Antimony: Beyond Batteries - A Growing Critical Metal

Locales: Nevada, Utah, Idaho, Colorado, UNITED STATES

The Critical Role of Antimony: Beyond Lead-Acid Batteries

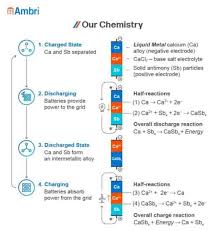

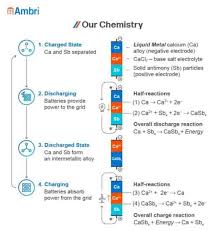

For those unfamiliar, antimony is a relatively obscure metal, often overshadowed by its more prominent counterparts. However, its importance is growing exponentially. Traditionally, antimony's primary application has been in lead-acid batteries, commonly found in conventional vehicles. But the future is electric, and with that shift comes a dramatic increase in the need for lithium-ion batteries, where antimony plays a surprisingly critical role. It's not simply a minor component; antimony enhances the performance and crucially, the safety of these batteries. It acts as a flame retardant, mitigating the risk of thermal runaway - a major concern in large-scale battery applications. This makes it indispensable for EVs, grid-scale energy storage, and consumer electronics.

USAT: Mining, Refining, and Recycling for a Sustainable Future

United States Antimony isn't just a mining company; it's an integrated operation. The company's business is divided into two core segments: mining and refining, and recycling. The mining and refining segment involves the extraction and processing of ore containing antimony, alongside lead and other metals. This vertical integration allows USAT a degree of control over its supply chain and pricing. The recycling segment is a vital differentiator. USAT recovers valuable metals, including antimony, from industrial byproducts, creating a more sustainable operation and often providing a cost advantage. This commitment to recycling resonates with growing ESG (Environmental, Social, and Governance) investment trends, which could attract a wider pool of investors.

Financial Performance: A Story of Improvement

Historically, USAT's financial performance has been characterized by periods of unprofitability. However, the last few years have shown encouraging signs of a turnaround. Revenue has consistently increased, fueled by rising antimony prices and increased production. While profitability has remained somewhat inconsistent - heavily influenced by fluctuations in antimony prices and operational efficiency - the trend clearly indicates improving margins. The company's success is directly tied to its ability to manage costs and optimize production processes within its mines and recycling facilities. The recent expansion of its refining capacity should contribute positively to margins in the coming years.

Valuation and Future Potential: A High-Risk, High-Reward Scenario

Valuing USAT is inherently challenging given its small size and the limited public data available. However, projections based on anticipated antimony demand, coupled with a conservative assessment of USAT's potential production capacity, suggest substantial upside potential. Several industry analysts now predict a significant price increase in antimony over the next decade as EV production accelerates and energy storage becomes increasingly ubiquitous. If USAT's management team can successfully execute its expansion plans and maintain operational efficiency, the company's valuation could increase significantly.

Navigating the Risks: A Cautious Approach

Investing in USAT isn't without risk. Several potential headwinds could derail the company's progress. First and foremost is operational execution - the company's ability to efficiently manage its mining and refining operations is paramount. Secondly, antimony's price volatility is a constant concern. Sudden price drops could severely impact profitability. Macroeconomic conditions also play a role; a global economic slowdown or a deceleration in EV adoption would undoubtedly dampen demand. Finally, the antimony market, while not saturated, is relatively concentrated, meaning USAT faces competition from larger, more established producers. Geopolitical risks, particularly concerning antimony sourcing (a significant portion of the world's supply originates from China), should also be considered.

Conclusion: A Strategic Bet on the Future

United States Antimony presents a unique opportunity for investors willing to embrace a higher degree of risk. Its strategic position within the burgeoning antimony market, combined with its commitment to sustainable recycling practices, creates a compelling narrative. However, careful consideration of the operational, financial, and macroeconomic risks is essential. Successful navigation of these challenges, coupled with effective execution of expansion plans, will be critical for USAT to realize its considerable growth potential and solidify its position as a key player in the electric age.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4862376-united-states-antimony-plenty-of-growth-ahead-if-management-can-execute ]