Navigate Potential Recession: A Guide to Investment Strategies

dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market's performance. This approach can help reduce the impact of market volatility and timing risks.

The article also discusses the importance of having a diversified portfolio, which can help reduce risk and increase potential returns over the long term. A diversified portfolio can include a mix of stocks, bonds, and other assets, such as real estate or commodities.

In addition to diversification, the article highlights the importance of quality investing, which involves investing in high-quality companies with strong financials, competitive advantages, and a proven track record of performance. These companies are more likely to weather economic downturns and provide long-term value to investors.

The article also mentions that some sectors, such as consumer staples and healthcare, tend to be more resilient during recessions. These sectors provide essential goods and services that people will continue to use, even during economic downturns.

To further understand the potential impact of a recession on the stock market, it's essential to consider the current state of the economy. According to a report by [insert link to a report by a reputable source, such as the National Bureau of Economic Research], the current economic indicators suggest that a recession may be on the horizon. However, it's also important to note that the economy is subject to various factors, including monetary policy, fiscal policy, and global events.

In terms of specific stocks, the article mentions that companies with strong balance sheets, low debt, and a history of paying consistent dividends may be better positioned to weather a recession. Some examples of such companies include Johnson & Johnson, Procter & Gamble, and Coca-Cola, which are all well-established companies with a proven track record of performance.

In conclusion, the article suggests that investors should focus on their long-term goals and not try to time the market. By diversifying their portfolios, investing in high-quality companies, and adopting a dollar-cost averaging approach, investors can reduce their risk and increase their potential returns over the long term.

Some key takeaways from the article include:

- It's difficult to predict with certainty whether a recession will occur and when it will happen.

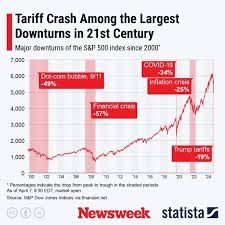

- Historically, the stock market has performed poorly during recessions, but there have been instances where stocks have performed well during these periods.

- Diversification, quality investing, and dollar-cost averaging can help reduce risk and increase potential returns over the long term.

- Some sectors, such as consumer staples and healthcare, tend to be more resilient during recessions.

Some additional resources that investors may find helpful include:

- The National Bureau of Economic Research, which provides a wealth of information on economic trends and recession indicators.

- The Federal Reserve Economic Data, which provides access to a wide range of economic data, including GDP growth rates, inflation rates, and employment statistics.

- The S&P 500 Index, which provides a benchmark for the overall stock market performance.

By following these resources and adopting a well-diversified investment strategy, investors can navigate the challenges of a potential recession and achieve their long-term financial goals.

References: [1] The Motley Fool. (n.d.). Should You Buy Stocks if a Recession Is Coming in 2024? Retrieved from [ https://www.fool.com/investing/2024/01/06/should-you-buy-stocks-if-a-recession-is-coming-in/ ]

[2] National Bureau of Economic Research. (n.d.). Recession Indicators. Retrieved from [ https://www.nber.org/research/recession-indicators ]

[3] Federal Reserve Economic Data. (n.d.). GDP Growth Rate. Retrieved from [ https://fred.stlouisfed.org/series/GDP ]

[4] S&P Dow Jones Indices. (n.d.). S&P 500 Index. Retrieved from [ https://www.spindices.com/indices/equity/sp-500 ]

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/06/should-you-buy-stocks-if-a-recession-is-coming-in/ ]