market volatility and competitive pressure, analysts maintain a predominantly positive outlook for PayPal. Their optimism is rooted in the company's established market leadership, the tangible progress in margin improvement, and the strategic investments in AI and innovation. While short-term fluctuations in the stock price are inevitable, the long-term trajectory appears promising, fueled by PayPal's continued adaptation and expansion within the dynamic fintech sector. The 'Magnificent Seven' label itself underscores the belief in PayPal's enduring value and potential for long-term growth.

Conclusion: A Cornerstone of Digital Payments

In the ever-shifting landscape of the Magnificent Seven, PayPal's position as the dominant fintech force remains unchallenged. Its enormous scale, coupled with a renewed commitment to operational efficiency and groundbreaking AI investments, sets it apart. While navigating the complexities of the digital economy requires constant adaptation, PayPal's enduring strength and proactive strategies firmly position it as a compelling investment opportunity for those seeking exposure to the future of digital payments.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/25/1-magnificent-seven-stock-clear-fintech-powerhouse/ ]