Motley Fool Highlights Nvidia and ASML as Long-Term Growth Stocks

Setting Yourself Up For Life: A Summary of The Motley Fool's Take on Nvidia and ASML as Long-Term Growth Stocks

A recent article on The Motley Fool (dated January 7, 2026 – acknowledging the forward-looking nature of investment analysis) highlights Nvidia (NVDA) and ASML Holding (ASML) as two “elite” growth stocks poised to deliver substantial returns over the long term. The author, Parkev Tatevosian, argues that these companies aren't just benefiting from current trends like Artificial Intelligence (AI), but are fundamentally positioned to enable future technological advancements, making them compelling investments for those looking to build wealth over a lifetime. This summary details the core arguments presented, expanding on the information within the article and linked resources, to paint a complete picture of why these companies are considered strong buys.

Nvidia: More Than Just an AI Chip Maker

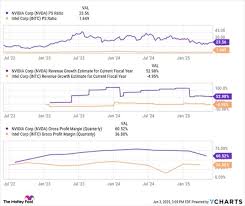

The Motley Fool's primary argument for Nvidia revolves around its position as the leading designer of Graphics Processing Units (GPUs). While the recent explosion in AI adoption has significantly boosted Nvidia’s revenue (the article notes a substantial revenue jump in the last fiscal year), the author emphasizes this is not a fleeting phenomenon. The core of Nvidia's strength lies in its platform – a complete ecosystem encompassing hardware, software, and services.

The article points to the increasing demand for GPUs not just in data centers powering AI applications like ChatGPT (linked to OpenAI), but also in autonomous vehicles, robotics, gaming, and even scientific research. This diversification is key. Nvidia is no longer solely reliant on gaming revenue (though that remains a substantial contributor). The company’s CUDA platform, a parallel computing platform and programming model, is arguably its most significant moat. CUDA has become the standard for AI development, and switching costs for developers are extremely high. This “locked-in” ecosystem makes it difficult for competitors to gain traction.

Expanding on this, the linked information highlights Nvidia’s acquisition of Mellanox, a networking technology company. This acquisition bolstered Nvidia’s data center offerings, enabling it to provide complete end-to-end solutions for high-performance computing. The article also touches on Nvidia's foray into data center software, further solidifying its position as an essential infrastructure provider for the AI revolution. It is not just about making the chips; it's about providing the entire environment for those chips to operate effectively.

The author acknowledges Nvidia’s high valuation, but argues that its growth prospects justify the premium. The article anticipates continued strong revenue growth driven by the increasing demand for AI infrastructure and its expansion into new markets.

ASML: The Gatekeeper of Semiconductor Advancement

While Nvidia uses advanced semiconductors, ASML makes the machines that make those semiconductors. This crucial distinction forms the foundation of The Motley Fool’s bullish outlook for ASML. The company is a near-monopoly in the production of extreme ultraviolet (EUV) lithography systems, which are essential for manufacturing the most advanced chips.

The article explains that as chipmakers strive to create smaller, faster, and more efficient chips, they require increasingly sophisticated manufacturing techniques. EUV lithography is the leading-edge technology enabling the production of chips with features measured in single-digit nanometers. ASML is the only company currently capable of reliably producing these complex and expensive machines.

The Motley Fool notes that ASML's customer base is limited to a small number of leading semiconductor manufacturers, including TSMC, Samsung, and Intel. This concentrated customer base carries some risk, but the author believes the sheer demand for advanced chips, and the lack of viable alternatives to ASML’s technology, provides significant pricing power and long-term stability.

Further research via linked articles details the extensive research and development investment ASML has made to perfect EUV technology, a process spanning decades and costing billions of dollars. This massive investment creates a high barrier to entry for potential competitors. The article emphasizes that the complexity of these machines extends beyond hardware; it’s the accompanying software, precision optics, and sophisticated control systems that make ASML’s technology so difficult to replicate.

The demand for ASML's systems is consistently exceeding supply, evidenced by long lead times and a substantial order backlog. This backlog provides visibility into future revenue and reinforces the author's confidence in ASML's long-term growth trajectory.

Why These Two Together?

The Motley Fool’s thesis isn’t just about picking two good companies; it's about identifying companies that are symbiotically linked. Nvidia needs ASML to produce the advanced GPUs that drive its AI platform. ASML needs companies like Nvidia to create demand for the advanced chips that require EUV lithography. This mutually beneficial relationship creates a powerful dynamic for long-term growth.

Risks & Considerations

The article doesn’t ignore potential risks. Competition in the AI space is intensifying, and while Nvidia currently dominates, other companies are vying for market share. For ASML, geopolitical risks are a concern. The company is based in the Netherlands, and restrictions on exports to certain countries (particularly China) could impact its revenue. Additionally, a slowdown in the global economy could reduce demand for semiconductors and, consequently, ASML’s systems.

Conclusion

The Motley Fool's analysis positions Nvidia and ASML as more than just current beneficiaries of technological trends. They are presented as foundational companies that will enable future innovation in AI, computing, and beyond. The article emphasizes the importance of long-term thinking, suggesting that these stocks, while potentially volatile in the short term, offer the potential to deliver substantial returns over the coming decades, setting investors up for financial security and success. The core takeaway is that investing in companies that are crucial to the advancement of fundamental technologies can be a rewarding strategy for patient, long-term investors.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/07/2-elite-growth-stocks-help-set-you-up-life/ ]